Advertisement|Remove ads.

Bitcoin At $60,000? Traders And Analysts Say Peak Fear May Still Be Ahead

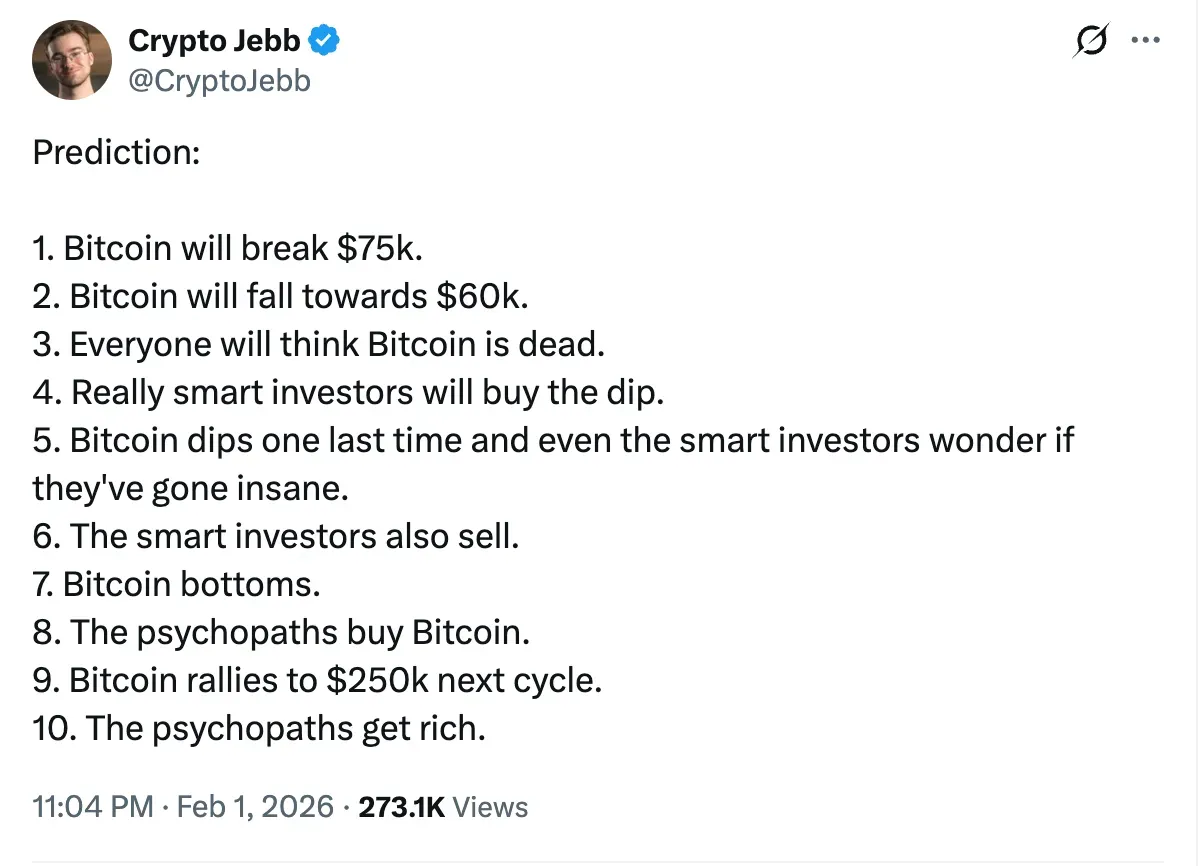

- Crypto Jebb predicted Bitcoin will break below $75,000 and fall toward $60,000 before forming a cycle bottom.

- EmperorBTC and TechDev said a deeper downside could reflect liquidation-driven capitulation rather than structural weakness.

- Raoul Pal has tagged Bitcoin’s current weakness as a liquidity-driven delay rather than a demand breakdown.

Crypto market analyst, Jebb McAffee, known as Crypto Jebb on YouTube, said on Monday that Bitcoin (BTC) will break below $75,000 and fall toward $60,000, predicting a capitulation phase before the market forms a durable bottom.

On X, McAffee said that the Bitcoin sell-off would likely convince most investors that “Bitcoin is dead” before a recovery begins. He added that even “really smart investors” would question their positions before the market finally bottoms and rallies in the next cycle. However, he wasn’t alone.

Many traders and analysts echoed similar views on X, arguing that the deeper downside is a potential late-stage capitulation rather than a structural breakdown.

Bitcoin (BTC) was trading at $76,712, down by 2.4% over 24 hours. On Stockwits, the retail sentiment around Bitcoin remained in ‘extremely bearish’ territory, as chatter levels around it improved from ‘extremely low’ to ‘extremely high’ over the past day.

Capitulation Before Recovery

Another YouTuber and trader, EmperorBTC, said a drop to the mid-$70,000 range could trigger a liquidation cascade that harms retail investors while creating attractive spot-buying opportunities for experienced traders during peak fear.

Macro-focused analyst TechDev said a possible move toward $60,000 “wouldn’t change a thing” for Bitcoin’s broader structure. He argued that such a decline could align with the first business cycle reversal since 2020, potentially setting the stage for a multi-year advance.

Separately, entrepreneur and macro investor Raoul Pal argued that Bitcoin is trading below its macro fair value based on global liquidity models. Pal said on a podcast by Coin Bureau that the current cycle appears delayed rather than derailed, framing the gap as a timing issue rather than a demand problem.

Coinvo Trading stated that Bitcoin has been declared dead many times, but each time it has come back stronger. The analyst said that if someone had bought Bitcoin every time it was called "dead," they would have become a millionaire. He said that the current sell-off is just another extreme in the cycle of sentiment.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)