Nvidia’s evil plan to take over the stock market was put on hold today despite labor market data helping build the case for a June rate cut. 🤔

The February jobs report showed that nonfarm payrolls rose by 275,000, topping the 198,000 expected. However, the previous two months’ numbers were revised lower by 167,000 jobs, causing the unemployment rate to jump to 3.90% and signaling a further softening of the labor market. 🔻

On top of that, wage growth was just 0.1% MoM and 4.3% YoY, a positive sign for the Fed’s fight against inflation.

Weakness in the labor market renewed investors’ hopes for a June rate cut, causing stocks to surge after the open. However, after making a new high, sellers came in and pushed stocks lower throughout the day, as shown in Nvidia’s chart below. An 11% swing in a $2 trillion stock is quite the single-day move on no company-specific news. 😳

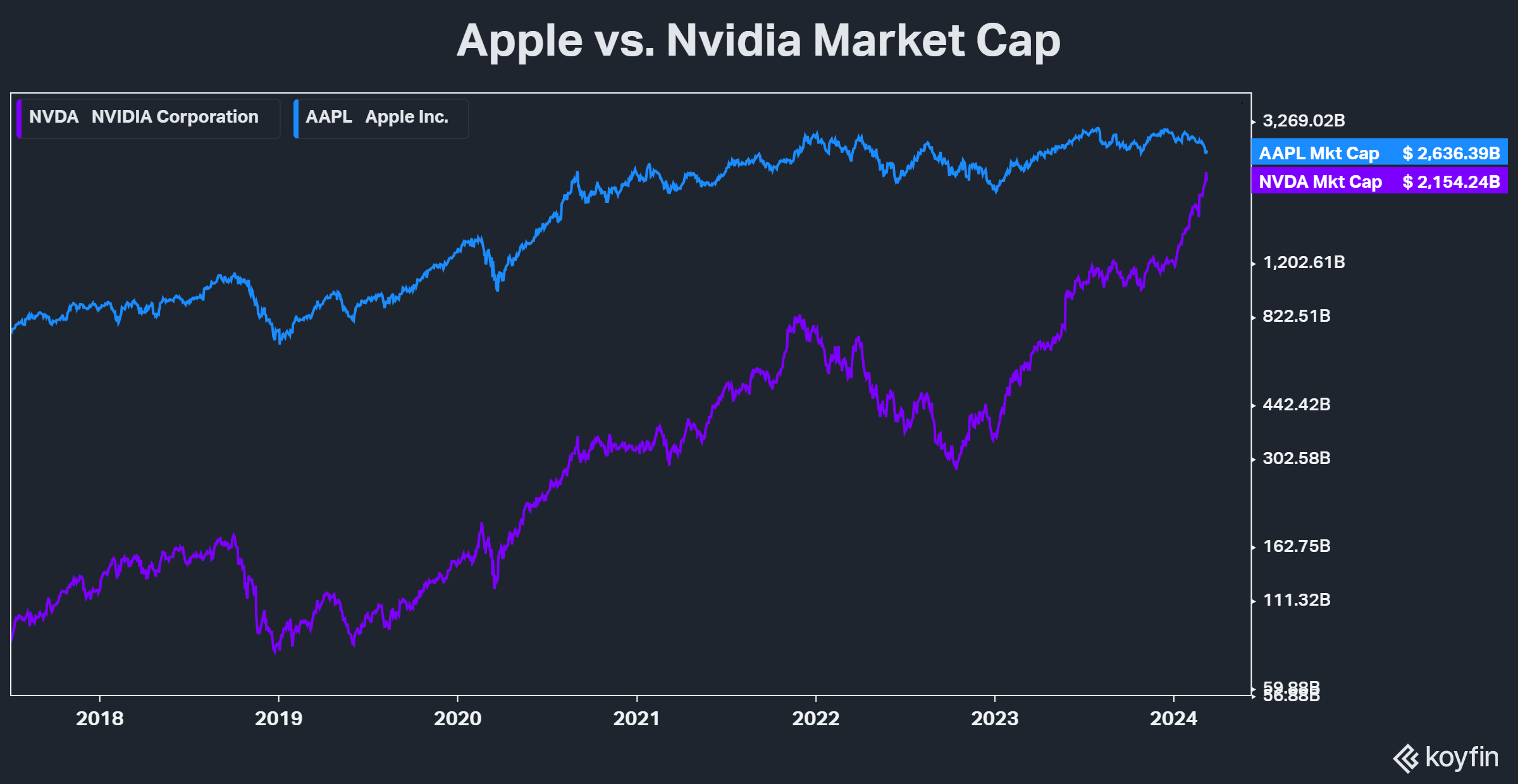

And speaking of Nvidia, one graph that’s been going around lately to show just how wild the stock market’s move has been is Nvidia vs. Apple’s market cap. The gap between them has been closing at a record pace, with many pointing out it would only take a few good days from Nvidia and a few more bad days from Apple for it to become the second-largest company in the world. 🫨

Overall, the large-cap stock market indexes continue to grind higher while small and mid-cap stocks play catchup. Investors and traders will be watching to see if stocks posting their third down week of 2024 will change the momentum in the near term. ⚔️