Stocks remain stuck in the mud as investors await tomorrow’s employment report — here’s what you missed today. 👀

Today’s issue includes AMD’s earnings preannouncement, Louisiana’s divestment from BlackRock, and more news! 📰

Check out today’s heat map:

Only energy (+1.78%) was green today, with utilities (-3.30%) and real estate (-3.28%) lagging. 🔻

The U.K. market drama continues, with the Bank of England saying pension funds were hours from disaster before its intervention. Meanwhile, some speculate that the bond market crisis could be entering a second act. Lastly, rating agency Fitch cut its U.K. outlook from ‘stable’ to ‘negative.’ 👎

The “International Monetary Fund” warned of higher recession risk in its new, darker global outlook. Yet, despite that, Crude oil, gasoline, and heating oil continue to extend gains quietly. 🤫

Biden pardoned all prior federal offenses of simple marijuana possession. The news sent marijuana stocks higher as investors viewed the move as another move that made the regulatory environment more favorable for the industry. 😶🌫️

Initial jobless claims jumped 29k to 219k, with announced job cuts rising 46% to ~30k in September. Regarding job cuts, GE is laying off hundreds of workers, Peloton is cutting another 500 jobs, and Spotify is laying off 5% of staff. ❌

In crypto news, there’s Securities and Exchange Commission infighting over Gensler’s “rouge” tactics. The Do Kwon saga continues as South Korean authorities begin the process of canceling his passport. And all Russian crypto payments to European wallet providers are forbidden. ₿

Other symbols active on the streams included: $APRN (-0.36%), $AMV (+95.45%), $KITT (-15.66%), $AERC (-14.26%), $MULN (-4.03%), $AVCT (-5.41%), $PEGY (+64.86%), and $TOPS (-35.22%). 🔥

Here are the closing prices:

| S&P 500 | 3,745 | -1.02% |

| Nasdaq | 11,073 | -0.68% |

| Russell 2000 | 1,753 | -0.58% |

| Dow Jones | 29,927 | -1.15% |

Earnings

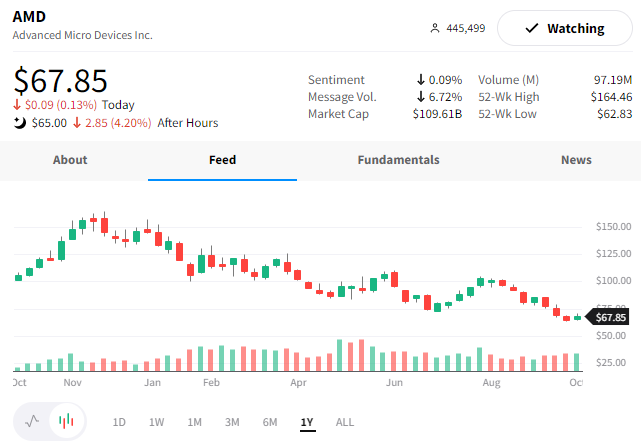

AMD: Another Major Disappointment

The hits keep on coming for semiconductor stocks. In August, Nvidia reported preliminary results well below expectations, followed by mixed earnings from Micron in September.

Advanced Micro Devices followed suit today, issuing preliminary third-quarter results well below its initial guidance. 😮

While it expected $6.50-$6.90 billion in revenue, it reported $5.6 billion. Additionally, its non-GAAP gross margin will likely be around 50%, while it had previously forecasted 54%. 🔻

The company said the primary driver was “…weaker than expected PC market and significant inventory correction actions across the PC supply chain.”

The news sent shares of $AMD down about 4% after hours, taking many of its peers along with it. 📉

Policy

The Louisiana…Sale?

We’ve written about how controversial the topic of environmental, social, and governance (ESG) investment strategies are. And after a lot of hemming and hawing, we’re finally seeing a major player take action express their views on the subject.

Louisiana’s state Treasurer John Schroder said the state is pulling $794 million out of BlackRock Inc’s funds. Regarding the decision, the primary reason cited was the asset management firm’s push to embrace ESG strategies. 🌎

Schroder said in a statement: “This divestment is necessary to protect Louisiana from mandates BlackRock has called for that would cripple our critical energy sector.”

The roughly $800 million will not put a dent in BlackRock’s more than $8 trillion in assets under management. However, the state’s move could spark others to follow suit. As we’ve seen, many people and organizations talk, but rarely walk the walk. If there are organizations that dislike how asset managers apply their ESG mandates/views, this could be the push they need to begin expressing those views in dollars. 💰

BlackRock has yet to comment, so we’ll have to see how this develops and will keep you updated.

Levi Strauss & Co. reported adjusted earnings per share of $0.40, above analyst estimates of $0.37. Revenue of $1.52 billion came in below expectations of $1.60 billion.

Additionally, the company reduced its annual forecast for revenue and earnings. It now expects adjusted EPS of $1.44-$1.49 (vs. $1.50-$1.56) and revenue of $6.15-$6.17 billion (vs. $6.40-6.50). 🔻

Driving the reduced earnings is a significant currency headwind from a strong U.S. Dollar, ongoing supply chain disruptions, and a more cautious outlook for the North American and European economies. It noted signs of weakness in lower-income consumers, similar to what many other companies have reported. 👎

Some positives mentioned are the “casualization tailwinds” that emerged as jeans became more acceptable in the office. Additionally, it doesn’t have to discount its inventory as much as other retailers because it can be sold through multiple seasons. 👍

Overall though, investors saw more negatives than positives today and sent $LEVI shares down nearly 10%. 📉

Bullets

Bullets From The Day:

💰 Amazon makes first venture fund bets. The company is investing in outside venture capital funds for the first time, saying it plans to hand $150 million to firms that are backing under-represented founders. The online retailer said it aims to put money into more than ten funds supporting 200 companies at or before the seed stage of investing through next year. The trend of companies supporting these efforts is not new but picking up steam. For example, last year, PayPal committed $100 million to funds and depository institutions in support of women. Reuters has more.

📉 Apartment demand falls during its busiest season for the first time in 30 years. Every year the third quarter is historically the most active for apartment rentals, but a report from RealPage suggests that demand fell for the first time in the 30 years it’s been tracking the metric. In addition, asking rents fell in September for the first time since December 2020. The company’s head of economics and industry principals says, “Soft leasing numbers coupled with weak home sales point to low consumer confidence.” More from CNBC.

🤔 Porsche market cap overtakes VW; here’s why the math behind it is wonky. The company became Europe’s most valuable automaker a week after its initial public offering when its market cap rose above its parent company, Volkswagen. The strange part is that VW owns 53% of Porsche, meaning that the market values its core business at less than $40 billion when you back out the value of its Porsche holdings. Whether or not that continues remains to be seen, but it’s certainly an interesting situation to observe. Yahoo Finance has more.

🤝 Musk asks Twitter to end all litigation to close the deal. A judge ruled that Musk must complete the Twitter deal under its original terms by October 28 to avoid going to trial. The news comes as Twitter refuses to drop the lawsuit against Musk because of its concern that he will not close the deal as agreed. But, as many suggested earlier in the week when Musk reversed his decision, the situation is far from over and remains messy. Hopefully, this October 28 deadline will help push things forward for both sides. More from CNBC.

⚖️ Hacker responsible for $270 million in damages gets light sentencing. Paige Thompson, a former Amazon software engineer, stole 100 million people’s personal information from Capital One, costing the company at least $270 million. And although Thompson was found guilty of wire fraud, unauthorized access to a computer, and damaging a protected computer, her attorneys argued that she never misused the information she stole. Ultimately, the court handed down sentencing of time served and five years of probation. Gizmodo has more.

Links

Links That Don’t Suck:

🍔 Burger King’s new slogan rules

🤖 Exclusive: Boston Dynamics pledges not to weaponize its robots

😂 It’s happened: Someone’s filed for Cramer ETFs with the SEC

✈️ Hong Kong offers 500,000 free air tickets to tempt tourists back

💳 Legislation that could gut credit card rewards set to move through Congress

🤑 A $150 million beach home for sale would be the Hamptons’ priciest ever – if it can find a buyer