Stocks and ETFs related to the cannabis industry soared today, heating up again despite their habit of disappointing long-term investors. 🔥

The industry’s renewed interest came after a top official at the Department of Health and Human Services (HHS) recommended easing restrictions on marijuana. The official wrote to the Drug Enforcement Agency (DEA) Administrator Anne Milgram, calling for marijuana to be reclassified as a Schedule III drug under the Controlled Substances Act.

The HHS’s review was based on an extensive Food and Drug Administration (FDA) review of marijuana’s classification, which considered eight factors that determine the control status of statuses. A DEA spokesperson confirmed that they received the HHS’s recommendation and will now initiate its own review. 🕵️♂️

While reclassification is short of federally legalizing the drug entirely, it would mark a critical shift away from its current status as a Schedule I substance. That status puts it alongside other high-risk drugs like heroin, LSD, and ecstasy. Meanwhile, Schedule III substances like ketamine are viewed as less dangerous and can be obtained legally with a prescription. 🥦

The news spurred hope that the cannabis market could expand nationwide. Currently, 38 states allow it for medical use, with 23 allowing it for recreational use. However, the clashing of federal and state rules has created many issues for companies operating in the space. ⚔️

As a result of the slow adoption of looser federal regulations, the industry has been plagued with oversupply and lackluster demand. 👎

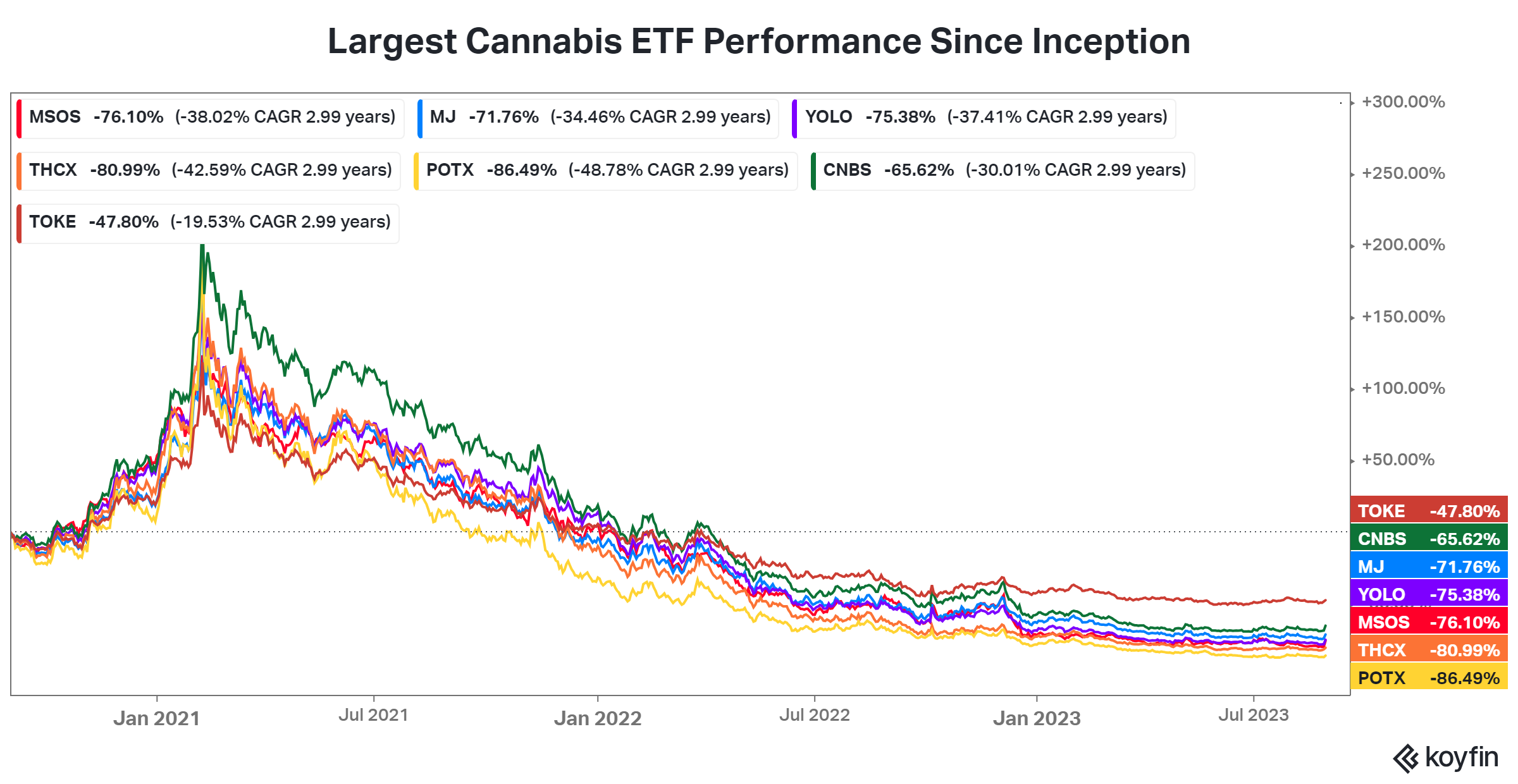

The most popular cannabis industry ETFs all popped today on the news, but most remain near all-time low prices. Experts say today’s news provides some hope but that the broader issue of federal and state rules conflicting with each other needs to be resolved fully. And the best way to do that is to remove cannabis from the Controlled Substances Act and regulate it similarly to alcohol.

Time will tell if that ever happens. But for now, pot stocks are hot again. We’ll see if their rally lasts or if these short-term gains go up in smoke as they have in the past. 😶🌫️

And since we’re talking about trends from the late 2010s, it’s worth mentioning that 3D printing stocks caught a bid today. The new Apple Watches will reportedly feature 3D-printed parts, which would be a boost for the largely forgotten industry. ⌚