Good evening, y’all. Welcome to another week in the Market of Stocks. 🤑

The major indexes opened the week on a poor note, largely due to the insane amount of geopolitical turmoil rn. President Biden called Russia’s advance into Ukraine “an invasion,” and the S&P 500 rolled over 1.01%. The Dow dove 1.42% and the Nasdaq dropped 1.23%. 🌎 More on this below.

Houghton Mifflin Harcourt Company soared 15.34% today to six-year highs after being acquired by Veritas Capital for $2.8 billion, or $21/share. $HMHC is up 29.85% YTD.

Every sector closed in negative territory. Consumer discretionary collapsed 2.92% (ouch), energy erased 1.62%, and materials moved 1.42% lower.

Commodities were cranking — wheat futures whizzed 6.03%, soybean oil futures flew 3.62%, and corn futures climbed 3.13%. 🌽

Home Depot plunged 8.85% in Tuesday’s session despite beating earnings and sales estimates. 🤷 Read more about Home Depot below.

$AMLX ascended 13.17%, $DWAC stacked 10.2%, $HBAR.X hopped 15%.

Here are the closing prices:

| S&P 500 | 4,304 | -1.01% |

| Nasdaq | 13,381 | -1.23% |

| Russell 2000 | 1,980 | -1.45% |

| Dow Jones | 33,596 | -1.42% |

Earnings

Earnings Recap

Tempur Sealy sank 19.43% today to one-year lows after falling short of earnings and sales expectations. Revenue and earnings rose to record highs.

$TPX | EPS: $0.88 (vs. $0.96 expected) | Revenue: $1.36 billion (vs. $1.45 billion expected) | Link to Report

Palo Alto accelerated 6.5% in extended trading after beating on the top and bottom line. The company also raised revenue and earnings guidance. Revenue grew +30% YoY.

$PANW | EPS: $1.74 (vs. $1.64 expected) | Revenue: $1.3 billion (vs. $1.28 billion expected) | Link to Report

Teladoc tanked 7.35% to two-year lows despite an earnings and sales beat. The telemedicine provider reported guidance for full-year 2022 revenue between $2.55 billion and $2.65 billion.

$TDOC | EPS: ($0.07) (vs. ($0.59) expected) | Revenue: $554.2 million (vs. $543.5 million expected) | Link to Report

Sponsored

A Tech-Powered Startup is Reinventing the $480B Retail Pharmacy Industry

NowRx’s tech-enabled business model operates at a fraction of the cost of major retail chains.

The result? Amazing service, Great Prices and Free Same Day Delivery.

With $26M in annualized revenue in 2021 and plans for 10 more locations this year, it’s time you get your shares in this rapidly growing startup.

Policy

Russia Makes Its Move

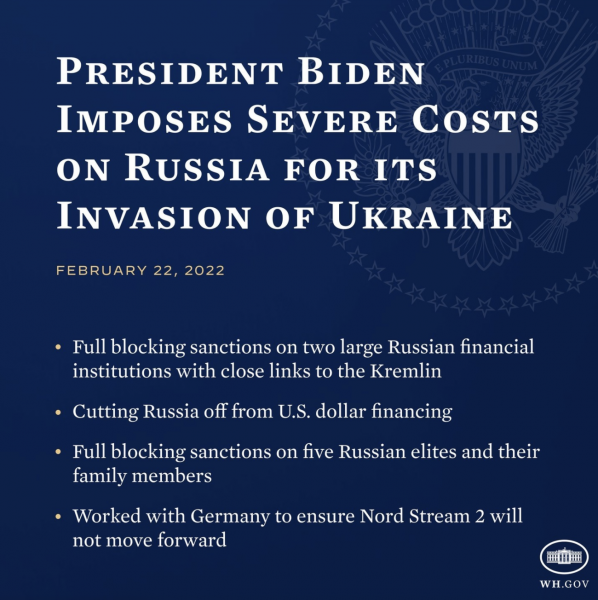

You’ve probably read the headlines, but we’ll reiterate for your convenience — Russian troops have advanced into Ukraine, and President Biden is calling Russia’s move an “invasion.”

In response to Russia’s advance, President Biden enacted sanctions on Russia’s VEB bank and the country’s military bank. Biden shared the following about the U.S.’s sanctions:

“That means we’ve cut off Russia’s government from Western financing. It can no longer raise money from the West and cannot trade its new debt on our markets, or European markets either.” Wealthy Russian citizens and the country’s elites will also face personal sanctions from the U.S.

President Biden commented on his military response to Russia’s movements as well. He announced: “Today, in response to Russia’s admission that it will not withdraw its forces from Belarus, I have authorized additional movements of U.S. forces and equipment already stationed in Europe to strengthen our Baltic Allies, Estonia, Latvia, and Lithuania.”

The markets felt the heat from the ongoing international turmoil. 🔥 🔥 The Dow, Nasdaq, and S&P 500 each shaved over a percent. Germany shut off its access to the Nord Stream 2 natural gas pipeline, and Europe’s natural gas costs surged over 11%. Brent crude gained over 2% to nearly $100/barrel, its highest level since 2014.

We’ll obviously be keeping watch on the escalation of this situation. 👀

Earnings

Home Depot Earnings 🔨 🏡

Home Depot shares fell over 8% today after the company reported Q4 earnings. The home improvement store beat on revenue, but missed on earnings estimates — Home Depot credited inflation for some of its sales boost, and that didn’t sit well with investors. 🤷

Revenue: $35.72 billion, +11% YoY (compared to estimates of $34.87)

Earnings per share: $3.21, +17% YoY (compared to estimates of $3.18)

Guidance: 2.5% increase in sales, 4.7% increase in EPS for the full year

The highlight of the company’s presentation was its sales figure, which showed +10.7% YoY growth from Q4 2020. Home Depot’s sales came in at $35.7 billion, a $3.5 billion increase from Q4 the year before. The ultra-hot housing market is also working to Home Depot’s advantage because a higher quantity of homeowners are renovating. 🔨

Home Depot’s Chairman and CEO, Craig Menear, shared “Our ability to grow the business by over $40 billion in the last two years is a testament to investments we have made in the business, our ability to execute with agility, and our associates’ relentless focus on our customers. I would like to thank all of our associates, as well as our supplier partners, for their hard work and dedication to serving our customers, communities and each other.”

Home Depot revealed a 15% increase to its dividend, which will pay out $7.60/share annually to investors starting March 24, 2022. Home Depot will also appoint a new CEO in the coming months.

$HD is up 0.18% in afterhours.

SoFi plummeted 10% today on news of its M&A deal. SoFi announced its purchase of Technisys SA, a banking-software company, for $1.1 billion… that’s literally 10% of SoFi’s entire market value.

This deal aims to implement Technisys’ banking technology to jumpstart SoFi’s financial services for its banking users. SoFi will gain a back-end platform capable of sustaining its personal banking app, customer accounts, and customer deposits. 💰 💰

Despite SoFi’s 10% dump, the company’s CEO Anthony Noto isn’t doubting his play. 💡 Noto shared “We’re not slowing down. The distance between us and others is only going to increase.” The company anticipates an additional $800 million in revenue from Technisys’ capabilities until 2025.

SoFi went public via SPAC last year, but officially became a bank this year after its acquisition of Golden Pacific Bancorp Inc. and its purchase of Galileo Financial Technologies Inc. for debit card issuance. Although SoFi is moving full-steam ahead, its stock is down a whopping 28% over the last year.

$SOFI is up 0.98% after hours.

Bullets

Bullets From The Day:

Slack was down this morning. The platform’s chat feature was temporarily disabled this morning (which you may have noticed), but it was fixed in just a couple of hours. The company says it’s not sure what caused the outage, but its investigation to get to the bottom of the disruption is ongoing. Read more in CNBC.

Donald Trump launched his Truth Social app in the U.S. The platform is owned by Trump Media & Technology. Truth Social’s first day live was apparently a rough one, as many users experienced glitches or were forced to join a waitlist. Nonetheless, $DWAC soared 10.18% and the app was Apple’s #1 most-downloaded free app of the day. Read more in WSJ.

Macy’s will separate its e-commerce and brick-and-mortar business segments. The company claims to foresee a strong performance in 2022, as its CEO announced “We are a different Macy’s Inc. today than we were in 2019: more agile, more profitable and more relevant to our customers.” Inflation, the current labor market, and a lack of international tourism (this is apparently a huge source of Macy’s brick-and-mortar income these days) threaten the company’s financials, however. Read more in WSJ.

Links

Links That Don’t Suck:

💰 This company has raised over $15M from almost 5,000 investors and you can join them.*

🤔 What’s Worth More: Unicorns or the Biggest U.S. Tech Companies?

😟 Why This Economic Boom Can’t Lift America’s Spirits

🤦 U.S. Embassy in Ukraine Posts Cringe Memes as It Retreats to Poland

😷 Covid Infections Plummet 90% from U.S. Pandemic High, States Lift Mask Mandates

🎓 Thousands of Chicago Students and Their Parents to Get Full College Scholarships

*this is a sponsored post