Advertisement|Remove ads.

‘No Crypto Tax’ Push Draws Spotlight As CLARITY Act Nears Senate Markup

- President Donald Trump reportedly wants to remove taxes on Bitcoin and other crypto transactions, according to Paul Barron.

- Barron said the proposal could apply to Bitcoin, Ethereum, Solana, and XRP, eliminating the need to track small taxable crypto payments.

- The proposal emerges as the CLARITY Act moves toward a Senate markup and lawmakers debate stablecoin regulation.

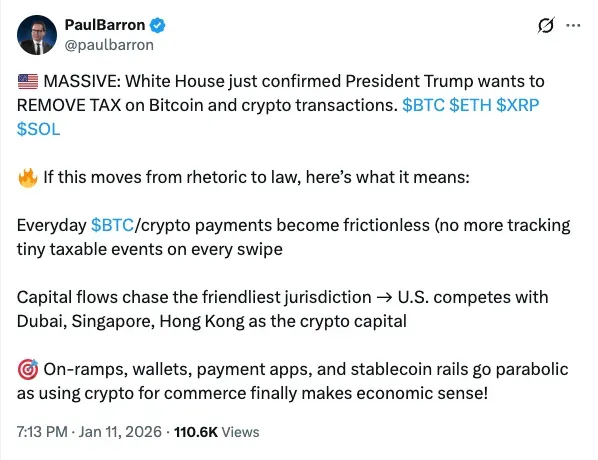

President Donald Trump is reportedly set to remove tax on Bitcoin and other crypto transactions, according to journalist and technologist Paul Barron.

Paul Barron reported on X about Trump’s intent to remove taxes on Bitcoin (BTC) and potentially cover Ethereum (ETH), Solana (SOL), and Ripple’s XRP (XRP). Barron noted that this move would eliminate the need to track small taxable events in crypto transactions, making payments “frictionless” for customers.

Barron added that if the proposal to remove crypto tax moved from “rhetoric to law,” it would position the US as a competitive “jurisdiction” for crypto activity, alongside Dubai, Hong Kong, and Singapore.

Currently, crypto is considered a digital asset, and the Internal Revenue Service (IRS) treats it like other capital assets, such as stocks and bonds. As a result, crypto transactions are subject to capital gains tax each time an asset is sold, exchanged, or used for payment.

In March 2025, the White House reported that Donald Trump had signed an Executive Order creating a Strategic Bitcoin Reserve. This order positioned the US as a leader in the government digital asset strategy. According to the release, Trump said that he would turn the US into “the crypto capital of the world.”

Clarity Act Moves Towards Senate Markup

As the CLARITY Act markup nears approval, Barron said in a previous X post that the Banking Lobby demanded to “profit from interest reserves,” generated by stablecoins. He wrote that the GENIUS Act currently prohibits stablecoin issuers like Tether (USDT) from paying interest to users directly, creating a loophole that allows third parties, such as Coinbase (COIN) and decentralised finance (DeFi) protocols, to pay yield to customers directly. In the same vein, Coinbase has prepared to revoke its support for the CLARITY Act on Monday.

Coinbase (COIN) was trading at $239, down 0.52% in pre-market hours on Monday. On Stocktwits, retail sentiment around Coinbase dropped from 'bullish' zone to 'neutral' territory, accompanied by 'high' chatter levels.

The Clarity Act is a broad crypto market structure bill that would create a unified framework for Digital Asset regulation. The act also seeks to clarify the US Securities and Exchange Commission’s (SEC) role in regulating cryptocurrencies.

Read also: Papa John’s Watch Traffic Spikes, Polymarket Contracts Jump Amid US-Iran Tensions

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)