What looked like a fourteenth straight positive day for the Dow was stopped short by the bears. Despite better-than-expected economic data, sellers finally took enough control to close the market red. Let’s see what else you missed. 👀

Today’s issue covers what has Crocs shares on the rocks, why Enphase lacks energy, and traders flagging an ominous “bearish engulfing pattern.” 📰

Check out today’s heat map:

One sector closed green. Communication services (+0.84%) led, and real estate (-2.11%) lagged. 💚

In economic news, the U.S. economy’s second-quarter growth surprisingly accelerated to 2.4%, and the personal consumption expenditures index (PCE) continued decelerating to 2.6%. The labor market remains tight, with initial jobless claims falling to 221,000 vs. the 235,000 expected. And U.S. durable goods orders rose more than anticipated in June, driven by strength in transportation. 🔺

Pending home sales jumped 0.3% MoM in June, marking their first increase in four months but remain down 15.6% YoY. U.S. single-family homes fell 2.5% MoM in June but are up 23.8% YoY as the median new home price declined 4% YoY. Overall, tight supply and low affordability are keeping housing activity depressed. 🏘️

Internationally, the European Central Bank raised rates by 25 bps to twenty-three-year highs. While it didn’t provide any forward guidance, it did hint at a potential pause in September as it gives time for its policy to impact the economy. Meanwhile, Turkey’s central bank more than doubled its previous inflation estimate to 58% as it ramps up its tightening policy. 📈

An earnings beat and raised outlook from Royal Caribbean sent the industry cruising higher today, as strong bookings at record prices buoy the group. Not every company has positioned itself well for the resurgence in travel demand, with Southwest Airlines dropping after an earnings miss and weaker-than-anticipated revenues. 🚢

Bud Light maker Anheuser-Busch is laying off several hundred corporate staff while competitor Boston Beer rallies on strong growth in its Twisted Tea product. 🍺

And the nearly century-old trucking company Yellow Corp fell 45% after laying off its entire 30,000-person staff and preparing to file bankruptcy on July 31. 🚚

Other symbols active on the streams included: $SAM (+8.25%), $MRSN (-72.63%), $QS (+14.30%), $URGN (+98.56%), $WRNT (-27.43%), $TUP (+56.32%), $SIMO (-19.65%), and $VIEW (+44.36%). 🔥

Here are the closing prices:

| S&P 500 | 4,537 | -0.64% |

| Nasdaq | 14,050 | -0.55% |

| Russell 2000 | 1,955 | -1.29% |

| Dow Jones | 35,283 | -0.67% |

The stock market reversed sharply today, and many are pointing to treasury yields as the cause. Let’s find out why. 👇

Last week we discussed how much of the stock market’s gains since October have come from multiple expansion, not earnings growth. Essentially, investors have been willing to pay more for every dollar of earnings S&P 500 companies generated. However, that was primarily driven by the belief that interest rates and inflation had peaked and rates would come down.

Yesterday’s Federal Reserve press conference reiterated that the committee remains open to another rate hike before the end of the year. It will depend on the data, which is mixed right now. Core and headline inflation continues to trend lower (albeit slowly), and the housing market has stalled. But the labor market remains historically strong and is buoying consumer confidence and spending. 💪

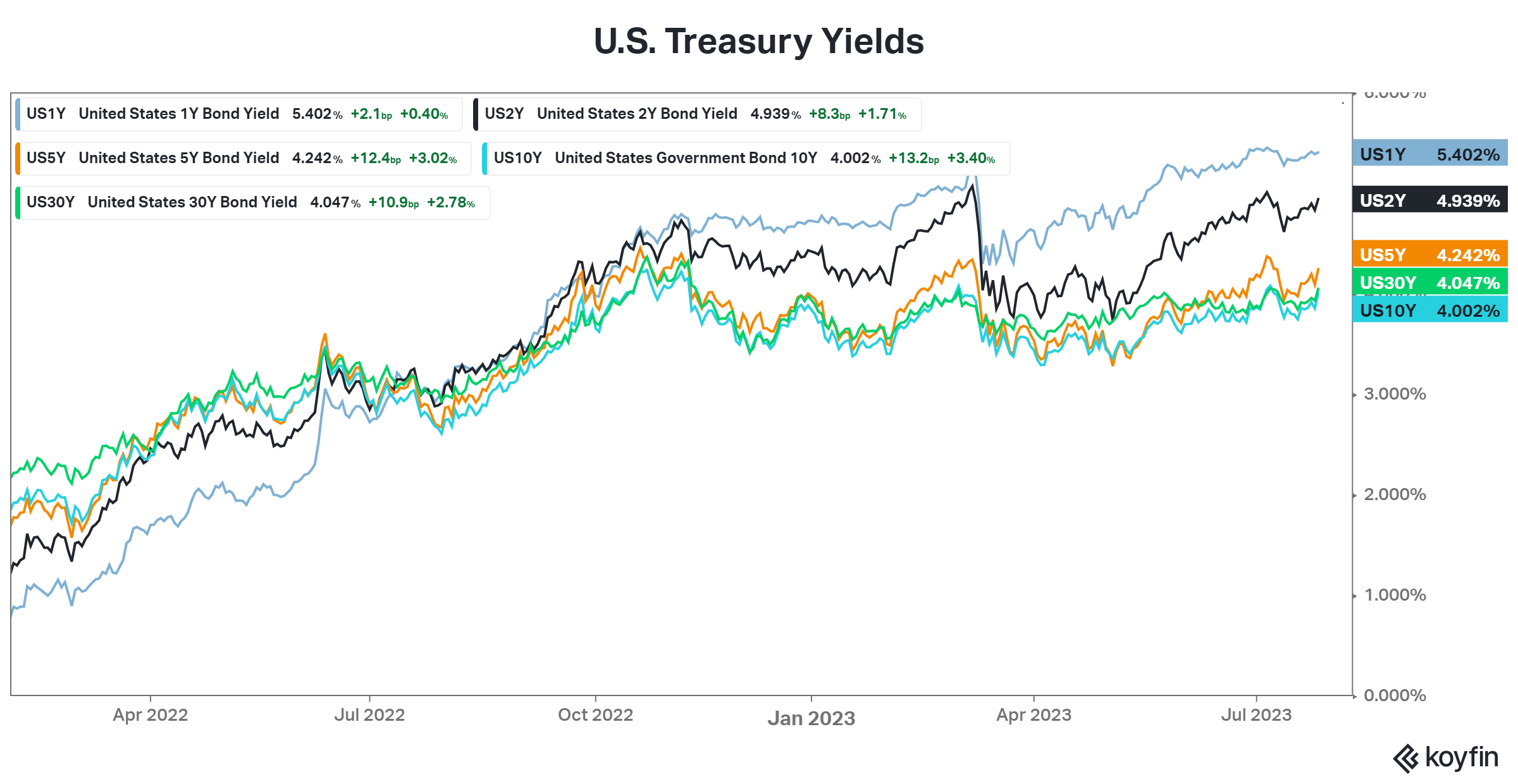

Today’s second-quarter GDP report came in at 2.4%, showing that the economy remains more resilient than even the Fed anticipated. And if that’s the case, rates may have to adjust higher than they are. That’s why Treasury Yields across the curve pushed higher today, with the U.S. 10- and 30-year yields topping 4% again.

The chart below shows that longer-term rates have held steady since October as the market bet on a Fed pivot. But the economy never weakened, and the Fed hasn’t changed its tone materially. As a result, we may be witnessing the early stages of a breakout in yields. That’s at least what shook the stock market today. 📈

Stocks across the board have rallied significantly, and earnings haven’t been there to support them. Many companies have said their pricing power is diminishing as inflation comes down, but costs remain elevated due to the tight labor market. And if interest rates continue to move higher from here, then it will only be more difficult for companies to generate better margins and earnings. 🐻

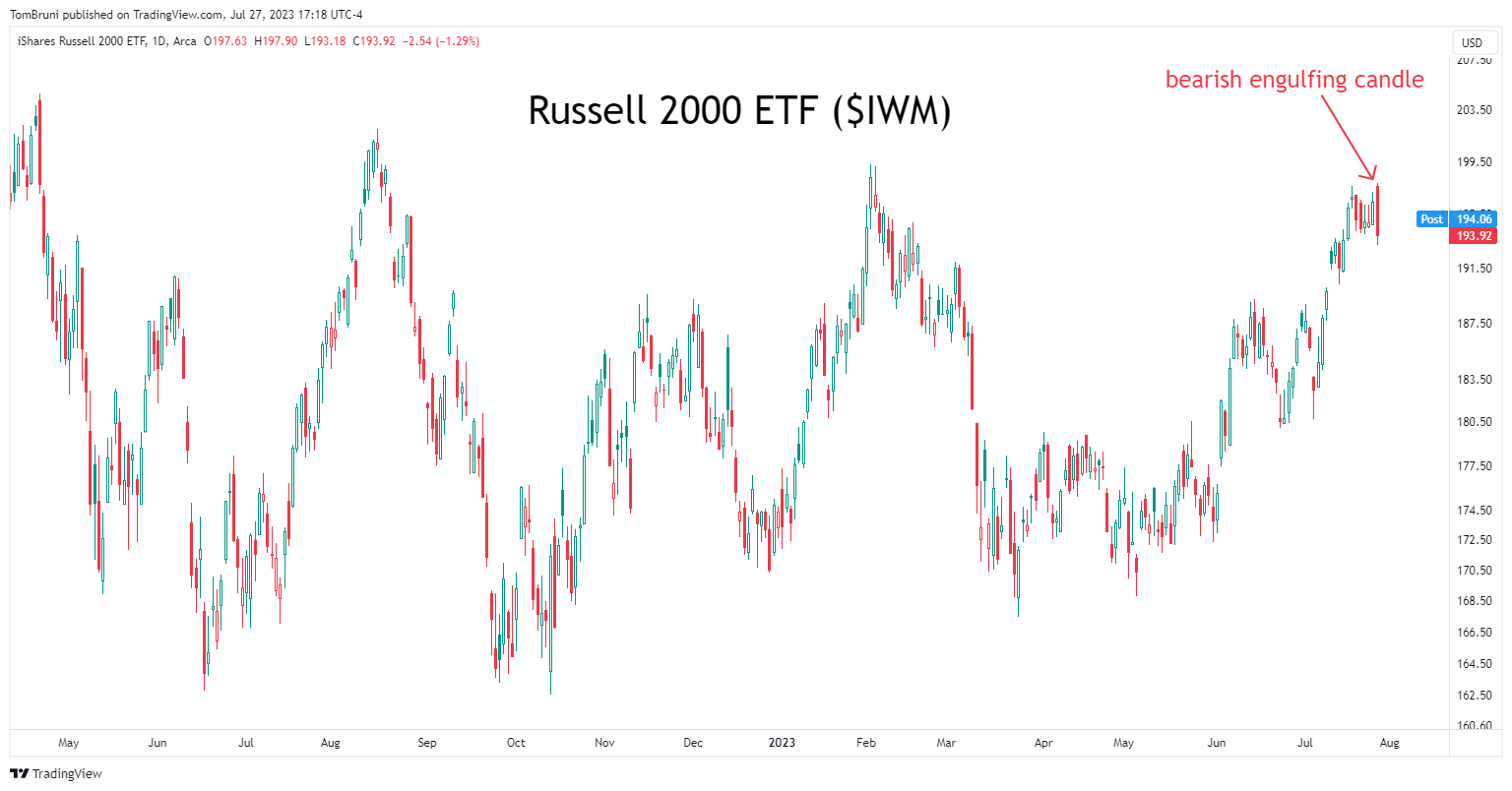

As a result, some market analysts believe today was the start of a short-term pullback. Many are pointing to the “bearish engulfing candles” taking place in the major indices like the Russell 2000 and many individual stocks. 🐻

This technical analysis pattern is the opposite of its bullish counterpart and essentially signals the start of a potential trend change. However, this signal requires downside follow-through in the days after to confirm that sellers have taken control. 📉

Overall, after a strong run in the stock market, bulls are looking for the next catalyst to take the market higher. With high valuations and prices rallying sharply since October, many fear that there are more potential bearish catalysts than bullish ones. Time will tell, but at least now you know the prevailing narrative. 🗫

Earnings

Crocs Shares On The Rocks

HeyDude, Crocs shares are falling 15% today despite better-than-expected results. 🤔

The footwear company reported adjusted earnings per share of $3.59, topping the $2.98 expected. Revenues rose 11.2% YoY to $10.72 billion, outpacing the $1.044 billion consensus view.

Looking ahead, the company expects full-year 2023 earnings of $11.83 to $12.22 per share and revenues of $4.00 to $4.065 billion. Wall Street expected $11.57 per share on $4.019 billion in revenue.

On its surface, everything looked great. However, it ran into problems when walking through its HeyDude brand numbers. The company acquired the casual footwear brand for $2.5 billion nearly 1.5 years ago, and growth is already beginning to slow. 🔻

Overall revenues grew just 3%, while wholesale revenue fell 8.4% to $148.8 million. Direct-to-consumer (DTC) sales did rise 30% YoY, but that wholesale weakness caused the company to lower its full-year revenue growth guidance from the mid-20% range down to 14% to 18%. 📉

CEO Andrew Rees told analysts that the company’s wholesale partners are “pretty cautious on the back-half of the year,” citing three primary reasons: caution about overall consumer spending, overstock in some other brands, and a lack of good history with HeyDude in the second half of the year.

As a result, the company is shifting toward a more direct-to-consumer approach as it uses for its Crocs brand. But that transition will take time. ⏱️

Given the slowing growth, investors pushed shares of $CROX to new year-to-date lows. If the company is going to maintain its significant premium over other footwear brands, it will have to deliver premium sales and earnings growth. And today’s earnings cast doubt on its ability to do that. 😟

Earnings

Enphase Lacks Energy

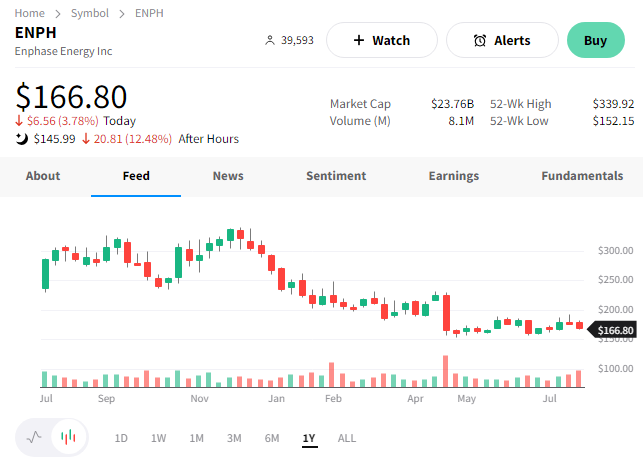

Enphase Energy develops and manufactures solar micro-inverters, battery energy storage, and EV charging stations for residential customers. However, today the only thing it produced was losses for its shareholders. 😬

The company reported adjusted earnings per share of $1.47, which topped the $1.28 expected. Revenues fell short, though, at $711.1 million vs. the $726 million consensus view. 🔻

Executives expect third-quarter revenues of $555 to $600 million. That was well shy of the $749 million Wall Street expected.

The revenue miss and weak guidance were enough to send $ENPH shares down another 13% after hours. 📉

Meanwhile, competitor First Solar jumped after beating both revenue and earnings expectations. $FSLR shares jumped 8% toward the 15-year highs set earlier this year. 🌞

Bullets

Bullets From The Day:

🏦 Regulators unveil new capital requirement rules for big banks. The sweeping new set of rules will apply to banks with more than $100 million in assets, resulting in a roughly 16% increase in common equity tier 1 capital requirements across the industry. Most banks already have enough capital to meet the new requirements, but those who do not will have until July 2028 to fully comply. CNBC has more.

✂️ Samsung extends production cuts as losses mount. Although the chipmaker said the worst is over for the global memory chip market, it extended its production cuts because demand recovery is primarily constrained to high-end chips used in artificial intelligence. The move comes after the South Korean firm incurred a $7 billion operating loss from its chip business during the year’s first six months. Many chipmakers had expected a rebound in the second half of 2023. Still, that recovery may be pushed into 2024 as they cut production to create a better supply and demand balance. More from Reuters.

😮 Netflix receives backlash for AI product manager role paying $900,000. Striking writers and actors are taking aim at Netflix for shelling out the big bucks for machine learning talent while they fight for better pay and benefits. They’re also concerned that the technology could be used as an alternative to their skills, cutting them out of the picture entirely (or at least reducing their long-term negotiating leverage). TechCrunch has more.

👀 EU eyes Microsoft in latest antitrust case. The European Commission opened a formal antitrust investigation into Microsoft’s bundling of its Teams software with its Office productivity suite. Slack filed an anti-competitive complaint against Microsoft in July 2020, but the regulator was slow to act. It’s the first time Microsoft will face an antitrust investigation in the EU for nearly 15 years, with the last being about its Windows Media Player and Internet Explorer bundling. More from The Verge.

😶🌫️ Cannabis industry encounters another major headwind. As if the industry didn’t have enough issues to overcome, it’s faced with one more. The second-largest payment processor, Mastercard, has told financial payment companies to stop allowing U.S. customers to buy legal marijuana in shops using its debit cards. The move comes after it found some shops accepted debit payments despite the federal-level ban that requires purchases to be made in cash. BBC News has more.

Links

Links That Don’t Suck:

⚠️ Largest electric grid operator in U.S. issues alert as temperatures climb

🔥 As e-bikes proliferate, so do deadly fires blamed on exploding lithium-ion batteries

🚜 America’s farms are desperate for labor. Foreign workers bring relief and controversy

🕵️ Why Elizabeth Warren and Lindsey Graham want a new U.S. agency to police Big Tech

🚀 NASA awards contract for nuclear-powered rocket that could help humanity reach Mars

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.