It was a mixed day in the markets, with bonds rallying and stocks pulling back on the realization that a March rate cut may be out of reach. Let’s see what you missed. 👀

Today’s issue covers bears ravaging a troubled regional bank, Powell introducing risk to the “rate cut” thesis, and a cautious view on Apple ahead of tomorrow’s earnings. 📰

Here’s today’s heat map:

0 of 11 sectors closed green. Healthcare (-0.14%) led, & communication services (-2.47%) lagged. 💔

Samsung Electronics dampened the chip sector’s mood after reporting a record annual loss for its semiconductor business. The world’s largest maker of dynamic random-access memory chips continues to forecast a 2024 recovery for consumer device chips. Qualcomm’s first-quarter earnings and smartphone chip sales also support that view. 📱

In mergers and acquisitions news, Cardinal Health agreed to buy Specialty Networks for $1.2 billion as it looks to enhance its data analytics capabilities. Meanwhile, Cigna is selling its Medicare business for $3.3 billion to the parent of five Blue Cross and Blue Shield health insurance plans. 🤝

Paramount Global shares jumped more than 6% on news that media mogul Byron Allen has secured financing for his $14 billion offer. However, skeptics say Allen has a long history of making offers on major media assets that fail to materialize. 💰

Industrial tech giant Rockwell Automation plummeted 18% after its earnings and revenues missed analyst expectations, while free cash flow for the quarter was negative. Despite all the bad press Boeing has gotten recently, the stock popped 5% after its quarterly losses came in lower than anticipated and revenues beat. ✈️

Other symbols active on the streams: $FSR (-8.04%), $PHUN (+10.68%), $RUM (+12.48%), $GOEV (+13.26%), $PLUG (+19.30%), $RNA (+14.99%), $TVST (+28.18%), & $ENPH (-2.09%). 🔥

Here are the closing prices:

| S&P 500 | 4,846 | -1.61% |

| Nasdaq | 15,164 | -2.23% |

| Russell 2000 | 1,947 | -2.45% |

| Dow Jones | 38,150 | -0.82% |

Earnings

Bears Ravage Regional Bank

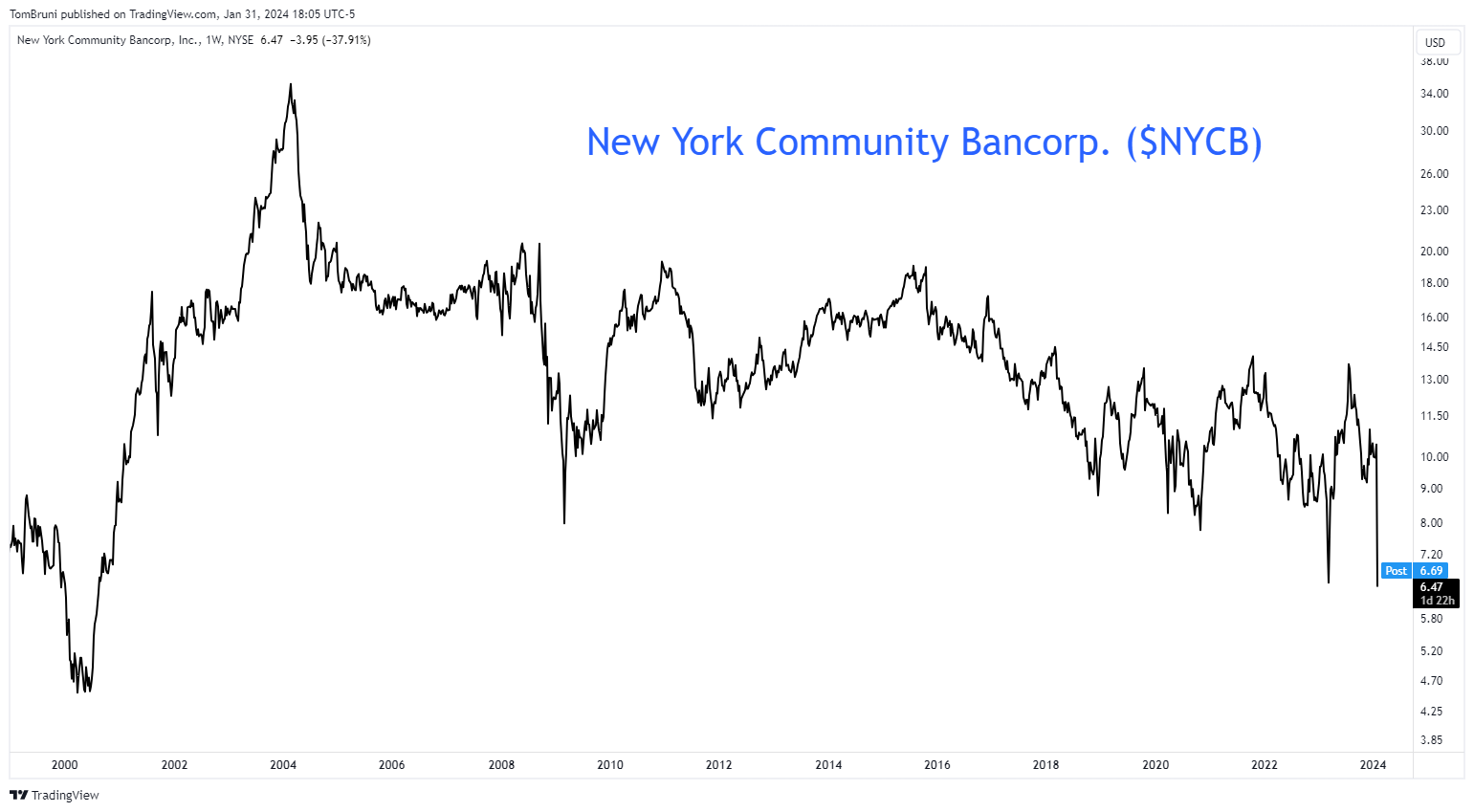

While it may seem like last year’s regional banking crisis is well behind us, investors were reminded today that many of the core risks remain. New York Community Bancorp’s earnings were horrendous, so let’s break down the key points. 📝

The New York-based bank reported a fourth-quarter adjusted loss of $0.27 per share, while analysts expected $0.26 in earnings. Revenues of $886 million and net interest income of $740 million missed estimates of $929.5 million and $788.1 million, respectively. 🔻

Net charge-offs rose from $24 million in the third quarter to $185 million, primarily due to two loans. The first was a co-op loan customized to pre-fund capital expenditures. The loan is not currently in default, but the company is choosing to sell it in the first quarter. The second was an office loan that went nonaccrual during the third quarter after its updated valuation.

The bank said, “Given the impact of recent credit deterioration within the office portfolio, we determined it prudent to increase the allowance for credit losses coverage ratio…” And given that roughly 46% of the bank’s loans are in the commercial real estate sector, investors are concerned that more nonperforming loans and “fire sales” are ahead. ⚠️

Also, the acquisition of Signature Bank last year was a double-edged sword. NYCB now meets the regulatory definition of a Category IV bank, forcing it to meet the regulatory capital requirements of banks with $100 to $250 billion in assets. As a result, it had to cut its quarterly dividend from $0.17 per share to $0.05 to speed up the process of meeting this requirement. ✂️

Overall, investors were not happy with what they heard. Obviously the dividend cut stings, but management’s inability to preannounce and communicate a clear forward operating plan really pushed shareholders over the edge. With $NYCB shares trading at 24-year lows, the Stocktwits community’s sentiment is in “extremely bearish” territory. 😡

Sponsored

FibroBiologics Direct Listing Available on NASDAQ

Did you know that the stem cell revolution began with fibroblasts? FibroBiologics is fibroblasts. FibroBiologics is harnessing the power of fibroblasts to develop a pipeline of treatments and potential cures for chronic diseases using fibroblast cells and fibroblast-derived materials.

Fibroblasts are known for their ability to be easily sourced, cultured, and differentiated, but also possess stem-cell-like immune-modulating and anti-inflammatory properties.

FibroBiologics strives to leverage these advantages into effective treatments for conditions as diverse as multiple sclerosis, degenerative disc disease, wound healing, thymic involution, and cancer.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Policy

Risks To The Rate Cut Thesis

One of the big themes we’ve discussed for the last four months has been the Fed cutting rates in 2024. However, there’s been a major disconnect between the market’s expectations and the Fed’s guidance since November. That disconnect made today’s Fed decision and commentary tricky for the market to digest. Let’s talk about why. 🤔

First off, going into this year, the Fed fund futures market was anticipating six rate cuts during 2024. Meanwhile, the Fed’s guidance in December suggested the central bank was estimating just three cuts during the year, as it believes there are still upside risks to inflation.

As a result, the Fed met expectations today by keeping rates unchanged. With that said, the red-lined version of its statement showed significant changes. 📝

In it, the committee signaled continued improvements in several factors it’s watching, ranging from the labor market to overall economic activity. But the line that cast doubt on a rate cut at its March meeting was, “The committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving substantially toward 2 percent.”

And if that line left any doubt, Chairman Jerome Powell said this during his press conference, “I don’t think it’s likely that the committee will reach a level of confidence by the March meeting.” He clarified that by saying the committee is looking for a continuation of the good data we’ve been seeing, not better data.

During his press conference, Powell reiterated that risks remain, answering the economic “soft landing” question with the following: “No, I would not say we achieved that. We have a ways to go. We are not declaring victory at this point.

Overall, the hawkish tone continued as Powell and the committee attempted to temper the market’s rate cut expectations. They fear that the bond market could get ahead of itself and, in turn, loosen financial conditions. And if financial conditions loosen too much, that could stoke further inflation and start this whole darn cycle again. ⚠️

Nobody wants that. As a result, the Fed would rather accept the risk of keeping conditions too tight for too long, especially given the labor market and the economy’s overall resilience.

We’ll receive more labor market data later this week, but early indications from today’s ADP employment report and fourth-quarter employment costs show the labor market is continuing to cool. Nonfarm payrolls and initial jobless claims have been the wildcard, consistently coming in better than expected. So when those start to give way, we’ll really know that the economic slowdown is in full swing.

As for the market, today’s mixed reaction shows the next few days should be interesting. Stocks sold off on the news, but bonds rallied sharply. Fed Fund futures are finally moving in the right direction but still see a 36% chance of a rate cut at the March meeting. 📊

We guess hearing “no” directly from Powell wasn’t enough evidence to get everyone on the same page. We’ll see if that changes in the coming days and weeks. 🤷

Stocktwits Spotlight:

It’s been a mixed bag of big-tech earnings so far, with Netflix beating expectations easily and others like Google and Microsoft failing to impress. We’ll hear tomorrow after the bell from Amazon, Meta, and Apple, which has many investors wondering if they will fall, too. 🚨

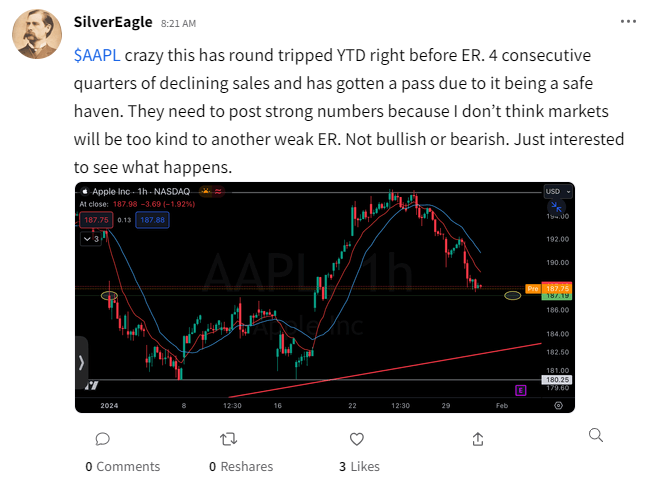

Today, Stocktwits user SilverEagle pointed out that Apple could be vulnerable, especially given this week’s more “bearish” market environment. ⚠️

He pointed out that while other tech stocks were pressing higher, Apple has fallen back to where it started the year. That could suggest Wall Street is expecting holiday-quarter results to underwhelm, especially as some of its retailers, suppliers, and other stakeholders have warned of a sluggish recovery in consumer electronics sales.

The consumer tech giant has experienced four straight quarters of declining sales, but overall, the market has given it a pass. Given its rock-solid balance sheet, dividend and buyback program, and diversified revenue streams, investors have opted to “buy the dip” in the stock rather than look for opportunities elsewhere. 💸

It’s unclear whether that behavior will continue tomorrow. But one thing is clear: the tech sector could use some solid earnings from Apple in its peers to regain its footing.

We’ll be watching these earnings reports closely tomorrow, and we know Silver Eagle will be too. For updates on his view of Apple and more ideas like this one, be sure to follow him on Stocktwits! 👀

Bullets

Bullets From The Day:

🔺 Red Sea supply chain inflation may already be behind us. Cargo rates on trade routes from Asia to Europe and the Far East to the Mediterranean are showing a slight decline after a January spike. Logistics experts say shippers are pushing back after diversions by ocean carriers, especially as demand remains tepid. With that said, U.S.-bound cargo prices continue to rise as the average delay for late vessel arrivals climbed to 5.35 days. CNBC has more.

🚫 FCC moves to outlaw AI-generated robocalls. The Federal Communications Commission has proposed a rule to make using voice cloning technology in robocalls fundamentally illegal. Doing so would make charging the operators of these frauds significantly easier. While robocalls themselves are already illegal, the fact is that some automated calls are a necessary and desirable part of certain businesses. Only when a call operation is found to be breaking the law can authorities pursue them. More from TechCrunch.

🏬 H&M chief will depart as sales slump. High Street fashion chain H&M’s CEO is stepping down after four years, with eighteen-year veteran Daniel Erver to assume the role. The news comes after the retailer reported annual profits well below market expectations, with the holiday season failing to spark the turnaround many were looking for. H&M and the rest of the fashion retail market are facing a squeeze, with shoppers spending less on discretionary items and focusing more on essential goods and experiences. BBC News has more.

👟 Adidas will sell its remaining Yeezy stock at cost. The German sportswear maker expects operating profit to nearly double this year as the effects of its break-up with Kanye West dissipate. It preannounced a full-year 2023 operating profit of 268 million euros, well above the 100 million euro loss initially forecasted by CEO Bjorn Gulden. The primary driver of this strength was its decision not to write off 300 million euros in Yeezy inventory and instead sell the remaining product at cost. Reuters has more.

💊 Biogen will stop making its controversial drug. The drugmaker announced it would discontinue the development and marketing of a landmark Alzheimer’s disease treatment that provoked controversy over conflicting data around its efficacy. The FDA granted accelerated approval to the drug in 2021, but an internal review of its research and development efforts suggests it should redirect its resources toward developing other drug candidates. Its primary candidate is an alternative Alzheimer’s treatment that won traditional FDA approval last year. Politico has more.

Links

Links That Don’t Suck:

🧑🏻💻 Falcon Trading Systems’ Winter Sale 🚀❄️💻 — Upgrade & Save on a High-Performance Trading Computer*

☣️ Do Stanley cups contain lead? What you need to know

📰 Digital news startup blows through $50 million in less than one year

🤔 Who can rein in Elon Musk? Someone you’ve probably never heard of

🧑⚖️ DOJ reaches $59M settlement with eBay over sales of thousands of pill presses

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.