It’s a slower week in the markets, so it was slightly interesting that all of today’s top earnings movers seemed to start with the letter C. Let’s quickly recap their results. 👍

First up is Carnival Cruises, which reported another quarter of record results. The company’s adjusted loss per share of $0.07 beat expectations for a $0.13 loss, while a revenue jump of 40.60% to $5.397 billion topped the expected $5.295 billion. That was driven by a 54.70% increase in passenger-ticket revenue ($35.10 billion) and a 20.10% jump in other revenue ($1.886 billion). 🛳️

Booking volumes during its third quarter remained significantly elevated relative to last year and its 2019 pre-pandemic comparable. Additionally, pricing was considerably higher than last year, with customer deposits rising 25% to $6.40 billion. While consumers have pulled back on discretionary goods purchases, they continue to spend on experiences like travel.

Next up is used automobile retailer CarMax, which posted better-than-expected third-quarter results. Its adjusted earnings of $0.52 per share topped the $0.38 expected, though revenues of $6.15 billion did come in shy of the $6.29 billion consensus view. Comparable-store-used-unit sales fell 4.10% YoY. However, it maintained its gross profit per retail unit of $2,277 vs. last year. 🚗

With the automobile market remaining challenged by elevated prices and high borrowing costs, the company continues to focus on cost-cutting and operational efficiency. Its executives said their recent omnichannel investments have driven incremental retail customers, web traffic growth, and enhanced vehicle sourcing, among other improvements. On top of the earnings improvements, the company restarted the share-repurchase program it paused a year ago, showing additional confidence in its current position.

Lastly, the uniform-rental and other services provider Cintas boosted its full-year outlook after beating second-quarter results. The company now expects fiscal-year revenue of $9.48 to $9.56 billion, up from $9.40 to $9.52 billion. Its earnings guidance saw a more substantial adjustment, coming in at $14.35 to $14.65 per share, up from its prior view of $14.00 to $14.45 per share. 🫧

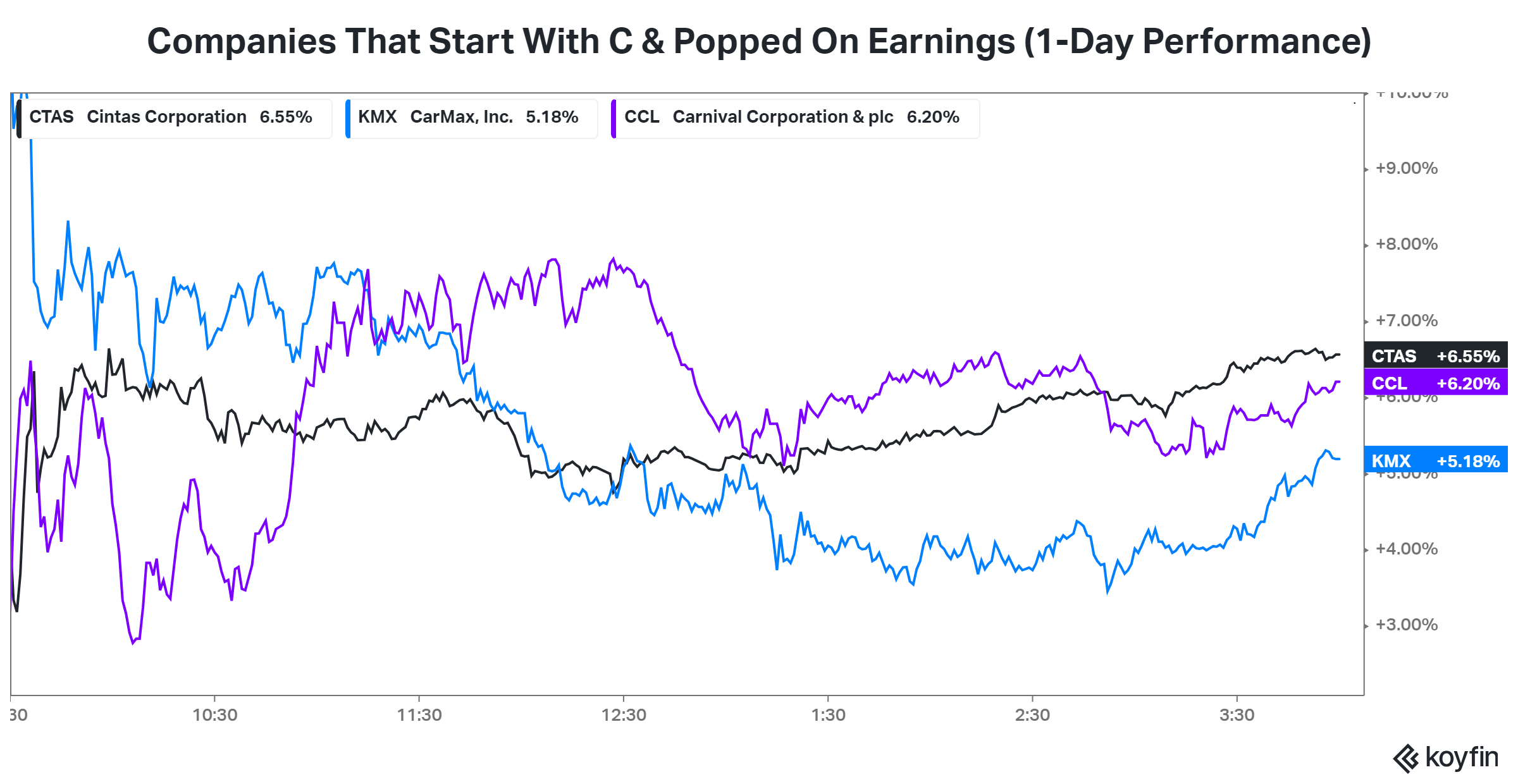

All three companies saw shares pop significantly today as investors digested the positive news. 📈