Advertisement|Remove ads.

Bitcoin, Gold Start 2026 Higher, But Analysts Say The Rally Is ‘A Simple Coincidence’

- Bitcoin and gold both moved higher at the start of 2026, prompting renewed comparisons between the two assets.

- Analysts say the moves are driven by different forces, not a shared macro or “risk-off” trade.

- Bitcoin has significantly outperformed gold over longer timeframes despite short-term correlations.

The value of both Bitcoin (BTC) and gold rose at the start of 2026, but analysts say the parallel move does not signify a lasting convergence.

Nic Puckrin, investment analyst and co-founder of Coin Bureau, told Stocktwits that it is “tempting to label this a risk-off or dollar debasement trade and predict that Bitcoin and gold are converging,” but that is far from the case.

According to Puckrin, gold and silver are extending momentum from 2025, while Bitcoin is seeing a reflexive rebound after becoming oversold last year. He pointed to institutional demand returning to crypto markets, noting that U.S. spot Bitcoin ETFs recorded $471.3 million in net inflows on Friday, the first full ETF trading day of 2026. “For now, it’s a simple coincidence,” he said.

Bitcoin (BTC) was trading at $92,698, 0.5% down in 24 hours, while gold was trading around $4,460 per ounce. On Stocktwits, retail sentiment on Bitcoin remained in ‘extremely bullish’ territory over the past day, with chatter levels at ‘high’.

In addition, Ryan Lee, chief analyst at Bitget, said precious metals are benefiting from elevated geopolitical risk, such as Maduro’s arrest, while crypto continues to trade with a mix of risk-asset sensitivity. He added that renewed ETF inflows, exchange outflows, and rising stablecoin supply suggest continued institutional accumulation rather than panic-driven buying.

Bitcoin Versus Gold

The comparison between Bitcoin and gold tends to arise whenever both assets see a rise simultaneously, especially during periods of macro stress. Bitcoin is often described as “digital gold” due to its fixed supply and store-of-value narrative, while gold has traditionally served as a defensive asset, used to preserve capital.

Peter Schiff has repeatedly rejected the comparison, arguing that physical gold remains superior as a hedge. Despite that criticism, Bitcoin has substantially outperformed gold over the past decade.

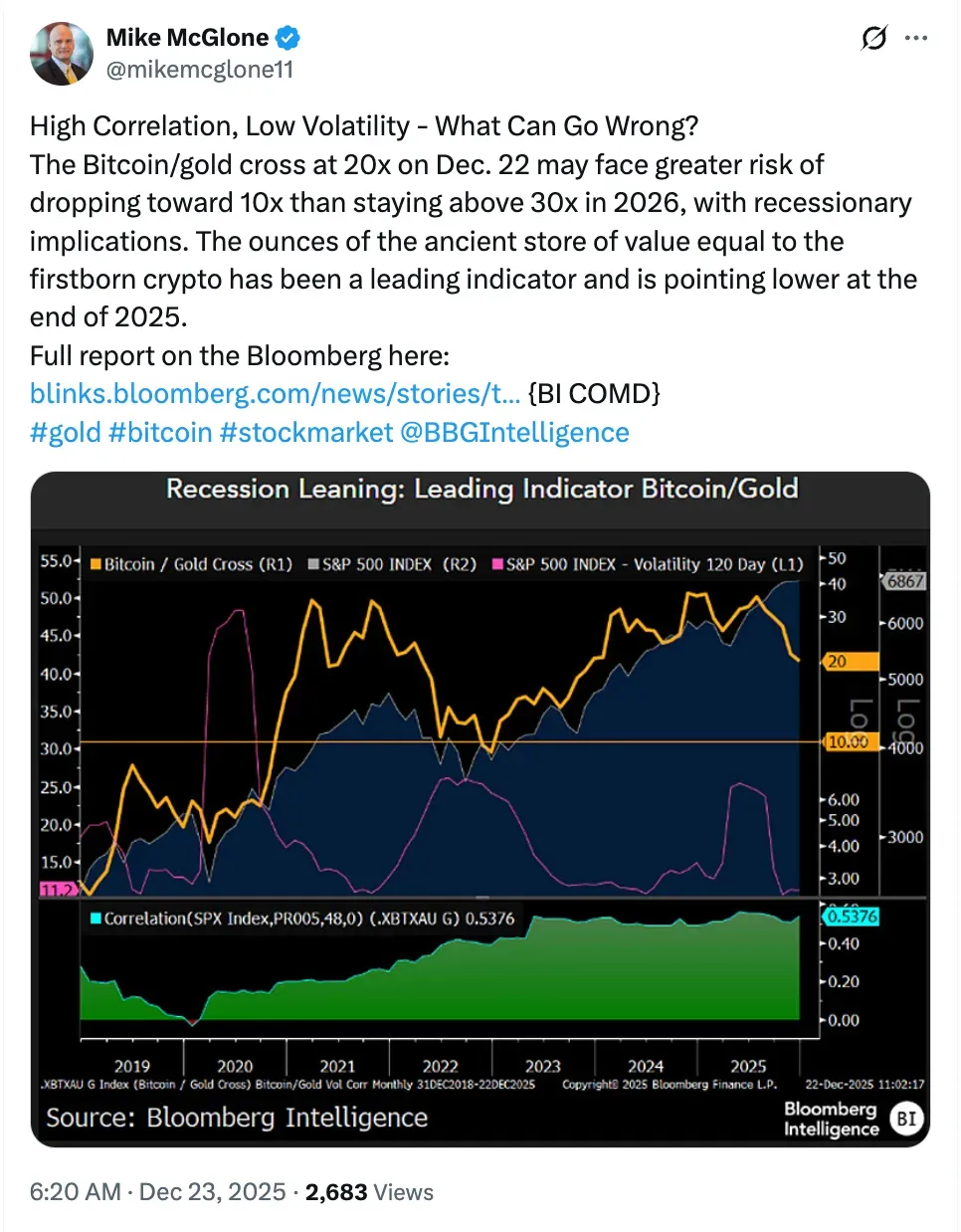

Some analysts, however, warn that rising short-term correlation may reflect growing macro risk. In a December post on X, Bloomberg Intelligence strategist Mike McGlone said the Bitcoin-to-gold ratio was acting as a leading indicator and pointing lower into 2026, potentially signaling downside risk for Bitcoin if recessionary pressures build.

Meanwhile, Tether has introduced Scudo for Tether Gold (XAU₮) today, adding new on-chain tooling aimed at simplifying gold-denominated transactions.

Read also: Ripple-Owned GTreasury Expands Enterprise Blockchain Stack With Solvexia Acquisition

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)