Popular fintech giant SoFi Technologies posted stronger-than-expected results and lifted its forecast. However, that wasn’t enough for the stock to hold onto early gains. Let’s dive into the numbers. 👇

The company’s revenues rose about 27% YoY to $537 million, topping expectations of $518 million. Student-loan originations rose 101% YoY to $919.3 million, with volume reaching its highest since the first quarter of 2022. Personal-loan originations also rose 38% YoY to $3.9 billion, while home-loan originations rose 64% to $355.7 million. 📊

Total new members were up 47% YoY to 6.9 million, with new product additions up 45% YoY to 10.4 million. As for deposits, they grew 23% YoY to $15.7 billion, with over 90% of SoFi Money deposits coming from direct deposit members. 💵

Its efforts to attract and retain new money appear to be working, with more than half of newly funded SoFi Money accounts setting up direct deposit by the end of their first month. That “stickier” money drives debit transaction volume and strong cross-buy trends with its lending and other financial services products. And with FDIC insurance of up to $2 million, nearly 98% of deposits were fully insured at quarter-end.

Its third-quarter net loss grew to $0.29 per share vs. the $0.08 loss per share analysts anticipated. However, it said that if it excluded the impact of non-cash impairment charges, that loss would have been only $0.03 per share. Management reiterated its confidence in achieving positive GAAP net income in the fourth quarter. And adjusted EBITDA of $98 million was its highest ever, topping the $65 million analysts expected. 🤑

Overall, executives remained optimistic about balancing growth, investment, and profitability. They lifted their full-year adjusted net revenue guidance range to $2.045-$2.065 billion, topping estimates of $2.026 billion. Their forecasted $386-$396 million in full-year adjusted EBITDA exceeded analyst estimates of $344 million.

Despite that, investors’ concerns boil down to a few key themes. The first is that the current environment for banks is a challenging one, as higher interest rates have both positives and negatives. The second major concern is that some analysts don’t believe the company will achieve its GAAP profitability targets and generate the cash needed to fund its growth. Since the company is still in investment mode, that means it may have to take on higher-interest debt. 🏦

Lastly, some on Wall Street don’t believe the online banking model is a viable one long-term. For now, the company is focused primarily on “wealthy” consumers earning over $100,000 per year. But, concerns are that it could limit its ability to grow market share. And if it needs to expand that course group of customers down the income spectrum, they’ll be playing a very different (and potentially more difficult) ball game.

As always, we’ll have to wait and see who is right. But for now, that’s why the stock’s valuation remains suppressed despite seemingly strong results. 🤷

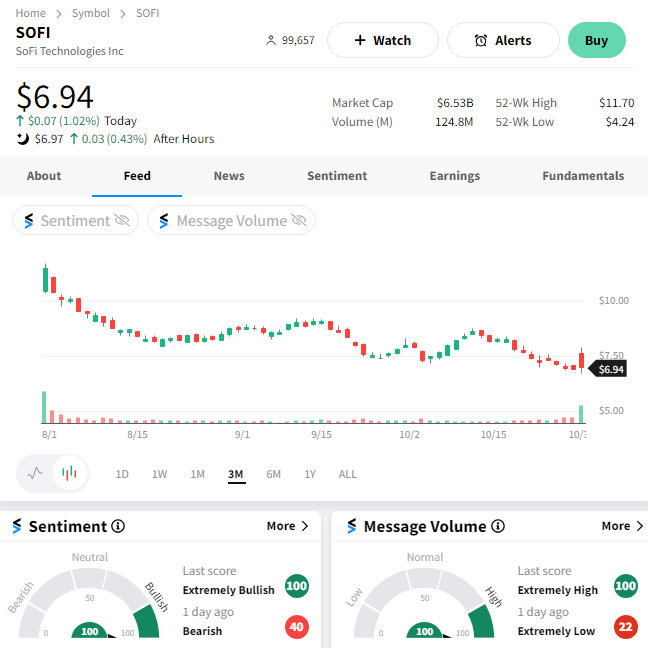

$SOFI shares were up as much as 15% but faded throughout the day to close slightly green. 🔺