Today’s big story was the Federal Reserve’s interest rate decision and projections, so let’s jump right into it. 👇

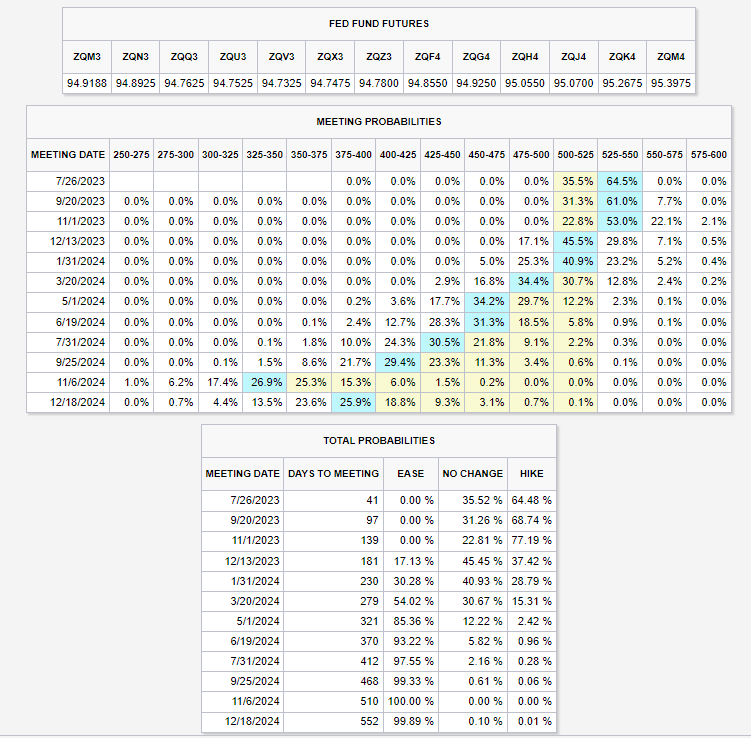

First, we’ll start with the market’s expectations. Coming into the decision, the bond market was pricing in a roughly 93% chance of a Fed “pause” today, with only 7% expecting another 25 bp hike. And…that’s exactly what we got. However, the devil is in the details. 🔍

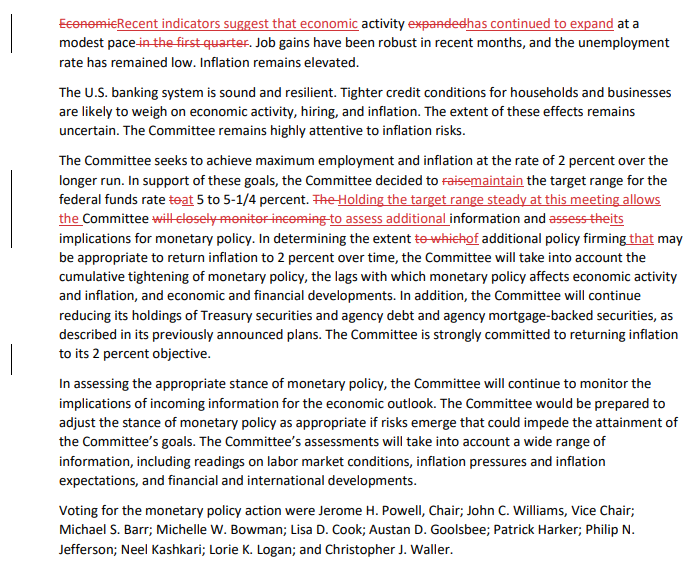

The Federal Reserve unanimously decided against an 11 consecutive interest rate hike, instead keeping rates unchanged. The redlined version of the FOMC Statement showed that this is more of a skip than a pause. Or at least that’s what the Fed would like the market to believe.

The language changed from “determining the extent to which additional firming may be appropriate” to determining the extent of additional policy firming that may be appropriate,” indicating that further hikes are expected; they’re just unsure how many or when. 🤔

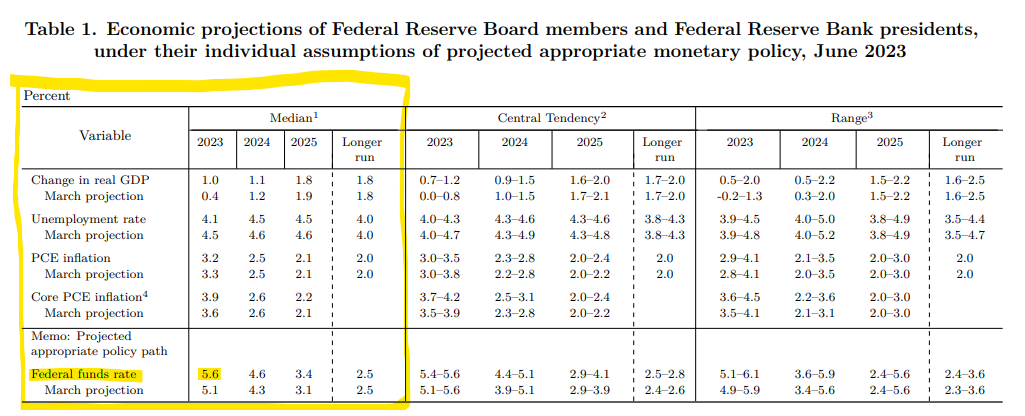

Meanwhile, the Federal Open Market Committee (FOMC) also released new economic projections that:

- Revised up growth expectations for ’23, ’24, and ’25

- Slightly revised down unemployment rate expectations for ’23, ’24, and ’25

- Kept PCE inflation expectations essentially flat while raising ’23 Core PCE inflation to 3.9%

- Raised federal funds rate expectations for ’23, ’24, and ’25

The key takeaway here is that the Fed sees more hikes ahead. The median federal funds rate projection is now 5.6%, implying two more 25 bp hikes before the end of the year. 🔺

As for why that’s the case? It expects core inflation to remain sticky through the end of the year, nearly double its 2% target. And it doesn’t anticipate that figure will reach its target until the end of 2025. 📆

During his press conference, Fed Chair Jerome Powell admitted that the committee’s inflation projections have been poor. However, its weak track record in anticipating inflation’s moves doesn’t change the fact that core inflation remains too high. Additionally, after a year of aggressive hiking, the federal funds rate is finally in line with rates set by market participants.

As such, the Fed is pausing and giving its policy decisions the time required to impact the economy. ⏯️

A slowdown in the labor market is the final piece of the puzzle for the Fed. Core inflation remains sticky because of services, which are driven by employment. After all, competition for labor means higher wages. And a lot of people with jobs and higher incomes ultimately means more money being spent in the economy. 🛒

So far this year, there have been some early signs that the labor market is softening and wage pressure is waning. Housing weakness, while dissipating recently, has helped bring down housing services inflation and should continue to do so at a moderate pace. But the economy continues to hum along, making the pace of disinflation too slow and the overall level of inflation too high.

As a result, the Fed’s messaging was left hawkish to keep a leash on markets and credit conditions. It believes that rates may be high enough to bring employment and inflation down but needs to wait and see like the rest of us. Unfortunately, it doesn’t have a crystal ball, or else this job would be much easier. 🦅

For the market, that means no rate cuts until at least 2024.

The CME FedWatch Tool shows expectations aren’t entirely aligned with the Fed just yet. It shows the market pricing in one more rate hike before the end of the year compared to the Fed’s two. The market has been ahead of the curve on inflation, so we’ll have to see who is right. 🤷

The stock market experienced volatility throughout the announcement, with the S&P 500 and Nasdaq 100 managing to close green on the back of big tech stocks. Interestingly enough, crypto markets held up well throughout the session but sold off after the 4:00 PM stock market close. 🔻

Initial moves following these announcements are always tricky to gauge, so we’ll have to see how the rest of the week pans out. 👀