As if investors in Chinese stocks didn’t have enough to worry about, the government introduced a new wild card. 🤪

Beijing released draft guidelines designed to curb excessive gaming and spending among consumers. The proposed rules would require owners of online games to abstain from providing or condoning high-value or expensive transactions in virtual entities, whether by auction or speculative activity. Daily login rewards would also be banned, along with pop-up warnings to users displaying “irrational” consumption behavior. 🚫

Analyst Brian Tycangco from Stansberry Research said, “…it casts doubt on the viability of existing business models that are built around incentives or rewards to attract users and boost loyalty.” However, Tencent Games vice-president Vigo Zhang shared a different view: “The new measures don’t fundamentally change the online gaming business model and operations.”

The Chinese government has long been cracking down on the technology sector. Still, investors thought that pressure had dissipated, given the focus on revitalizing its economy in a post-COVID world. However, this renews fears that the government could reintroduce past proposals, which included limiting the amount of time children under 18 could play video games or use smartphones.

While the market will likely get additional clarity on these rules in the weeks ahead, investors continue to sell first and ask questions later. With so many other areas of the global stock market working, many investors have thrown in the towel on Chinese stocks, citing economic risks, geopolitical and regulatory risks, and more. 💸

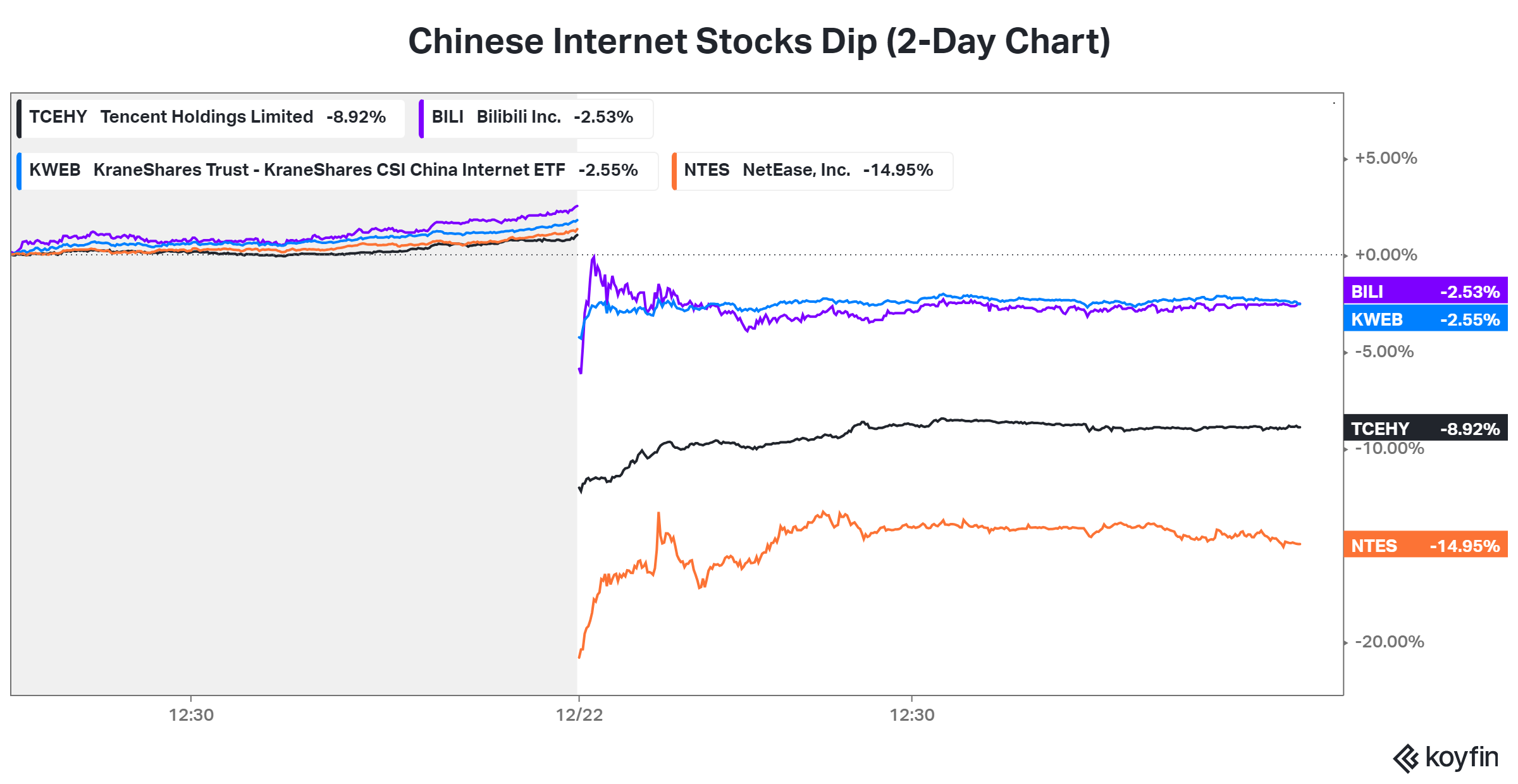

Some of the hardest hit stocks included those directly impacted, like social media giant Bilibili, and those supporting the industry, like NetEase. 📉