It’s a bit early for holiday carols, but with Philadelphia Federal Reserve President Patrick Harker speaking today, we couldn’t resist this title. 🎶

His comments towed the hawkish line that Jerome Powell and the other Fed members have been pulling for several months now. 💬

Some quotes that stood out included:

- “We are going to keep raising rates for a while.”

- “Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year.”

- “Sometime next year, we are going to stop hiking rates. At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work.”

- “Inflation will come down, but it will take some time to get to our target.”

Overall, none of these comments should come as a surprise.

The market has been slowly adjusting to the fact that interest rates will likely be high for a while. September’s consumer price index report showed that calculations for major components like rent take a while to work their way into the numbers. As a result, the Fed will have to stop hiking at some point to see how the economy reacts before taking further action. 🕵️

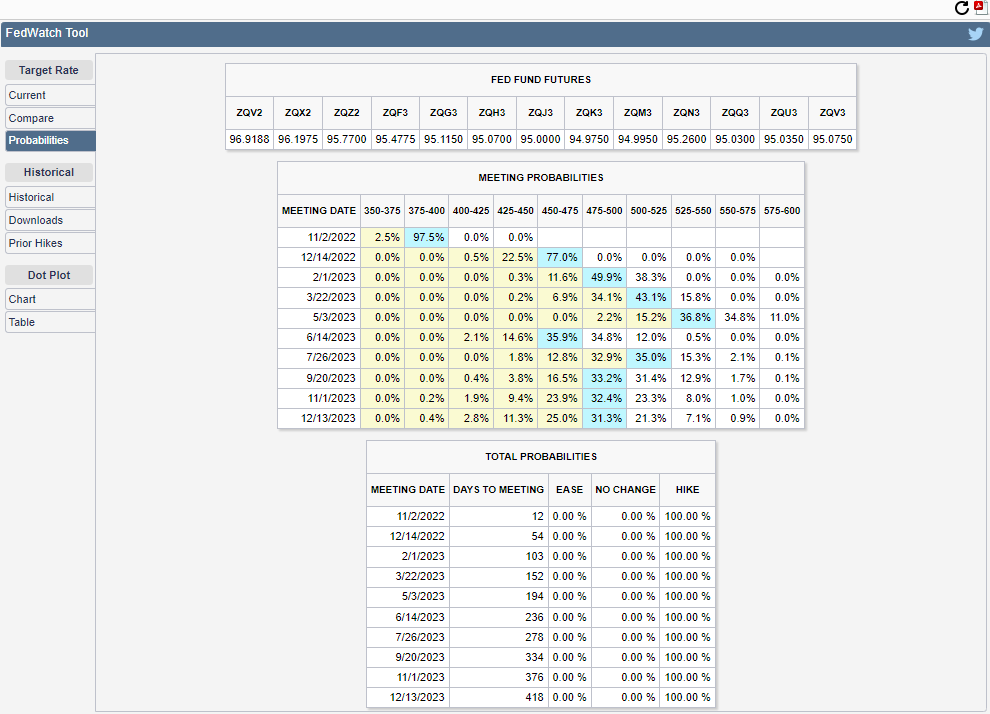

Right now, the CME FedWatch Tool shows that markets expect the Fed to continue hiking through its March meeting before taking its foot off the gas. That would put the Fed funds rate at around 5%, which is not far off the terminal rate the Fed has alluded to.

With that said, these expectations are highly volatile and change with almost every new data point that comes out. So take them with a grain of salt. 🧂

In the meantime, the 10-year U.S. treasury yield hit its highest level since June 2008. And the 10-year and 3-month yield curve, which typically precedes a recession, inverted briefly earlier this week before reversing to +0.24 bps.

Finally, it’s worth noting that until bond yields stabilize, many analysts expect risk assets like stocks and crypto to remain under pressure. Whether or not they’re right remains to be seen. But this week’s action certainly seems to jive with their theory. 🤷