Welcome to the Stocktwits Top 25 Newsletter for Week 27 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 27:

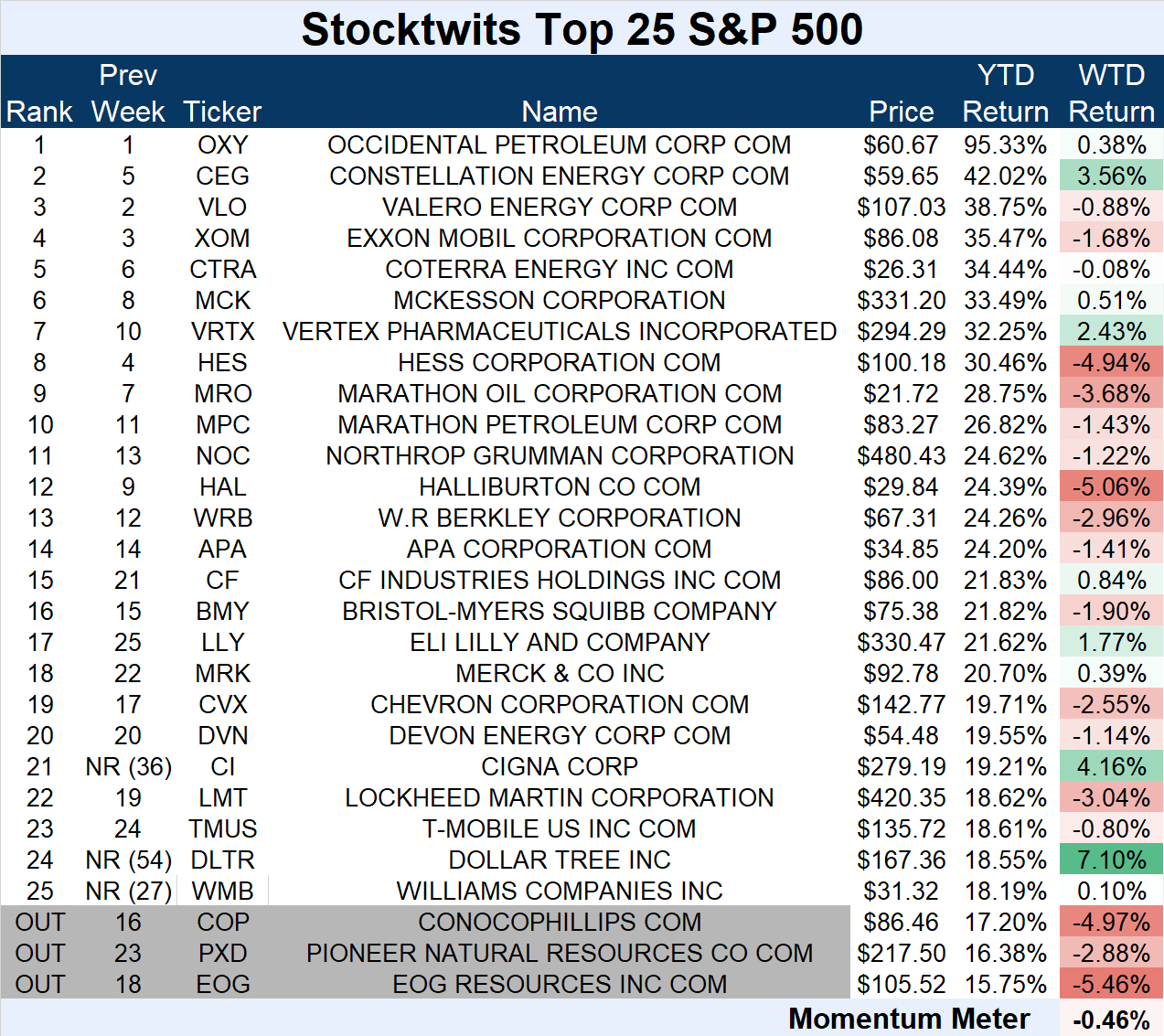

S&P 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (-0.46%) underperformed the S&P 500 index (+1.94%).

There were three major changes to the list this week.

Cigna Corp. (4.16%), Dollar Tree (+7.10%), and Williams Companies (+0.10%) joined the list.

They replaced ConocoPhillips (-4.97%), Pioneer Natural Resources (-2.88%), and EOG Resources (-5.46%).

Energy and materials stocks suffered losses, while defensive areas like consumer staples and health care held up best.

Check out how the momentum meter has performed vs. the S&P 500 index this year:

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+1.16%) underperformed the Nasdaq 100 index (+4.66%).

There were three major changes to the list this week.

Crowdstrike Holdings (+6.21%), Fortinet (+9.29%), and Electronic Arts (+2.36%) joined the list.

They replaced Paccar Inc. (-2.20%), JD.com (-5.97%), and Netease Inc. (-2.67%).

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+3.95%) outperformed the Russell 200 index (+2.41%).

There were five changes to the list this week.

Target Hospitality Corp. (+35.41%), Tenneco Inc. (+10.14%%), Eiger Biopharmaceuticals (+34.53%), Meridian Bioscience (+6.80%), and MRC Global (+7.19%) joined the list.

They replaced Valhi Inc. (-4.76%), Delek US Holdings (-10.92%), Kosmos Energy Ltd. (-10.45%), Solaris Oilfield Infrastructure (-9.07%), and Talos Energy (-7.90%).

The small-cap index often has some *BIG* movers; as you can see, this week was no different.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was Target Hospitality Corp., which rallied 35.41% this week.

The specialty rental and hospitality services company rallied after it raised its full-year guidance. In addition, the company recently received a government contract with a minimum initial value of $575 million, with the potential to generate more revenue from other services.

After this week’s move, the stock is trading at its highest level of the year.

$TH is up 101.86% YTD.

See Y’all Next Week 🤙