Happy Sunday, everybody! We hope you’re enjoying a sunny conclusion to your week.✨

Indexes were 1/4 this week. The Russell 2000 was the only index in the green. Huh, that never happens!

It looks like it’s fair to call this a September Slump or Snail Stock September. Stocks have notched two straight weeks of losses. Maybe there will be more to look forward to in October. 😎

If you can’t wait though, maybe crypto is a better bet. Large-cap coins found a lil’ bit of green this week. However, the biggest winners are ones you might not know about: $REN.X rose 34.9%, $ATOM.X popped 34.6%, and $AUDIO.X boosted $24%.

On the bright side, a few fire IPOs made stocks a lil’ more exciting. $FORG popped after its trading debut on Thursday. It’s up 35% from its opening price. $BROS got off to the races, but fell on Friday. It was up 26.6% from listing.

Q2 earnings are on the way out now… can you believe that Q3 starts in a little over a week? We’ve got a few big names reporting this week, peep our earnings section below.

Here’s last week’s moves:

| S&P 500 | 4,432 | -0.93% |

| Nasdaq | 15,043 | -1.10% |

| Russell 2000 | 2,236 | +0.38% |

| Dow Jones | 34,584 | -0.23% |

Stocks

Family Business

Nobody has sold more stock this year than Jeff Bezos, Mark Zuckerberg, or Sam Walton. However, an unexpected fourth player has made billions selling stock in his own son’s company. 💰💸

Ernest Garcia II, a 64-year-old billionaire and son of $CVNA CEO & Founder Ernest Garcia III, has sold $3.6 billion worth of stock. Garcia II is the owner of Carvana’s former parent, DriveTime.

During the pandemic, he added to his treasure trove of Carvana stock with a $25 million buy in a private offering, during which Carvana’s share price was valued as low as $30. The purchase made Garcia II, who does not work for the company, the company’s largest shareholder.

Since then, Carvana’s share price has exploded. The company is now worth over $60 billion, allowing Garcia II to take chips off the table. According to the Wall Street Journal, Garcia II’s sales represent just 16% of his holdings.

Carvana has already admitted that could be a red flag for some investors. A securities filing reveals that Carvana’s own filings warn against the “Garcia parties” not being “aligned” with investor interests. In other words, the Garcia family might trash investors for short-term gain. Uh-oh.

Academics and regulatory-types have echoed those concerns, claiming that revisions to the company’s “stock selling plan” (10b5-1 plan) has been changed frequently. The same parties are concerned that the family owns 85% of the company’s voting shares, in total.

However, there is nothing discernably illegal about the structure. Just that it’s… kinda sus. 🤔

Policy

Rules for Thee, Not For Me?

Federal Reserve Chairman Jerome Powell has ordered an ethics review of rules after reports emerged that Powell and other Fed Presidents owned assets that the Fed purchased throughout the COVID pandemic. All three of the Fed members bought the assets well before the pandemic. 📈

Though these Fed members didn’t “insider trade”, some argue that they benefited from the institution buying assets they held. The report has rekindled a discussion regarding to what extent public officials should have autonomy with regards to holding, buying, or selling assets while in office.

The discourse comes with another catalyst: an ongoing congressional insider trading scandal. It’s not exactly private knowledge that a number of congressmen sold holdings before COVID. Then some did what every great, well-to-do investor does after the entire market crashes: they bought the dip! Many complaints have stacked up against congressmen. Despite this, no prominent public servant has recently been charged with insider trading.

What the named Fed members did is not nearly as provocative and clear-cut as what various Congressional leaders are said to have done. However, it highlights important concerns about conflicts of interest in government and markets. We’ll be watching to see the conclusion of the Fed’s own audit. 👀

Coinbase seems to be a common staple in our crypto coverage as of late. There’s a few good reasons: the $51 billion company is America’s biggest digital asset exchange. However, the best reason might be that what goes for Coinbase will likely go for other crypto players in the U.S. 💼

That’s why when the Securities Exchange Commission threatened to sue Coinbase over the launch of a new stablecoin-centric lending product, investors leaned in to listen. The U.S. regulator also asked for Coinbase to fork over the personal information of users who signed up to the program, which the company did not oblige.

It seemed that Coinbase might be prepared to fight the approaching litigation threat, especially since the company desires regulatory clarity. They even raised $2 billion through a bond sale last week, which would give them more than enough cash.

However, they might have found a better solution instead: getting into derivatives (and futures.)

Coinbase is seeking a National Futures Association membership, in a bid to take on other crypto derivatives players such as FTX and Binance. The offering will likely cater to more experienced traders.

Data from market data platform CryptoCompare shows that derivative volume actually exceeded spot volume for the first time. The derivatives volumes totaled $3.2 trillion, while total spot volumes were half a billion lower at $2.7 trillion during the period.

Given the popularity of derivatives trading, Coinbase’s anticipated next step might be an amicable next-step. However, the war of regulation-by-litigation might still await them after this brief detour. 📜

The Brief

Here’s a brief for the week of Monday, September 20, 2021:

Economic Calendar:

9/21 Housing Starts & Building Permits (8:30 AM ET)

9/22 Existing Home Sales (10:00 AM ET)

9/22 EIA Crude Oil Inventories (10:30 AM ET)

9/22 FOMC Rate Decision (2:00 PM ET)

9/23 Initial & Continuing Claims (8:30 AM ET)

9/24 New Home Sales (10:00 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

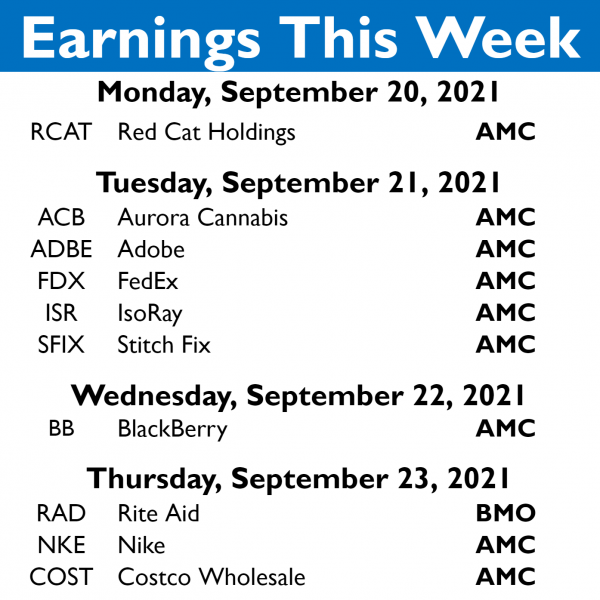

Here’s the shortlist of stocks that the Stocktwits community will be watching when they report this week:

There’s not much to be excited about on Friday, but earnings season is officially winding down. To see when your stocks are reporting (and what our community is watching), check out the Stocktwits earnings calendar.

Links

Links That Don’t Suck:

🖥️ Apple Lost Its App Store Case. What Now?

🏊 Dubai Has Built the World’s Deepest Pool

🤔 40 Concepts You Should Know, A Twitter Thread

📶 Helium & FreedomFi Preparing to Launch Blockchain-Powered DIY 5G Network

🎵 Kanye West Drops Wild New Music Video for “24”

😲 Liquor Found on New Boeing Air Force One Jet in Development

*this is a sponsored post