I’ll keep the details short and simple here because time is running out, and if I’m not done on time for pizza night with the kids, my wife will be very mad. 🍕

I almost wrote she’d kill me, but if I did that, there’d probably be a SWAT team and an army of social workers making sure I’m ok.

MINA

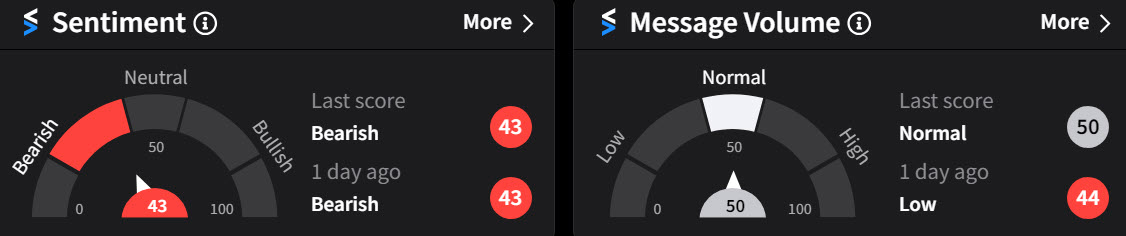

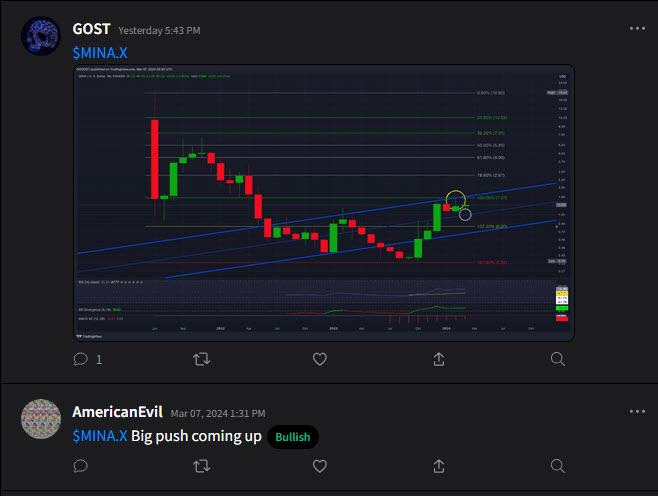

Oh man, $MINA is playing some sneaky sneaky bear trappy games here. At least, that’s what it looks like. It’s already fallen below the bottom trendline of the triangle, but bulls keep pushing up against it.

Analysts and traders on the bullish side are looking for a daily close at or above $1.50, which would put MINA above the triangle and above the prior swing’s close. And with the RSI in neutral conditions, any breakout might have a lot of room to run.

Oh boy, oh boy, the image below is hawt. Using Stocktwits Social Data is such a powerful tool – check out One Way To Use Stocktwits’ Social Data Tools as an example of how analysts and traders use the Stocktwits Social Data in their analysis and trading. 🔥

That MINA is pressing up against some near-term resistance, with a flat RSI, and the Sentiment and Message Volume are flat to bearish… Barring any broader weekend crypto shenanigans (which are incredibly probable), bulls be frothin at the mouth.

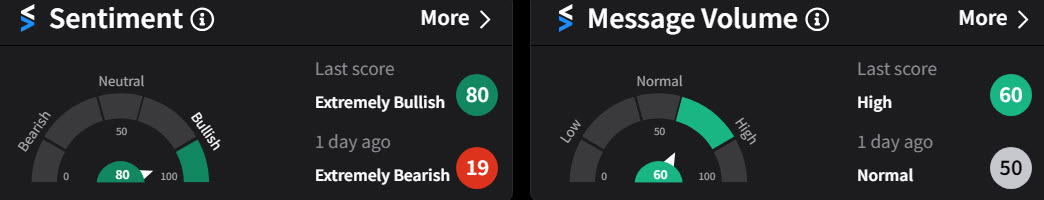

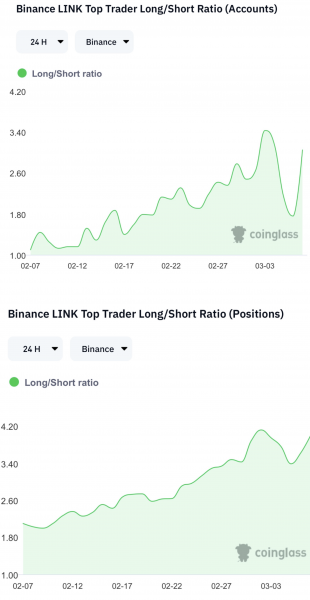

Chainlink

This guy’s been stuck against that $20 value area since the middle of February. Bulls cracked above the resistance level at $20.83, bears slid it back down, and price action keeps ping-ponging against that resistance level. 💣

Similar to MINA above, $LINK‘s RSI is in almost neutral conditions. Given how close the daily candles are to that resistance level, it looks like bulls want to give a move higher another go.

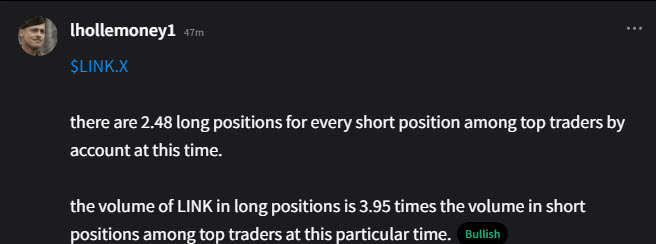

And here’s an interesting little piece of on-chain analytics from Stocktwits user lhollemoney1; he wrote:

Finally, I just want to reshare this analysis from last Friday because, yes, everything looks uber-bullish. Still, you’d be silly not to be cautious with crypto going into a weekend, which is when most price action shenanigans occur. ⛔