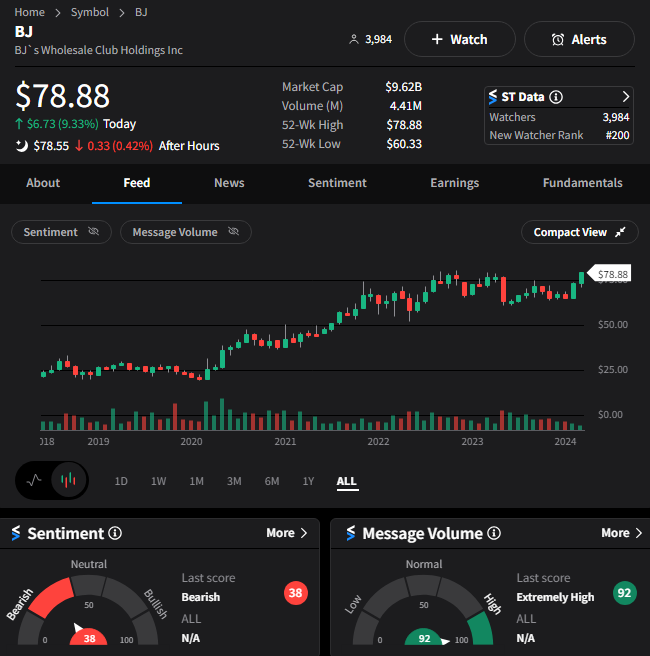

Today’s action shows that BJ’s may have a branding problem in the retail investing community. Despite the company’s results topping expectations today, sentiment readings from are community are still weaker than you’d expect. 🤔

BJ’s Wholesale Club revenues grew 8.70% YoY to $5.357 billion, with adjusted earnings of $1.11 per share. While earnings topped expectations, revenue was slightly below, with executives citing an uncertain macroeconomic environment as the primary driver.

$BJ shares jumped nearly 10% on the news and are just shy of all-time highs. Despite that, the Stocktwits community sentiment reading is sitting in bearish territory, as there seems to be some skepticism about the company’s ability to keep pace with Costco. 👎

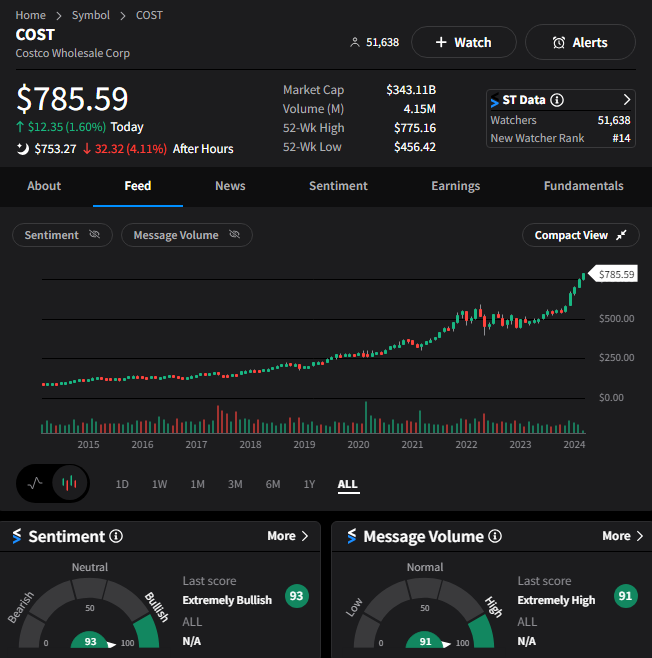

Meanwhile, Costco shares are selling off because its sales grew just 5% YoY to $58.4 0 billion. Like BJ’s, its adjusted earnings of $3.92 per share easily beat estimates of $3.61, but the overall pressure on sales in the membership-based retail space remains. 🪪

Despite that overall headwind, the Stocktwits community seems to believe more in Costco than BJ’s because sentiment is still in “extremely bullish” territory. 🐂

We’ll have to see how this divergence develops in the coming weeks and months. In the meantime, Kroger is a sleeper that continues to kill it. Despite the overhang of its blocked merger, the company continues to deliver strong earnings and revenue growth, driving the stock up another 10% today. 🛍️