Adobe made a splash today as it announced earnings with an extra twist. 🔀

Its adjusted EPS was $3.40 vs. $3.35 expected, while revenues were $0.01 billion shy of expectations at $4.43 billion. Current quarter EPS guidance beat expectations by $0.03, while revenue guidance was $0.08 below expectations. 📉

Additionally, the company announced a $20 billion acquisition of the web-first collaborative design platform, Figma. The company’s largest ever deal will improve its suite of applications that support online collaboration as more employers shift to a hybrid working environment.

Despite all the fanfare, not everyone is supportive of the deal. Some market participants are questioning the price it paid and whether it will have to raise debt in the current environment. Others say the deal suggests Adobe’s business is more vulnerable than it lets on. After all, acquiring competitors to defend its market share is not a sustainable solution.

Proponents of the deal say that the acquisition will allow Adobe to tap into a new customer base, particularly software developers and product managers. The synergies between the two companies should allow it to cross-sell products and cement its footing in a growing market.

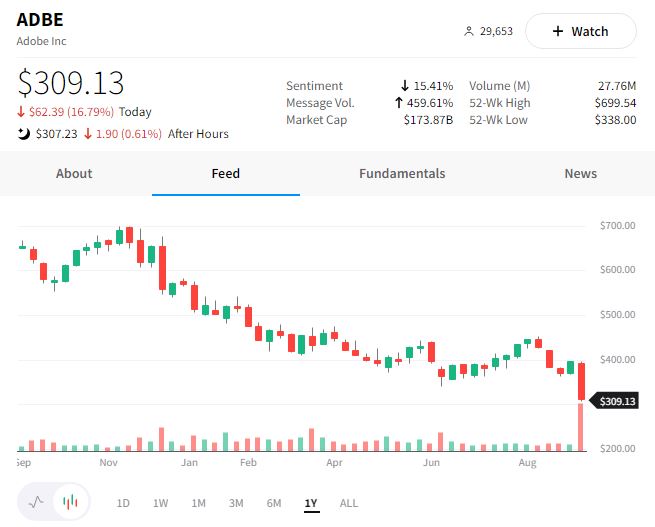

With that said, the stock declined nearly 17% today as investors weighed the announcement. Acquiring companies typically fall when announcing acquisitions, so we’ll have to wait and see if today’s action is a one-off. Or if it’s a continuation of the stock’s broader downward trend. 🤷