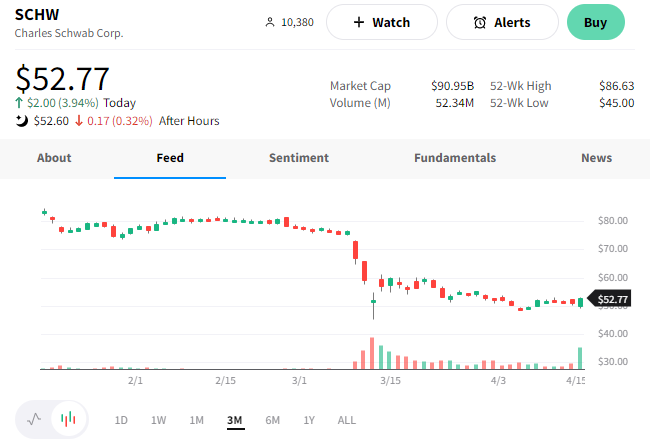

Investors hit Charles Schwab hard during the recent regional banking crisis over concerns that its deposits wouldn’t stick. 😬

Well, investors were sort of right. The company’s bank deposits fell by $41 billion (-30% YoY and -11% QoQ). However, that was actually better than anticipated. Additionally, the company reported a decline in the average daily pace of bank sweep movements during the quarter, even accounting for the banking system turmoil.

With that said, executives are staying cautious, given the recent banking crisis and regulatory uncertainty. They’ve paused the company’s active share buyback program to preserve liquidity. ⏸️

As for this quarter’s financial performance, results were mixed. 🤷

- Adjusted earnings per share (EPS) $0.93 vs. $0.90 expected

- Net revenue of $5.12 billion vs. $5.13 billion expected

- Net interest revenue of $2.77 billion (+27% YoY, -8.6% QoQ)

- Asset management and admin fees $1.12 billion (+4.7% YoY, +6.7% QoQ)

- Trading revenue of $892 million (-7.4% YoY, -0.34% QoQ)

- Total expenses excluding interest $3.01 billion (+6.4% YoY, +3.8% QoQ)

Investors still worry that the company will need to pay more for its deposits, eating into its net interest margin. That said, they bought today’s initial dip lower, with $SCHW shares rising 4%. 🔺

Lastly, the deposit competition for Schwab and other financial services companies continues to grow. Apple furthered its foray into the fintech space, launching Apple Card’s savings accounts yielding 4.15%. The number of places consumers can choose to park their money has never been greater… Now we’ll see if the incumbents can keep pace. 👀