Last week Pitchbook released its Q2 2022 U.S. VC Valuations Report, which had some interesting stats about the current environment. 📝

Early-stage valuations are beginning to reflect broader economic uncertainty, as quarter-over-quarter median pre-money valuations saw their first decline in ten quarters. The median pre-money valuation for early-stage VC was $52 million, down 16.1% YoY.

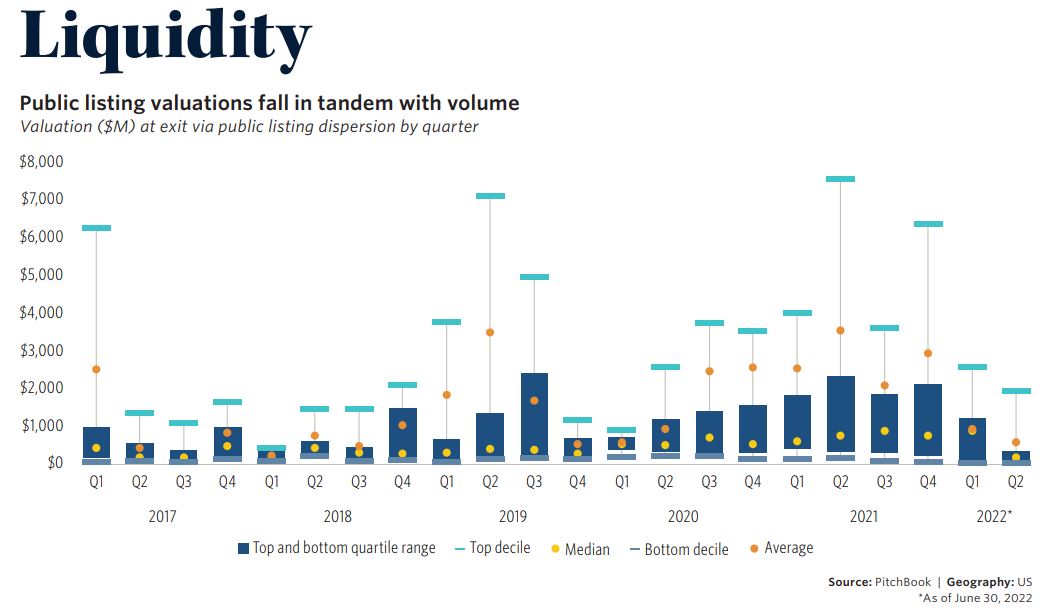

Public market valuations worsened in Q2. There were only 10 IPOs over $1 billion in the first half of 2022, compared with 102 during the same period in 2021. 🔻

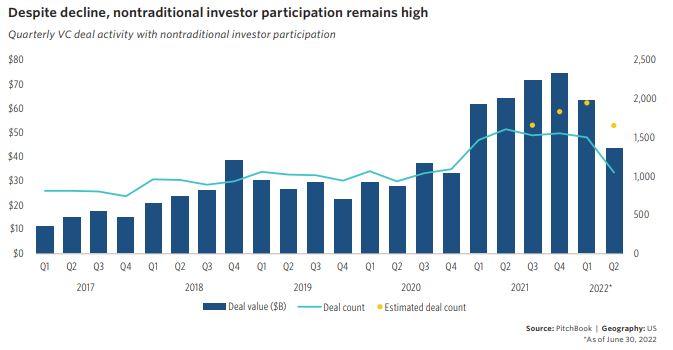

The lack of liquidity in public markets has caused nontraditional investors to become more cautious at the top end of the market. With the public markets no longer available as a place to exit their investments, they need their portfolio companies to extend their runway so that they can outlast the weak funding environment. Otherwise, they risk raising at unfavorable terms. 💧

The median and average private market valuations are still above their pre-2021 levels. Still, late-stage startups have to justify high valuations and deal sizes in the current environment, given their proximity to exit and the lack of liquidity at those valuations.

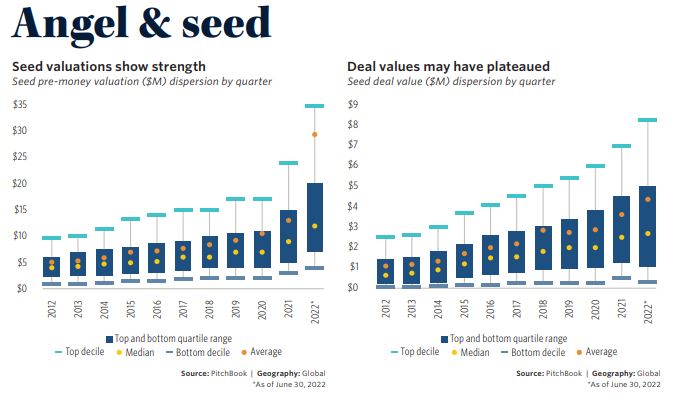

Meanwhile, the majority of the strength this year has been in angel and seed investing, where the broader macro environment and funding market trends matter less. Since these companies are in their early stages, they can focus more on business execution than raising their next rounds and setting up an exit for their investors. 👼

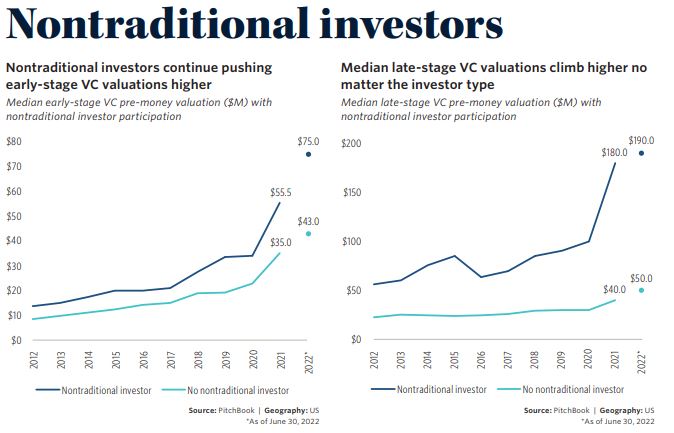

Another point to note is that increased involvement from nontraditional investors (asset managers, hedge funds, private equity firms, sovereign wealth funds, and corporate venture capital) continues to put upward pressure on valuations.

The problem with being a hot asset class is that everybody wants their piece, which inherently increases risk and lowers returns. 👎

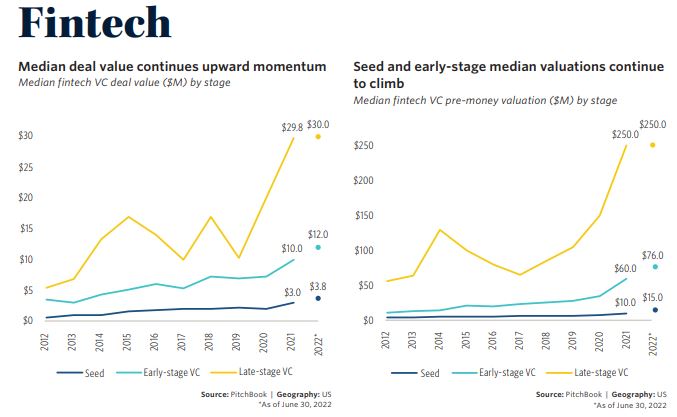

Lastly, the report included some info about several popular industries. For example, Fintech seed and early-stage median valuations continue to climb while late-stage valuations plateaued.

The key takeaway for investors here is that public and private markets are more connected than most people realize. Although private investments don’t mark to market every day like stocks or crypto, they experience similar trends and impact each other regularly.

Studying both so you can be aware of the overall market environment can be an essential part of any investment process. 👍