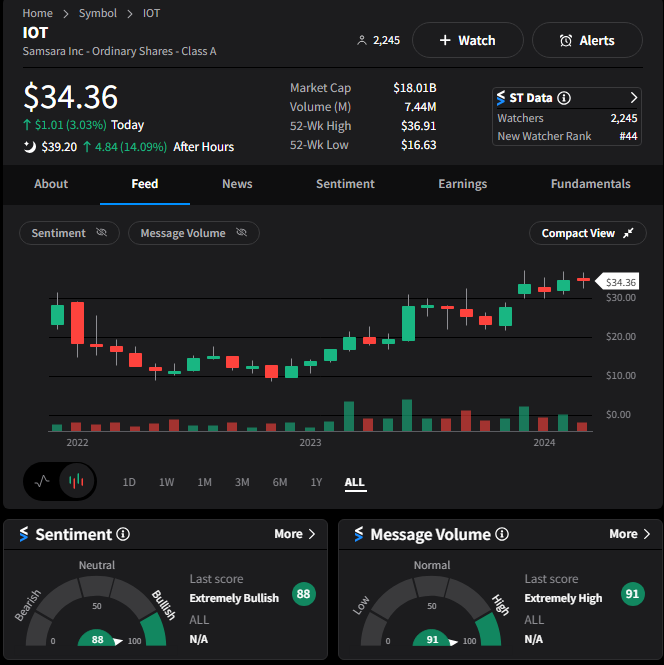

While sentiment surges around crypto and artificial intelligence, it’s no surprise to see that hype around the “Internet of Things” company Samsara is also popping off. 🤩

The stock jumped to fresh all-time highs in the after-hours session following better-than-expected results. Its fourth-quarter revenues of $276.3 million topped estimates of $258.3 million, with its adjusted loss also narrower than anticipated. 💪

The company ended the year with $1.1 billion of ARR, representing 39% YoY growth. Investors were happiest to see the path of profitable growth, with the company also posting its first year of positive adjusted free cash flow.

Executives expect the momentum to continue this year, targeting $1.19 to $1.20 billion in revenues and $0.11 to $0.13 in earnings per share. Both numbers beat Wall Street’s estimates.

$IOT shares jumped 14% after the bell to all-time highs, with the Stocktwits community pushing the extremes of our bullish sentiment readings. 🐂

Speaking of internet-related things, Reddit officially set a date for its IPO. It will begin trading on the NYSE under the ticker symbol $RDDT on March 20th. 👀