This holiday season, the talk of the town is the U.S. (and global) consumer. After all, consumer spending is two-thirds of the U.S. economy, so if we stop spending, the economy’s illusive recession could finally appear. 🎃

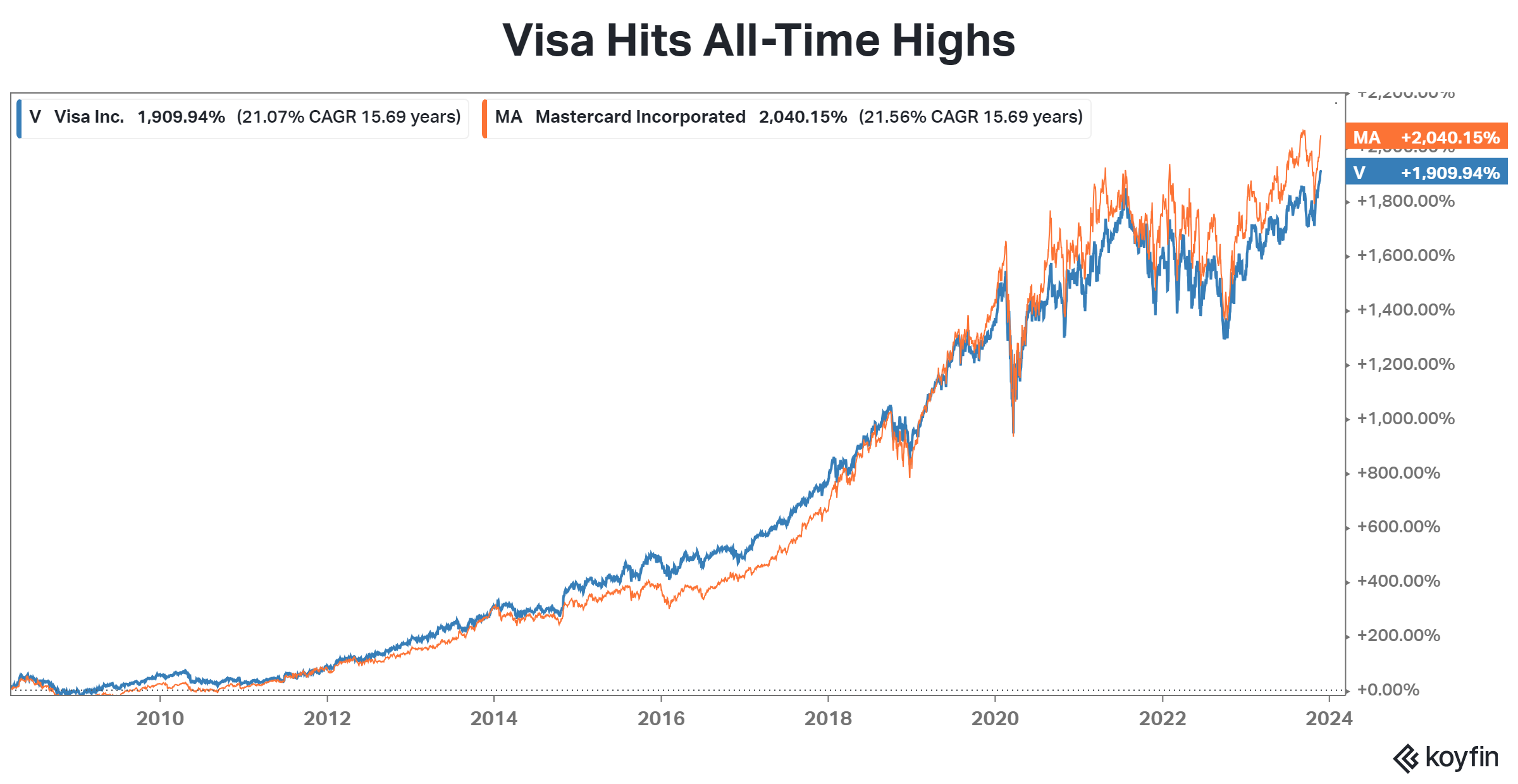

While many retailers have painted a cautious picture of the fourth quarter of 2023 and the beginning of 2024, some investors point to what they say is an obvious sign of strength. That is, Visa and Mastercard near all-time highs. 👀

These companies have told investors that consumers are continuing to spend, but where they’re spending their money is changing. And the total return chart below shows Visa making new highs today, while Mastercard is not far below its peak set a few months back.

Whether it’s a sign of a robust economy or just strength in these individual companies’ businesses, these stocks remain on investors’ radars into year-end. Especially with holiday shopping at the forefront of our minds. 🛍️