Despite this week’s volatility, the stock market continued to press onward and ended the week green. Let’s see what else you missed. 👀

Today’s issue covers big oil’s profit decline, consumer goods companies’ falling volumes, and the Bank of Japan’s major policy shift. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Communication services (+1.94%) led, and real estate (-0.26%) lagged. 💚

In economic news, the Fed’s preferred inflation metric, Core PCE, continues decelerating. It rose just 4.1% in June, marking its slowest annual pace since September 2021. 🔻

Shipping stocks like Costamare are rebounding lately as the market bets on the global economy holding up better than initially anticipated. Meanwhile, China’s housing ministry is looking to support the real estate market by making it easier for people to buy property. 🌏

AstraZeneca shares jumped 5% on news that its Alexion unit agreed to buy U.S. drugmaker Pfizer’s early-stage rare disease gene therapy portfolio. 💊

Reata Pharmaceuticals soared 54% after Biogen announced it would buy the company for $6.5 billion as it looks to bolster its rare disease portfolio. 📈

Global asset manager T. Rowe Price rose 8% after earnings and revenues topped expectations, with net client outflows of just $20 billion and assets under management (AUM) of $1.4 trillion. 💰

Direct lender for multifamily loan commercial real estate loans, Arbor Realty Trust, increased 9% after reporting better-than-expected quarterly results. 🏢

And investors jumped on the Booz cruise, with American government and military contractor Booz Allen Hamilton rising by 6% to new all-time highs after earnings. 😮

Other symbols active on the streams included: $ROKU (+31.38%), $PLTR (+10.28%), $NIO (+11.40%), $IONQ (+15.42%), $QS (+23.86%), $MRSN (+17.76%), and $VIEW (+33.64%). 🔥

Here are the closing prices:

| S&P 500 | 4,582 | +0.99% |

| Nasdaq | 14,317 | +1.90% |

| Russell 2000 | 1,981 | +1.36% |

| Dow Jones | 35,459 | +0.50% |

Earnings

Big Oil’s Big Profit Miss

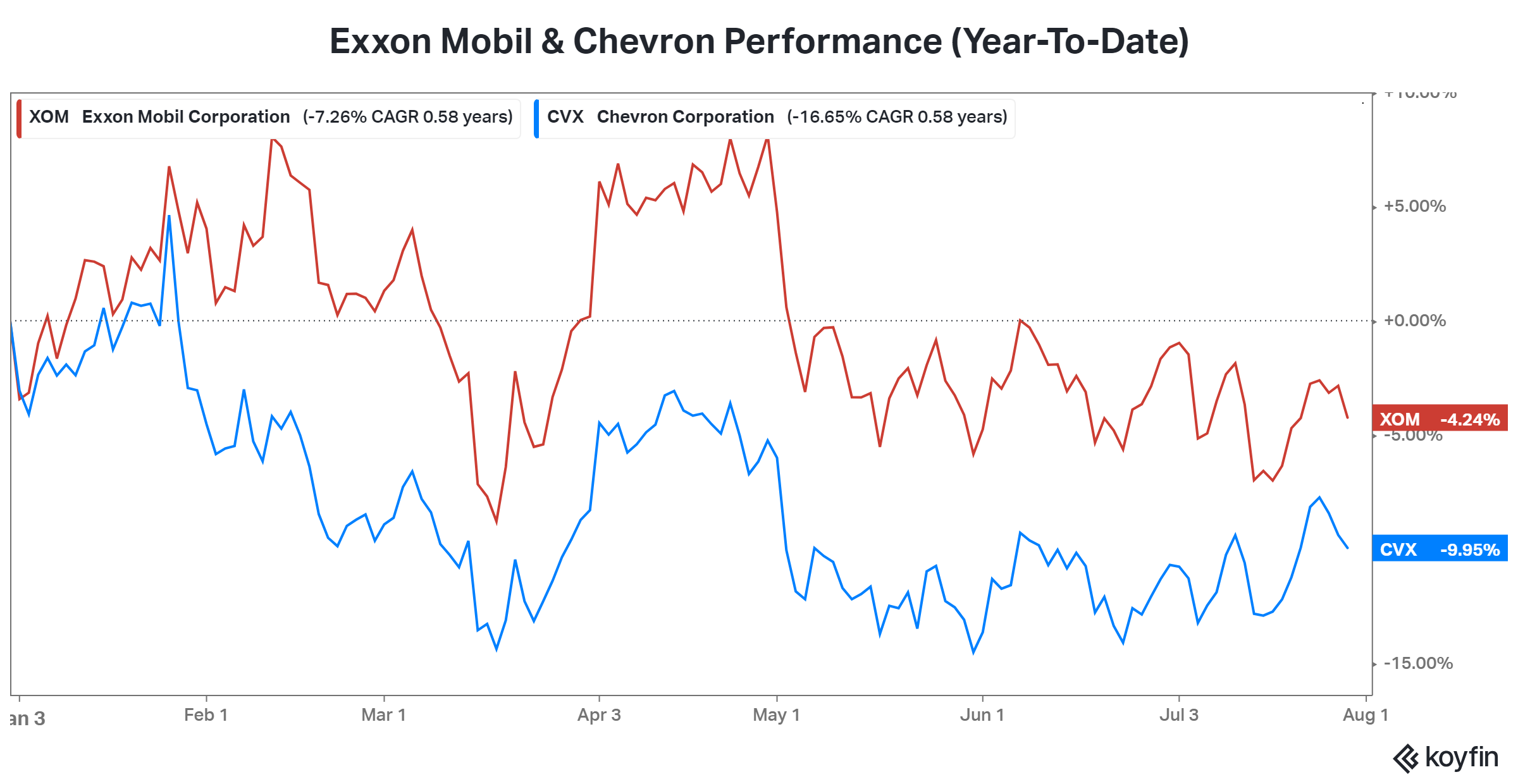

Oil majors made record profits last year on high oil prices and refining margins. However, falling prices through the first half of this year have weighed on results. Let’s take a look. 👀

Exxon Mobil reported adjusted earnings per share of $1.94 vs. the $2.03 expected. Revenues of $82.9 billion topped estimates of $81.80 billion.

A 40% YoY decline in natural gas prices drove the fall, which had been partially forecasted by management. Executives revised their estimates lower by 12% over the last month as the stock pulled back. But overall, the company says we’re back to a more normal environment for prices and profits. 🔻

Chevron’s results also echoed that sentiment. Although its $3.08 earnings per share topped estimates of $2.91, revenue slipped 29% to $48.90 billion. Net production grew 4% to a new quarterly record of 1.22 million barrels of oil equivalent per day, driven by Permian Basin strength. 🛢️

The company continues to invest in U.S. production, purchasing PDC Energy in May for $6.3 billion.

Overall, the days of bumper profits for the oil giants are behind us. But they’re still above pre-pandemic levels, and the recent uptick in energy commodities suggests they could have a tailwind in the year’s second half. Despite that, investors remain cautious about the stocks after their strong performance since late 2020. ⚠️

Policy

Japan’s Big Policy Shift

After a decade-long period of monetary easing, the Bank of Japan is finally making some adjustments. The central bank surprised markets by allowing the 10-year Japanese government bond yield to rise to a nearly nine-year high. 📈

Governor Kazuo Ueda said this doesn’t mean the bank is giving up his predecessor, Haruhiko Kuroda’s, easy policy that included negative short-term rates and capping the bond yield through large government bond purchases. However, it does mean it’s giving the market more freedom to affect yields.

More specifically, it’s keeping the 0.5% yield cap on the 10-year bond and setting a new rigid limit at 1%. It hopes this new policy will “improve the sustainability of the country’s monetary easing framework.”🔺

Recently, inflation has been rising in the country. As a result, many market participants believe this is the first of more moves the Bank of Japan will make to manage prices in the year ahead.

Higher rates would certainly shake up markets, both in Japan and globally. That’s because Japan’s Yen has been a major “carry trade” for foreign investors over the last decade. Low-interest rates in Japan meant investors could sell Yen for U.S. Dollars (or other foreign currencies) and then invest in higher-yielding assets in those countries. But, that could start to slowly unwind as the cost of that trade becomes higher and domestic Japanese investments become more attractive. 💱

Ultimately, the market does expect a gradual rise in rates, especially compared to the more aggressive hiking cycles in the U.S., Europe, and elsewhere. Clearly, the Bank of Japan wants to maintain control of its bond market but is slowly allowing the free market to express its views. Otherwise, it risks inflation getting out of control.

Time will tell how it plays out. But for now, investors are taking the weekend to assess the situation and adjust their views on the country accordingly. 👀

Earnings

Consumer Goods Earnings

Falling volumes remain the trend in consumer goods land, with several big players reaffirming that trend during their earnings release. 📉

Procter & Gamble’s fiscal 2024 outlook fell short of Wall Street expectations, with overall volume falling for the fifth consecutive quarter. Executives believe volumes will begin to increase in 2024 and expect to rise prices by only 1% to 1.5%.

Colgate-Palmolive beat revenue and earnings expectations, raising its full-year outlook. The company said an 11% price increase helped offset a 1.5% decline in volume. Gross margins also increased as supply chains improved and costs fell marginally.

Mondelez International experienced 17% organic net revenue growth during the quarter, as strong demand for its snacks offset its high cost of goods. Executives say pricing drove organic net revenue growth, as its volume/mix was flat during the second quarter. Looking ahead, they raised organic net revenue and adjusted EPS growth outlook to 12%+. But it shows that even with solid demand, volumes can’t seem to grow in the current environment.

Overall, these companies continue to face several headwinds. They’ve got inflation-strapped consumers trading down to private-label brands to save on necessities. Additionally, with supply chains stabilizing, their pricing power in the market is also dwindling. Plus, commodity price volatility could push costs if they begin to rally through the back half of the year. ⚠️

Executives are preparing for volatile results over the next year. They remain cautiously optimistic about the economy and overall consumer health. We’ll have to see if they’re right as their stocks continue to consolidate near all-time highs. 🤷

Bullets

Bullets From The Day:

🚗 Ford raises guidance despite EVs weighing on profits. The U.S. automaker raised its 2023 guidance after strong pricing and demand for its internal combustion engine (ICE) vehicles pushed second-quarter earnings beyond expectations. It now expects full-year adjusted earnings of $11 to $12 billion, up from $9 to $11 billion, despite higher costs causing slower electric vehicle (EV) adoption than anticipated. CNBC has more.

🖥️ Intel shares hit 52-week highs after earnings. It reported a surprise second-quarter profit and revenue beat expectations, catching Wall Street off guard. The chipmaker says the personal computer slump is over, and a comeback will be underway during the year’s second half. Not all parts of its business are recovering as quickly as hoped, with the server part of Intel’s operations weighed down by China and weaker demand from corporate and cloud customers. More from Yahoo Finance.

🏭 AMD is investing $400 million in India. The chipmaker joins its peers in diversifying its operations, looking to take advantage of India’s $10 billion incentive program designed to spur local tech investment. It plans to set up its largest design center in Bengaluru and invest $400 million in the country by 2028. TechCrunch has more.

🗓️ Did the pandemic change the meaning of “the weekend?” The consumer economy has significantly shifted since the pandemic, with workers taking more trips and spending more on experiences. That means stretching the weekend beyond the traditional Friday night to Sunday night timeline, opting to work remotely rather than use vacation days. How long it will last remains to be seen, but not needing to be in an office has given workers and the economy a significant boost. More from Axios.

📱 Zuckerberg says Threads users are down more than 50%. After the Twitter rival skyrocketed past 100 million users within five days of launching, Meta CEO Mark Zuckerberg says that less than half of those users have stuck around. As a result, it’s working to add highly-requested features like a “following” feed, expanding translation capabilities to new languages, and more. Chief Product Officer Chris Cox told staff they’re now focused on ‘retention-driving hooks’ to draw people back to the platform. BBC News has more.

Links

Links That Don’t Suck:

❌ EU stress test shows three banks falling short

◀️ a16z-backed Rewind launches an iPhone app to help you remember everything

🥪 Subway to give free sandwiches for life to person who changes their name to ‘Subway’

🤑 You have a month left to get your share of Facebook’s $725 million settlement — here’s how

🎰 Casino mogul Steve Wynn to pay $10m, cut gambling ties after Nevada sexual misconduct investigation