We will keep this article quick because we’ve spoken about inflation and Fed expectations a ton already. But this chart is worth a look ahead of tomorrow’s meeting. 👇

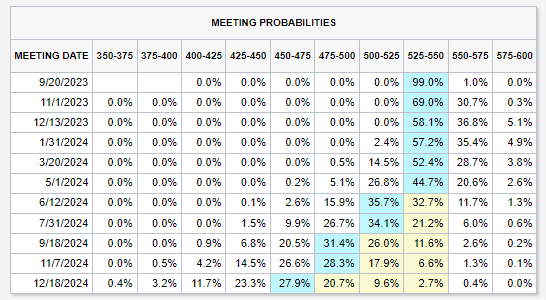

Despite last week’s uptick in consumer and producer prices, the Fed is not expected to raise rates. The bond market is currently pricing in a 99% probability that the current rate is maintained, hence the Jay-Z-inspired title of this article.

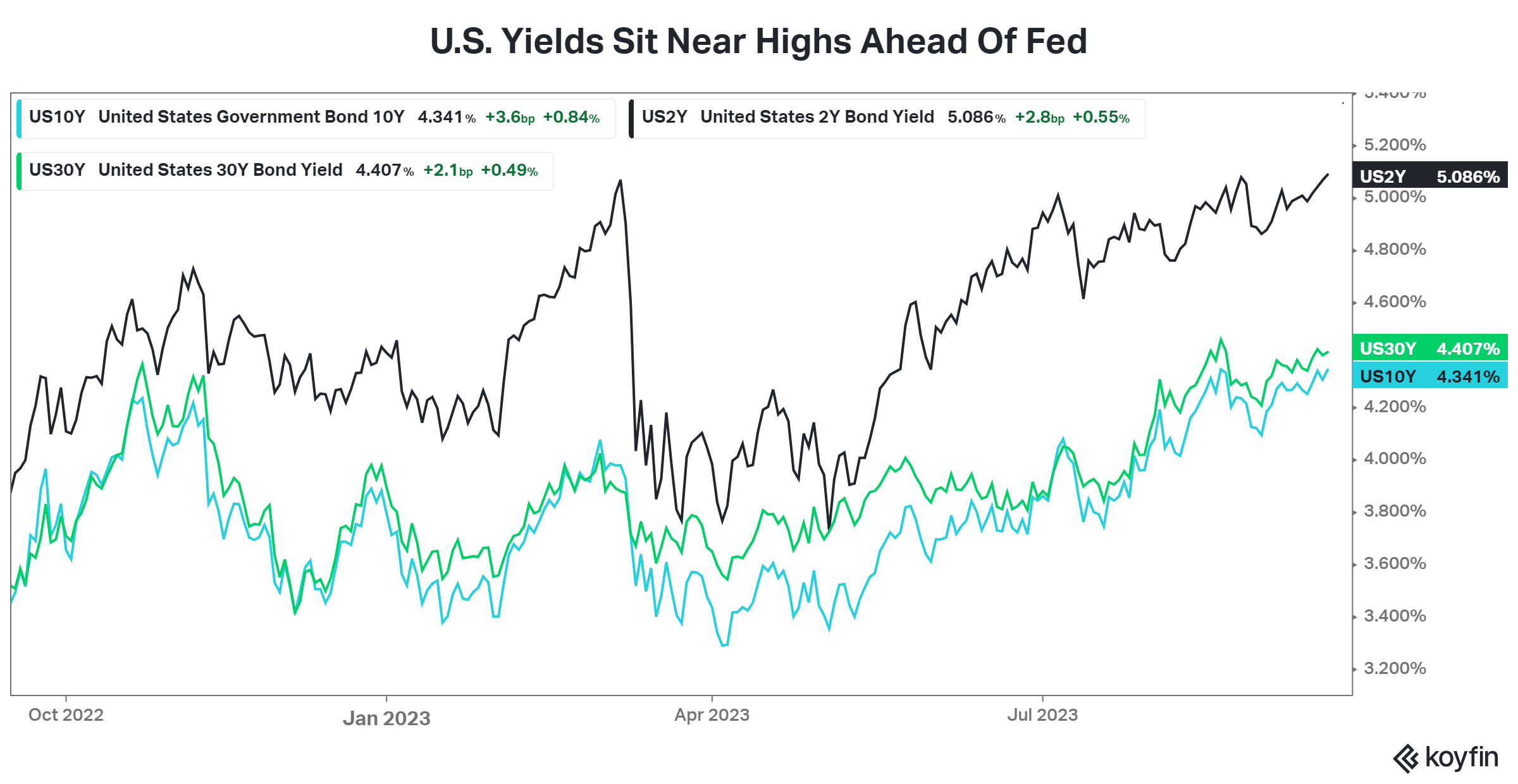

However, U.S. Treasury rates across the curve are at their 2022 highs heading into the meeting. This potentially suggests the market thinks rates will need to head even higher if inflation continues to stabilize at current levels (or even tick up). The Fed has been behind the curve its entire rate-hiking cycle, and some investors are betting it is underestimating inflation again.

Regardless, rates are at a major level that everyone’s watching and positioning themselves against as we head into this meeting. Even if the Fed holds rates steady as expected, it will release its new economic projections and provide commentary that will move the market. And given where rates are currently, some traders suggest things could move in a big way. 👀