Semiconductor giant Micron was back in the news today after posting a better-than-expected first-quarter report. 📝

The company’s adjusted loss of $0.95 was less than the $1.01 anticipated. Meanwhile, revenues of $4.73 billion topped the $4.58 billion consensus estimates. And that positivity continued with its current-quarter outlook. It’s now looking for a revenue range of $5.10 to $5.50 billion, well above Wall Street’s $4.97 billion view.

Executives say strong operational management and better pricing helped drive the upbeat results and outlook. 👍

The company is the leader in dynamic random-access memory, which is used in desktop computers, servers, and flash memory (smartphones and solid-state hard drives). As a result, it’s suffered from a supply glut for the last two years as the world reset from pandemic-fueled demand levels. 📊

Micron’s executives and others in the industry had been anticipating a trough would form in that industry in late 2023 and improve further in 2024. So far, that forecast appears to be coming to fruition. They sounded confident that the rebound in its primary market’s pricing and volumes, paired with generative AI opportunities, should get it back on a profitable growth path.

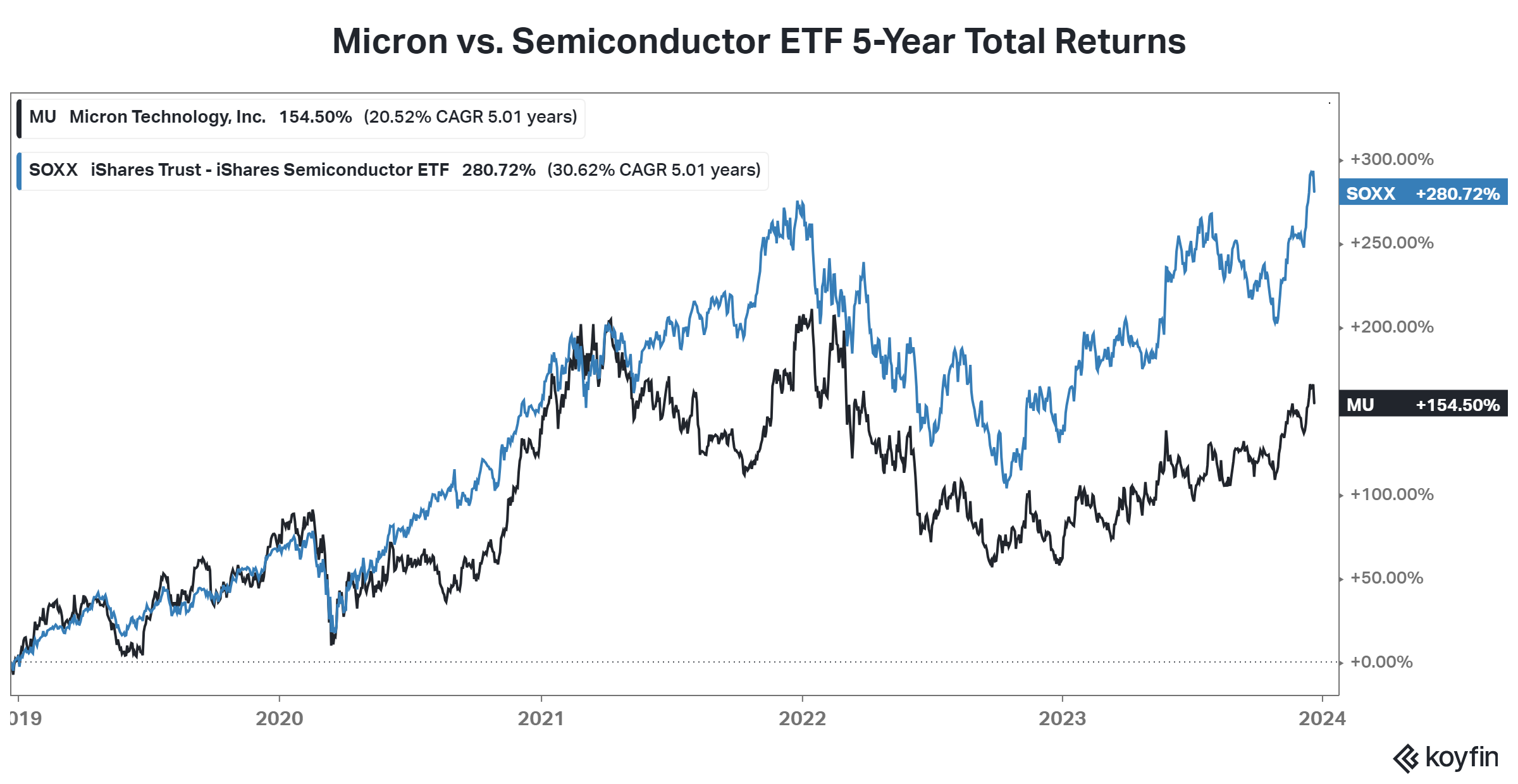

Investors hope this “multiyear growth” phase executives keep forecasting will pan out as anticipated. Although $MU shares have kept pace with the semiconductor industry’s broader ETF ($SOXX), its total return over most other timeframes has lagged significantly. 🙁

Below, the five-year performance comparison shows a significant gap that’s also present across one, three, ten, and twenty-year timeframes. Needless to say, investors are hoping it can catch up with some of its competitors and generate strong returns in the decade ahead.

As always, we’ll have to wait and see what happens. 👀