In a master stroke of irony, Elon Musk took to Twitter to proclaim that the deal involving his proposed buyout of Twitter is “temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users.” 🙃

The controversial tweet linked to a Reuters report stating that Twitter estimated less than 5% of the platform’s users are fake accounts. 📝

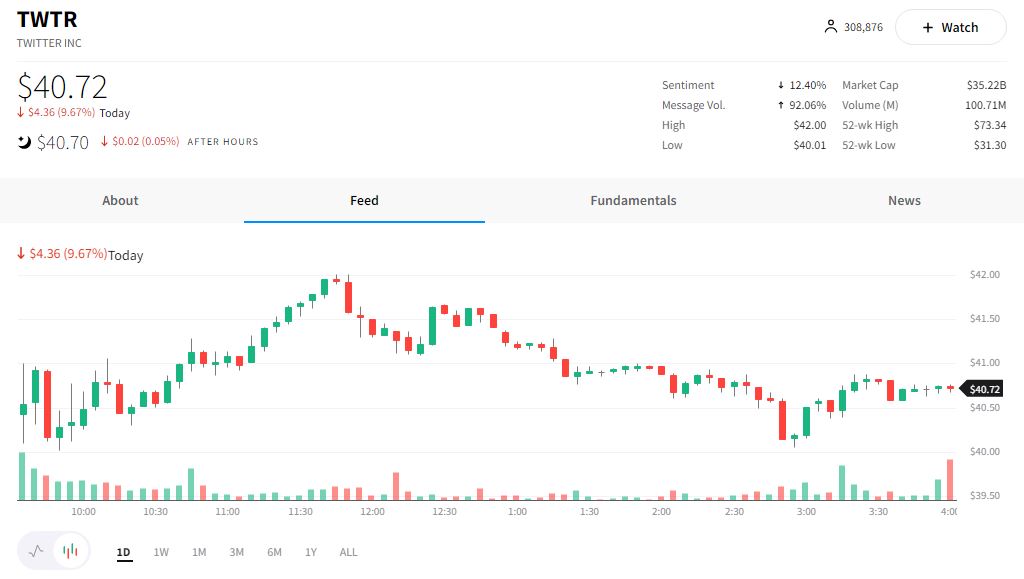

Traders weren’t exactly thrilled with this development as Twitter sank nearly 10% 🔻 while the Nasdaq (of which Tesla is a major component) was up almost 4%.

As you may recall, we reported Musk’s “funding secured” declaration in late April as the Tesla CEO put forward a proposal to pay $44 billion, or $54.20 per share, to acquire the company. Twitter didn’t take Musk’s offer seriously at first, with the company’s board imposing a “poison pill” to prevent Musk from acquiring more than 15% of the company. 💊

After warming up to the idea, Twitter tried to reassure investors in its Q1 2022 fiscal results press release that the deal would be moving forward. They outlined that Twitter will become a privately held company upon closing the deal, but noted, “The transaction is subject to customary closing conditions and completion of regulatory review and Twitter’s stockholder approval.” 👍

As we’ve come to expect with Elon, we’re left with more questions than answers. ❓

Adding more twists and turns to this ongoing story is all the internal stuff happening at Twitter. In particular, Twitter CEO Parag Agrawal reportedly fired Bruce Falck, general manager of revenue at Twitter, and Kayvon Beykpour, the company’s consumer product leader. In addition, chatter about Twitter’s design and engineering leads potentially exiting the company has picked up. This all comes amidst the company’s recent hiring freeze as it tries to navigate the on-again, off-again Musk deal. 💔

Is Musk really concerned about fake accounts? Or is this just a stalling tactic? Some market participants are thinking Musk may be realizing he could’ve gotten the company for a lower price, given the broader weakness in the technology sector, and is now trying to gain negotiating leverage. Others view this as “Elon being Elon.” 😉

Only time will tell how this $44 billion soap opera will unfold. However, we know for certain that the volatility surrounding this deal continues to affect the share price.

Depending on where you fall on this, today’s action is either viewed as a terrific dip-buy opportunity – or another warning sign that negotiations are about to break down. Only time will tell which view is correct…