Welcome to the Stocktwits Top 25 Newsletter for Week 20 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 20:

P.S. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

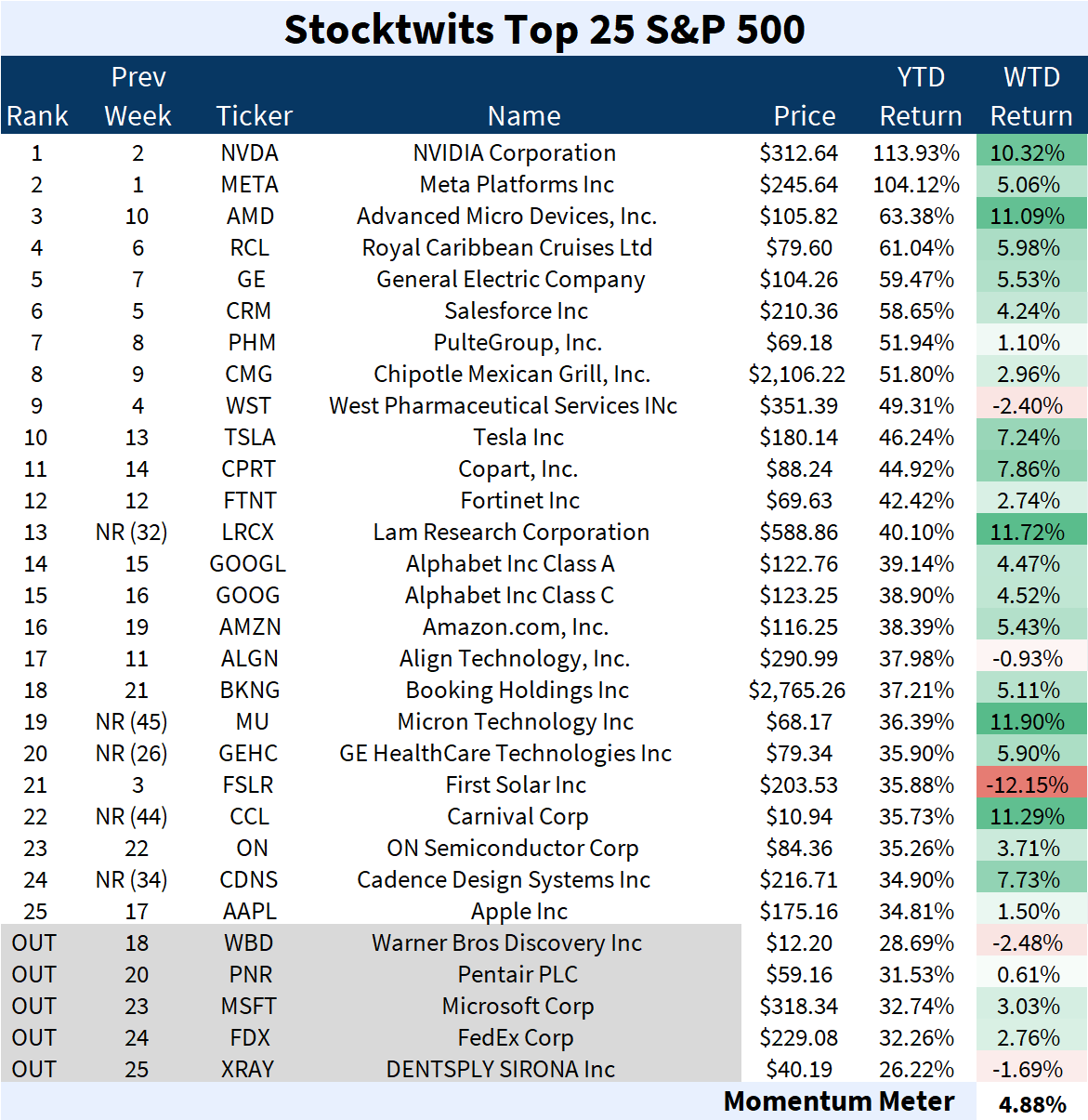

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+4.88%) outperformed the S&P 500 index (+1.65%).

There were five major changes to the list this week.

Joining: Lam Research Corp. (+11.72%), Micron Technology (+11.90%), GE HealthCare Technologies (+5.90%), Carnival Corp (+11.29%), and Cadence Design Systems (+7.73%).

Leaving: Warner Bros Discovery (-2.48%), Pentair PLC (+0.61%), Microsoft (+3.03%), FedEx (+2.76%), and Dentsply Sirona Inc (-1.69%).

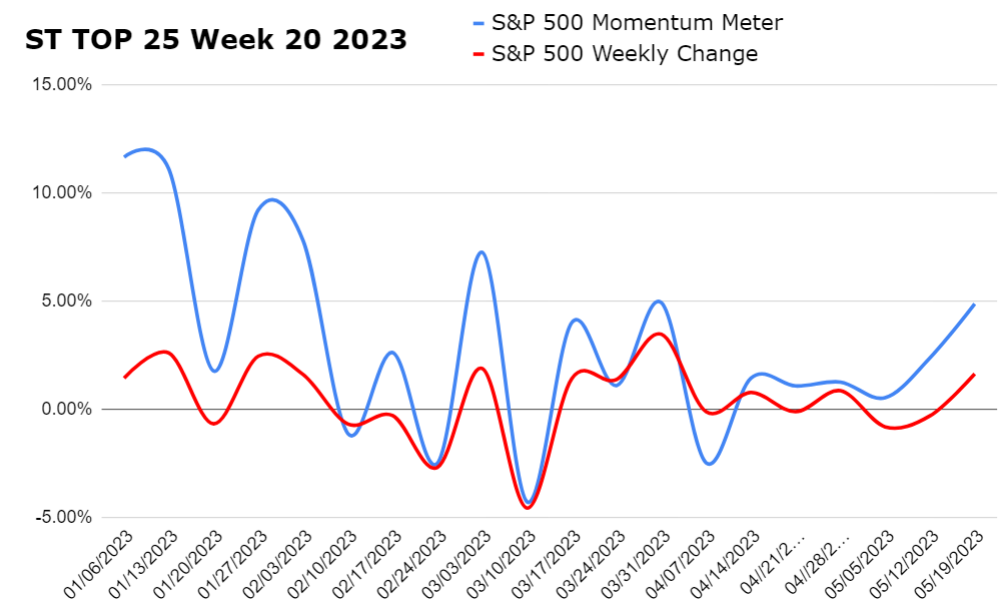

Check out how the momentum meter has performed vs. the S&P 500 index this year:

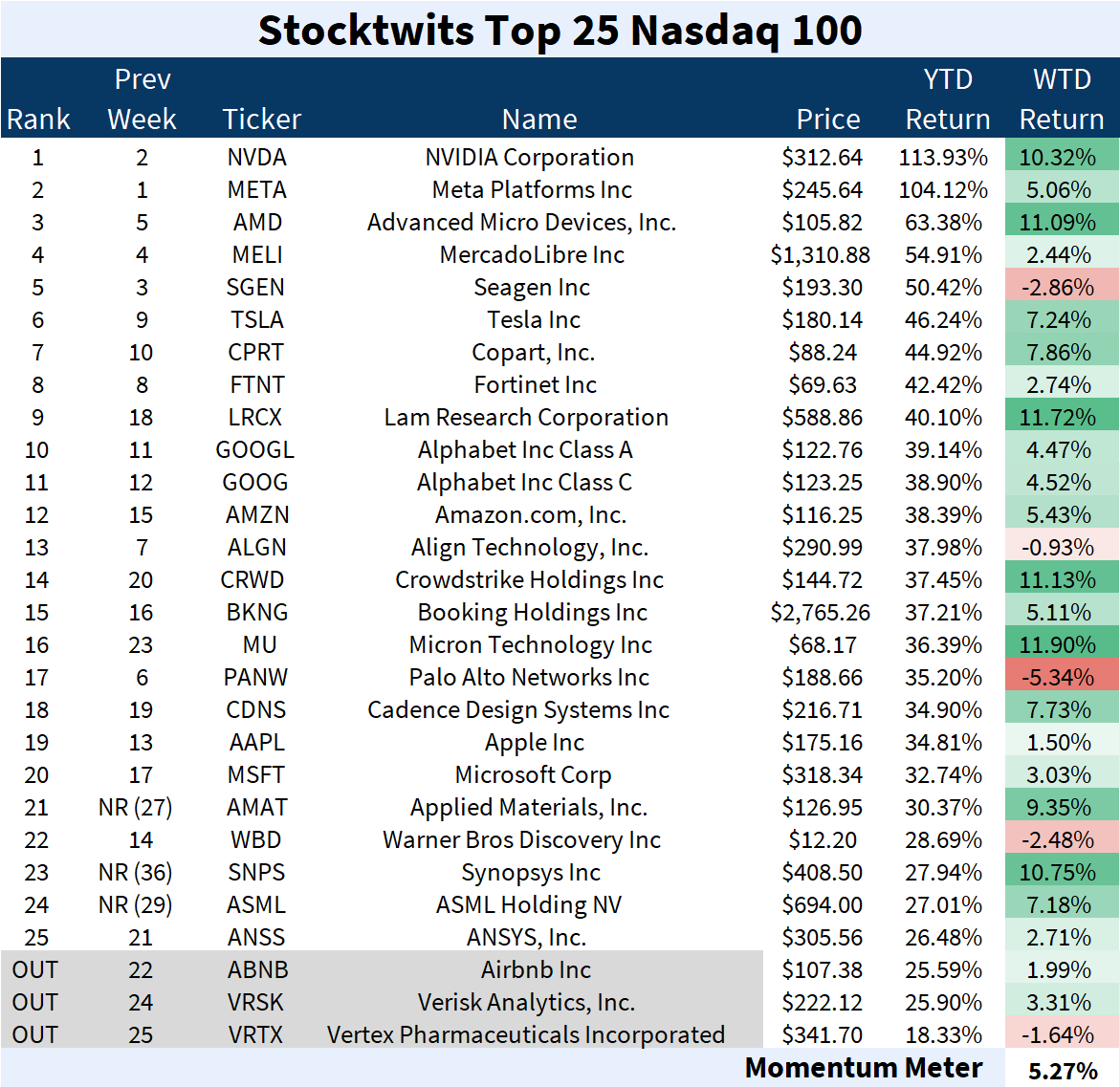

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+5.27%) outperformed the Nasdaq 100 index (+3.47%).

There were three major changes to the list this week.

Joining: Applied Materials (+9.35%), Synopsys Inc (+10.75%), and ASML Holding NV (+7.18%).

Leaving: Airbnb (+1.99%), Verisk Analytics (+3.31%), and Vertex Pharmaceuticals (-1.64%).

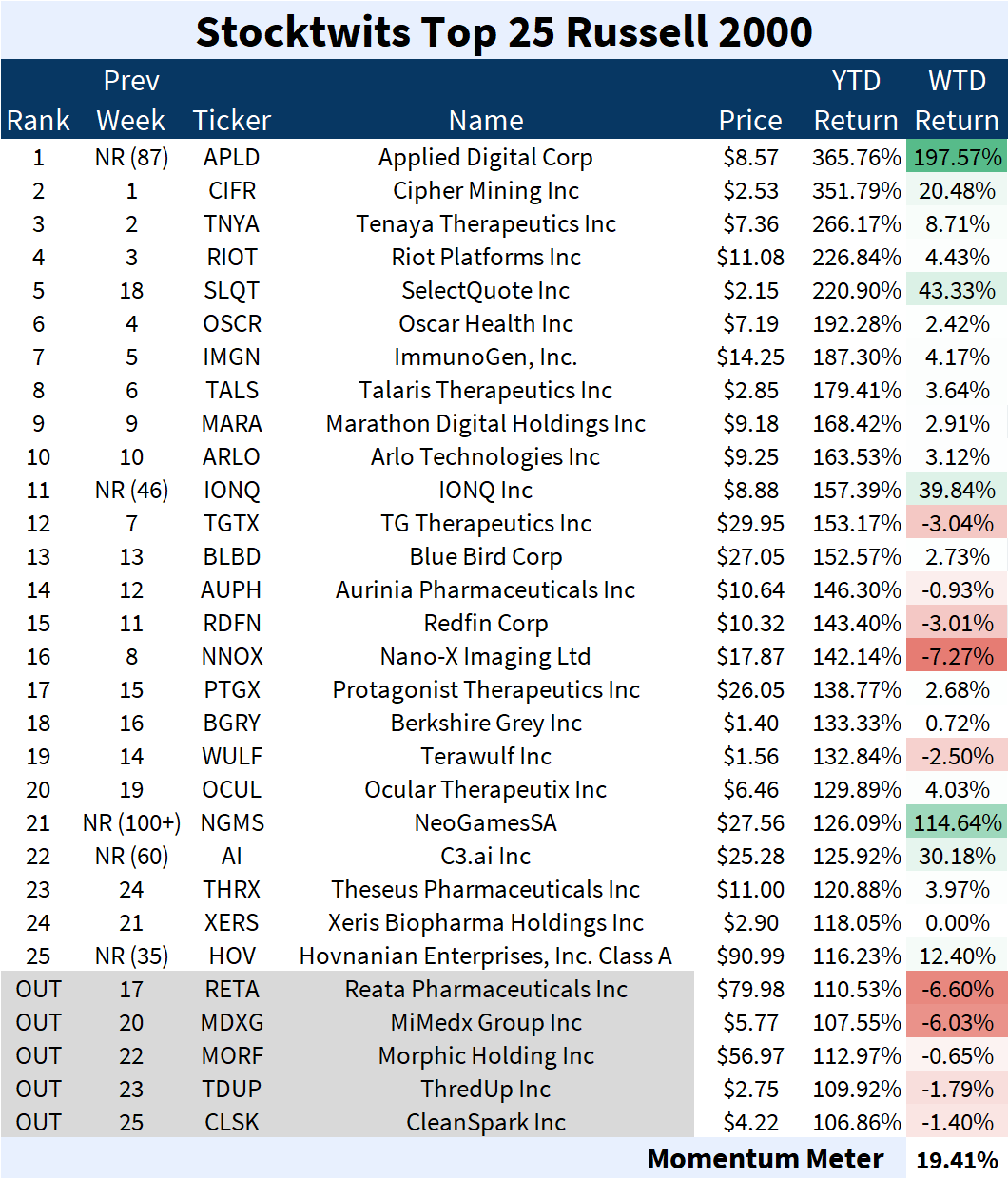

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+19.41%) outperformed the Russell 2000 index (+1.89%).

There were five major changes to the list this week.

Joining: Applied Digital Corp (+197.57%), IONQ Inc (+39.84%), NeoGames SA (+114.64%), C3.ai (+30.18%), and Hovnanian Enterprises (+12.40%).

Leaving: Reata Pharmaceuticals (-6.60%), MiMedx Group (-6.03%), Morphic Holding Inc (-0.65%), ThredUp (-1.79%), and CleanSpark (-1.40%).

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

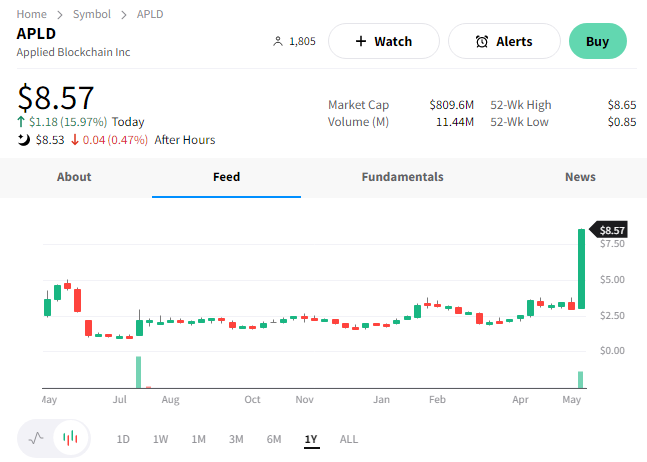

The Top 25 lists’ Top Dawg was Applied Digital Corp., which rallied 197.57%. 📈

Applied Digital is a small-cap software company that designs, develops, and operates data centers in North America. It’s had a rough run since the 2021 highs but rallied this week after announcing its Sai Computing subsidiary signed a $180 million, 24-month contract to support the work of a “major AI customer.” 📝

It didn’t disclose the customer’s name, but the words “artificial intelligence” were enough to get shares moving. It said the contract includes a “significant pre-payment” and that its work will begin in June, fully ramping by year-end. And on Friday, it announced a new $50 million loan that it’ll use to build out its AI Cloud platform and data centers. 💰

We’ll have to wait and see if the stock’s momentum can continue or if this is another blip on the radar of struggling long-term shareholders. 🤷

$APLD is up 365.76% YTD.

See Y’all Next Week 🤙