Yesterday’s downgrade of the U.S.’s credit rating pushed up interest rates further, tumbling tech stocks in the process. Let’s see what else you missed. 👀

Today’s issue covers Apple’s pre-earnings trend break, a dash of quarterly results with Robinhood, and a retail favorite hanging onto the edge. 📰

Check out today’s heat map:

2 of 11 sectors closed green. Consumer staples (+0.31%) led, and technology (-2.50%) lagged. 💚

In the U.S., Bank of America joined the Fed in reversing its recession call, now seeing the soft landing as the most likely outcome in the year ahead. It also pushed its first rate cut forecast to June 2024, with a slower pace of cuts to follow. Meanwhile, the ADP employment report showed that 324,000 jobs were added in July, driven primarily by the services sector. 👍

Internationally, the Bank of Japan’s policy meeting minutes helped walk back concerns that its easy money era is over. Deputy governor Shinichi Ichida said, “We do not have an exit from monetary easing in mind.” 📝

Earnings continue to roll in, with cloud-based customer service software company Freshworks jumping 18% after its revenues and earnings topped expectations. 🌥️

Scotts Miracle-Gro shares need some fertilizer after falling 19%, driven by weakness in its cannabis growing equipment unit, Hawthorne. 🌱

Paycom Software plummeted 19% following a second-quarter earnings and revenue beat but disappointing third-quarter guidance. 💳

The manufacturer of backup power generation products, Generac, lost 24% after its earnings indicated that consumer demand is softening. 🪫

Other symbols active on the streams included: $TUP (-31.78%), $YELL (-16.15%), $AMD (-7.01%), $CTNT (-39.42%), $QS (-25.03%), $ETSY (-8.31%), $SHOP (-7.44%), and $PYPL (-9.58%). 🔥

Here are the closing prices:

| S&P 500 | 4,513 | -1.38% |

| Nasdaq | 13,973 | -2.17% |

| Russell 2000 | 1,967 | -1.37% |

| Dow Jones | 35,283 | -0.98% |

All eyes are on Apple and Amazon earnings tomorrow. But some traders say the chart of Apple suggests some pain ahead for the consumer tech giant. 🤔

Below is the daily chart of Apple, which has been in a clear uptrend all year. Traders are pointing to today’s breakdown below a multi-month uptrend line as a potential short-term trend change and a potential omen of weak earnings to come. 👇

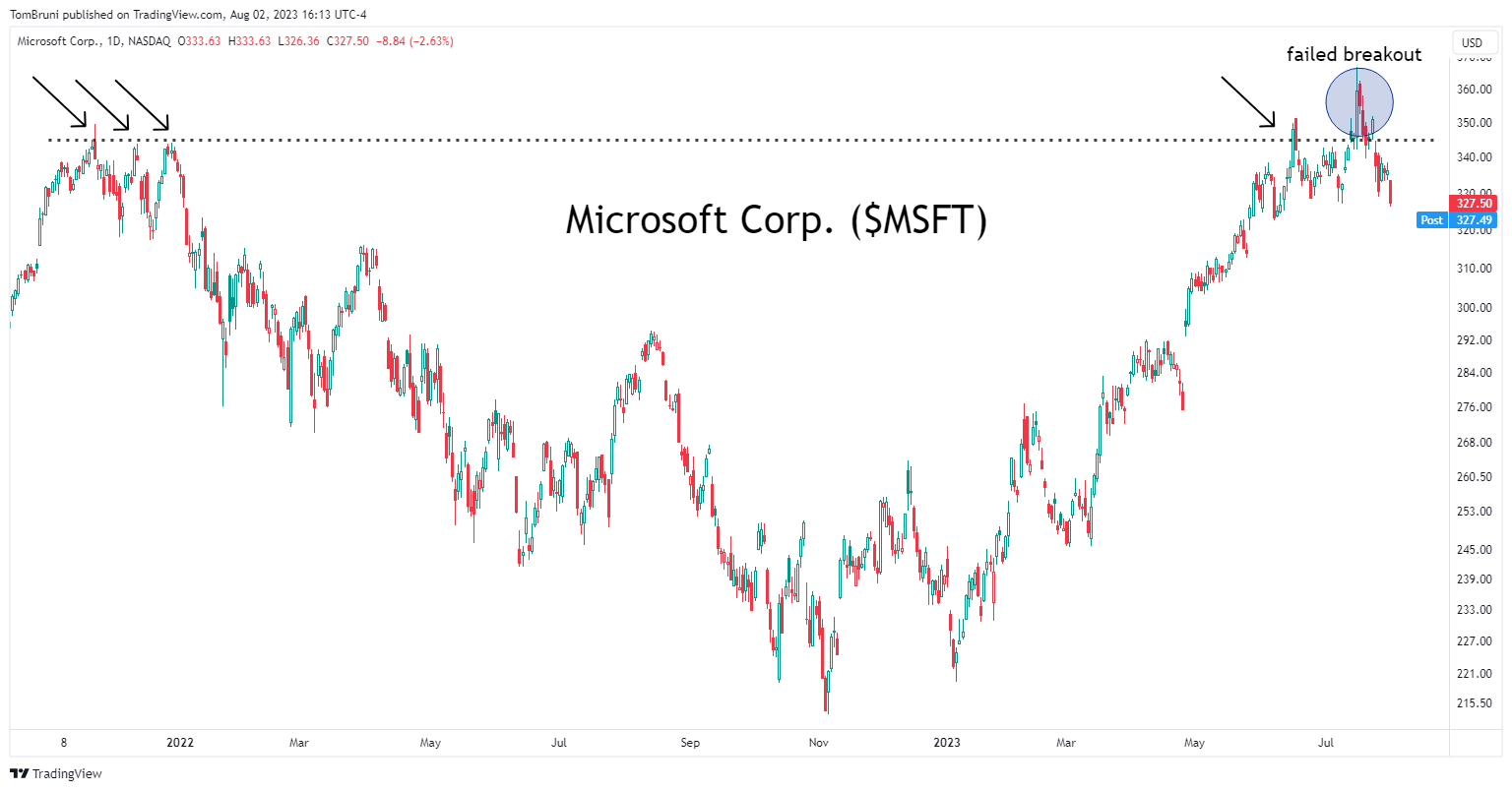

They’re also pointing to Microsoft, which experienced a failed breakout despite beating earnings expectations and giving investors more guidance on how it intends to monetize artificial intelligence (AI). If one of the market’s main technology leaders is already 10% off its highs following good news, has sentiment gotten too far ahead of itself in Apple and others? 📉

They also cited stocks like $AMD, which reported better-than-expected results but still sold off to support their argument further. 📝

Ultimately, we’ll have to wait and see how these chart patterns resolve themselves. In the meantime, investors will closely watch tomorrow’s earnings to set the tone for the overall market.

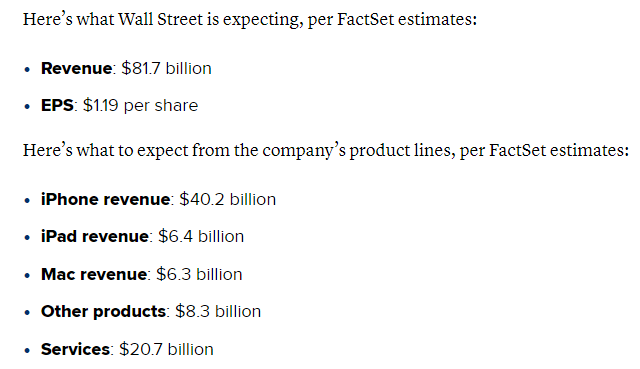

Apple is expected to post its third consecutive quarterly revenue decline, with Wall Street anticipating a 2.3% YoY drop to $81.7 billion. With Apple’s stock up over 50% in 2023 and just below all-time highs, investors will look ahead at its current-quarter guidance for answers. 🔻

The focus will partially be on international markets, including older growth driver China and its newly-entered market, India. Other companies have indicated a slower-than-anticipated recovery in China following its economic reopening earlier this year. We’ll see if Apple’s experience was similar.

Additionally, analysts are looking for a 5% YoY increase in high-margin services. Commentary on the personal computer (PC) market will also provide important context, as that business has been challenging for the last eighteen months. However, many industry players expect we’ve hit a trough and are due for a second-half rebound. And, of course, analysts will also be listening for any mentions of artificial intelligence (AI). 📝

Here’s what analysts are looking for from Apple tomorrow after the bell. Good luck to everyone playing the results! 🎰

Earnings

A Dash Of Earnings With $HOOD

It’s another busy day of earnings, but we’re keeping this one light by focusing on DoorDash and Robinhood. Let’s see how these retail favorites performed. 👀

Starting with Robinhood, which reported its first GAAP profitable quarter. The retail brokerage posted $0.03 of earnings per share on $486 million in revenues. Analysts had expected a $0.01 per share loss on $473 million in revenue. With that said, the primary driver of the surprise profit was a $484 million decline in operating expenses due to the cancellation of its founders’ stock-based compensation.

On the services side, net interest revenue rose 13% QoQ to $234 million due to asset growth, higher short-term interest rates, and increased securities lending. Its assets under custody (AUC) also rose 13% QoQ to $89 billion, driven by $4.1 billion in net deposits and higher equity valuations. 💰

On the transaction-based side, revenues fell 7% QoQ to $193 million. Options fell 5% to $127 million, cryptocurrencies fell 18% to $31 million, and equities fell 7% to $25 million. With that said, the company says its experimental 24-hour trading program is off to a strong start.

Monthly active users (MAUs) dropped by 1 million QoQ to 10.8 million. However, average revenue per user (ARPU) rose about 10% from $77 to $84 QoQ. 🔺

Overall, the company’s efforts to cut costs and become a full-service brokerage that relies less on transaction-based revenue continue to pay off. However, Wall Street remains concerned about its ability to compete with other brokers and retain client assets long-term.

$HOOD shares fell nearly 10% on the day, retreating from the same price level as November. 📉

On the other hand, DoorDash is continuing its recent run after reporting new records for total orders and revenue. 🤩

The food service delivery company’s revenues rose 33% YoY to $2.13 billion, topping the $2.06 billion expected. Total orders rose 25% YoY to 532 million, with marketplace gross order volume increasing 26% YoY to $16.4 billion.

Although the company lost $172 million on a GAAP basis, investors are happy to see its diversification beyond restaurants is paying off. Grocery and convenience store deliveries accelerated in the quarter, and consumer spending remains more resilient than anticipated. As a result, executives boosted their third-quarter and full-year forecasts. 🏪

$DASH shares are up about 4% after hours. 📈

Earnings

Retail Favorite Hangs Onto Edge

One of retail’s favorite stocks of the past, SolarEdge Technologies, is approaching the edge of a 3-year trading range after disappointing earnings. 🙃

The mid-cap solar company reported adjusted earnings of $2.62 per share, topping the expected $2.56. However, revenues of $991.3 million fell short of the $993.9 million anticipated. 🔻

More importantly, the company’s third-quarter forecast caused investors to run for the exits. It now expects revenues of $880 to $920 million, well below Wall Street’s consensus view of $1.05 billion. As for the cause? It says higher interest rates are weighing on the U.S. residential solar market, where most consumers finance their solar panel purchases over many years. 🌩️

The commentary adds to demand fears already sparked by competitors like Enphase. Last month, its management offered a weak revenue outlook and told analysts it was cutting shipments to address an inventory buildup.

As for the stock, technical analysts are watching the $190 to $380 trading range it’s been stuck in for three years. Today’s 18% decline in $SEDG shares brought them to the bottom of that range, where buyers must step up. If they don’t, analysts suggest a breakdown would be the start of a precipitous downtrend. 😬

Bullets

Bullets From The Day:

💉 GSK sues Pfizer for RSV vaccine patent infringement. GlaxoSmithKline’s U.S. court case alleges patent infringement over its respiratory syncytial virus vaccine (RV), saying Pfizer’s vaccine infringes on four patents related to the antigen used in its own shot. Both vaccines were improved by the U.S. Food and Drug Administration (FDA) for use, potentially causing significant financial damage to GSK. CNBC has more.

🧑💼 Kansas City Fed finds new president after a three-month-long search. Former bank executive Jeffrey Schmid will be the next president of the Federal Reserve Bank of Kansas City, succeeding Esther George, who retired after twelve years at the helm. He will become a vital member of the group that votes on interest rate decisions beginning in 2025. At age 64, he will not be subject to mandatory rules requiring Fed presidents to retire at 65. Instead, he can serve for ten years max. More from Axios.

🛍️ Amazon expands Fresh grocery delivery to non-Prime members. The service will be extended to people in a dozen major cities, ranging from Charlotte, North Carolina, to San Diego, California. Non-Prime members who place an order under $50 will pay a $13.95 fee, $50 to $100 will pay a $10.95 fee, and orders over $100 will have a $7.95 fee. Amazon plans to launch the offering nationwide by year-end and eventually include products from Whole Foods and other grocery stores. TechCrunch has more.

🏘️ Foreign buyers bail on the U.S. housing market. U.S. buyers are not the only ones stepping back from the housing market amid record prices, high-interest rates, and a short supply of homes for sale. Add a strong U.S. dollar, and international buyers are packing their bags and searching elsewhere for opportunities. New data shows that from April 2022 to March 2023, international buyers bought just 84,600, down 14% YoY and the lowest number since the National Association of Realtors began tracking them in 2009. More from CNBC.

🤖 Instagram plans labels for AI-generated content. The in-development feature will highlight when a piece of content has been ‘created or edited with AI.’ A user discovered hints about the feature after Meta and its competitors made commitments to the White House around the responsible development of artificial intelligence (AI). However, it’s unclear how automated the labeling system will be and to what extent it will rely on its users disclosing when AI has been used. The Verge has more.

Links

Links That Don’t Suck:

🎈 Allurion, maker of weight loss balloons, goes public

✅ X, formerly Twitter, now lets paid users hide their checkmarks

🏌️ Tiger Woods joins PGA board, as LIV Golf deal hangs in balance

📵 China floats two-hour daily limit of smartphone screen time for kids

💰 Mega Millions jackpot at $1.25 billion, fourth-largest in history: when is next drawing?

😡 Elon Musk sues disinformation researchers, claiming they are driving away advertisers