Happy Sunday, Stocktwits crew! We hope you’re ready for the start of a new week. But before we jump into the new-new, let’s reflect on last week’s moves:

All major indexes fell this week, but the pesky Russell 2000 fell the most this week, -2.45%. The Nasdaq bested the other major indexes, down just 0.38%.

The S&P 500 and Nasdaq-100 (the top 100 stocks in the Nasdaq) have been neck-at-neck for the last few weeks. Just take a look at this chart from Koyfin:

In other words, the crypto market has continued its recovery from its June lows. In large-cap action, Solana cracked the top 10 cryptos (by market cap) after rising over 37.8% this week. Cardano rose 21.9% this week.

There were even bigger winners outside of the familiar names: smart contracts platform Avalanche more than doubled this week, document & archive blockchain Arweave rose 81%, and blockchain streaming service Audius rose 73%. Double-digit moves in DeFi coins and altcoins are becoming common again!

It has been awhile since somebody talked about lumber prices. We’ve got a lil’ bit on that below… and who stands to benefit from the lower prices. 😉😉

Earnings season is on the way out. The Stocktwits community will have their eyes on $BBY, $CRM and others this week. Peep our earnings section below.

And, oh yeah… here’s last week’s moves:

| S&P 500 | 4,441 | -0.45% |

| Nasdaq | 14,714 | -0.38% |

| Russell 2000 | 2,167 | -2.45% |

| Dow Jones | 35,120 | -1.04% |

Company News

Bad News For Uber & Lyft 🚗

Lyft and Uber took a big hit this weekend after a state judge ruled against a ballot proposition which would have allowed the companies to continue classifying drivers as independent contractors.

A state bill passed in 2019 would have required the companies to treat their workers as employees. That would have entitled drivers to benefits such as workers comp, unemployment, paid sick and family leave, and health insurance.

Because the companies didn’t want to put up with that, they dumped millions into lobbying for Proposition 22. The proposition would have overturned the passed bill, allowing the companies to consider their drivers as independent contractors.

Lyft, Uber, and DoorDash spent over $200 million on the Yes on 22 campaign. And that money worked in convincing the overwhelming majority of Californians to vote yes on the prop. Unfortunately, that money went up in flames after a judge found it was “unenforceable and unconstitutional.” 😲

This court battle will likely rage on in the months ahead. However, in the meantime, the companies will likely have to encumber Californians with higher prices on their rides and deliveries. And this adverse ruling for the companies almost certainly means moves for their stock prices… and not the good kind. 📉

DeFi

The Flip Side 🥞

One of Binance Smart Chain’s largest decentralized exchanges is bulking up in the competition for traders. In July 2021, PancakeSwap was the third-most visited crypto exchange in the world. They came up short of only two exchanges: Binance and Coinbase.

PancakeSwap, which appreciated significant growth in Q1, is even starting to catch up with some of the most recognizable DEXes and lending platforms in terms of volume and total value locked (TVL). TVL is one way to measure the amount of user adoption in a DeFi protocol, because it measures how much money that investors are storing in a protocol or platform.

The world’s largest DEX by volume, Uniswap, posted roughly $7 billion in TVL as of this writing. PancakeSwap posted $5.9 billion. For volume, which measures how much money is being traded on the platform, PancakeSwap posted $712 million in the trailing 24-hour period. Uniswap posted just over a billion between their v2 and v3 platforms. 🦄🦄

The two exchanges are getting closer and closer in terms of meaningful figures. However, Uniswap and PancakeSwap are worlds away from each other in terms of market cap.

Uniswap trades at nearly 4x the market capitalization of PancakeSwap. That difference can speak to two factors: the awareness that investors have of Uniswap and investors’ preference for Ethereum. After all, Binance Smart Chain is run by one of the more controversial players in the world of crypto.

However, as the bull market gets back on its feet? $CAKE.X might be in a better position to run than its overpriced ETH-based competitor, $UNI.X, which is worth over 3x more than it manages in TVL.

$CAKE.X is down over 50% from its April highs, but up from $0.62 on Jan. 1. Today, it’s worth $22.93. 🥞🥞🥞

Commodities

Timber!

Since the pandemic started in March, many commodities have appreciated significant gains. The gains have investors calling it a commodities supercycle.

Early in the pandemic, a broader market crash led commodities lower. Investors expected suppressed demand, but the opposite happened. And by the time that many companies had realized, it was too late.

Robust demand, COVID lockdowns, people staying at home because of enhanced unemployment benefits, and supply chain breakdowns led commodities higher. Douse that flame with a lil’ bit of fresh JPow Money Printer™ money and you’ve got a recipe for… big price moves in everything! 📈📈📈

Commodities went to the moon… it’s as if crypto traders checked out and started YOLOing all their money on lumber and hogs. Lumber was one of the commodities that appreciated the biggest gains. Alas, the lumber mania is over. We’ve gone through the trouble of annotating it for you below:

Many commodities are starting to fall as we return to business as usual. That’s great for companies involved in the manufacturing, production, and construction of goods. For lumber specifically, it’s a positive development for homebuilders. There were over 1.5 million housing starts in July, that was up 2.5% YoY. Unfortunately for consumers, lower lumber prices are unlikely to translate to cheaper houses anytime soon. 🏠🏠

The Brief

And now a brief for the week of Monday, August 23, 2021:

Economic Calendar:

8/23 Existing Home Sales (10:00 AM ET)

8/24 New Home Sales (10:00 AM ET)

8/25 EIA Crude Oil Inventories (10:30 AM ET)

8/26 Initial & Continuing Claims (8:30 AM ET)

8/27 PCE Prices (8:30 AM ET)

8/27 Personal Income & Personal Spending (8:30 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

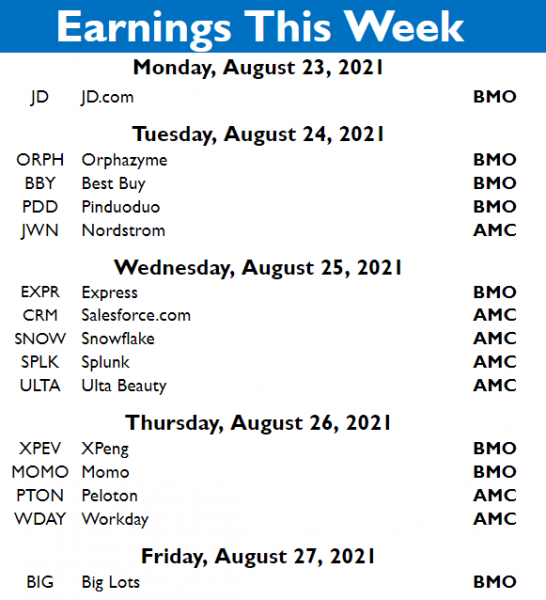

And here’s the shortlist of stocks to watch as they report this week:

Be sure to know when your stocks are reporting. Check out the StockTwits earnings calendar.

Links That Don’t Suck:

💰Up your trading game! For a limited time, you can watch IBD’s Online Courses for the lowest prices of the year. Save up to $600*

🌀 Hurricane Henri Gives New York City “Wettest Hour” On Record

🤖 Boston Dynamics’ Latest Robot Does Parkour In New Video

🎨 MyNFTeam Helps Connect NFT Artists, Developers, and Marketers For Projects

🌽 How a Billion-Dollar “Farm-Tech” Startup Stumbled, Then Revamped

📈 Where Do You Stack Up Against the Average American’s Net Worth?

😲 People Working From Home Are Increasingly Picking Up A Second Job

😍 Solana’s Official Site Got A Makeover

*this is a sponsored post