We said yesterday that expectations for a dovish Federal Reserve meeting were high. And for now, it appears that Jerome Powell and the FOMC have delivered just that. 🤩

The Federal Open Market Committee (FOMC) statement changed slightly vs. November, primarily adding verbiage that “inflation has eased over the past year” but remains elevated. As such, they kept rates unchanged to close out 2023.

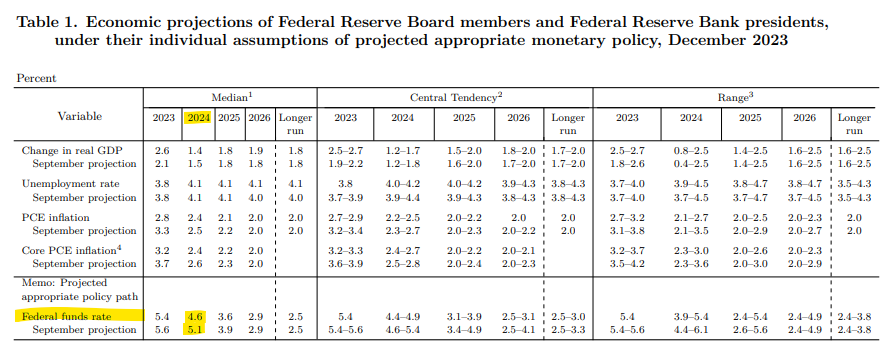

However, the real information was in the Fed’s updated economic projections. 📝

Below, we can see that the committee’s median projection for the federal funds rate in 2024 has dropped from 5.1 to 4.6, implying three rate cuts in 2024. Additionally, the median core PCE inflation expectation dropped by 20 bps to 2.40%. And although the committee anticipates slower growth in 2024, it’s projecting modest growth, not a recession. 📊

And Jerome Powell’s commentary did little to push back on those views, reinforcing that the battle against inflation will continue but that rates are likely high enough to slow the economy. As always, he hedged his comments by saying that the committee is prepared to tighten policy further if necessary and that a recession is still on the table for 2024.

Overall, it appears the market has gotten its “soft landing’ after all, which twelve months ago seemed like a dream scenario. The economy slowed enough to bring inflation down but not enough to tip us into a recession. ⚖️

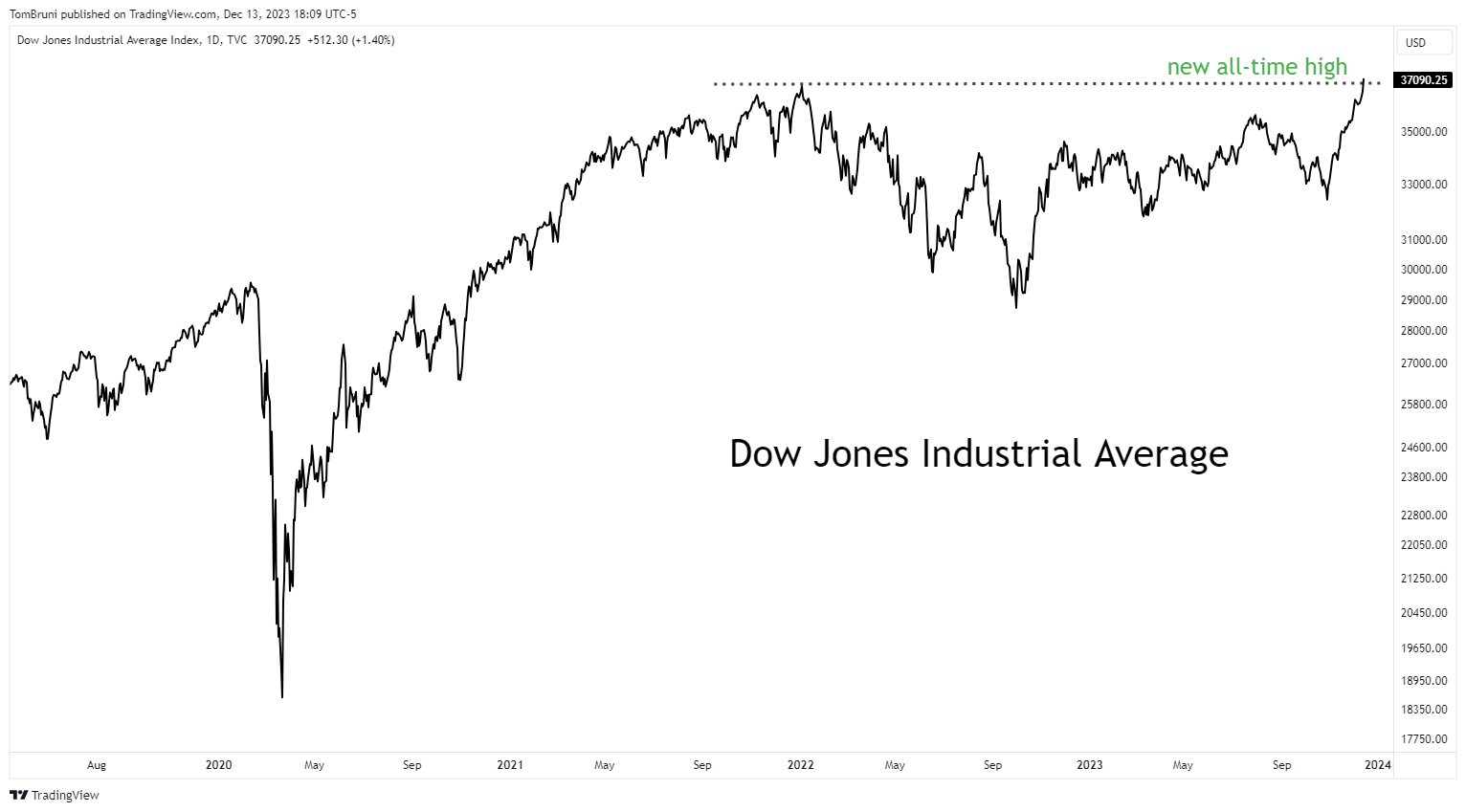

That was all investors needed to hear before getting back to buying stocks and other risk assets. The Dow Jones Industrial Average was the first U.S. stock market index to hit new all-time highs, but the S&P 500 and Nasdaq 100 are close behind. Meanwhile, the small-cap Russell 2000 surged another 3.40% as investors viewed the prospect of lower rates as supportive of the sector. 🐂

While it was a footnote in today’s data, the producer price index confirmed the continued disinflationary trend seen in consumer prices yesterday. Additionally, reports from Redfin suggest that rental rates fell the most in over three years, furthering the view that shelter prices are likely to “catch down” to other inflation components. 🔻

With the Fed meeting out of the way, it’s unclear what’s left to derail the bulls’ epic run. As always, we’ll have to wait and see. But for now, investors are partying like it’s 2023. 🥳