Advertisement|Remove ads.

Apple Stock Poised For 3rd Day Of Gains, But Fresh EU Scrutiny And Retail Concerns Loom

Apple Inc. (AAPL) saw a notable uptick on Thursday, with shares rising nearly 4%, a day after the Federal Reserve’s surprise 50 basis point rate cut, and on track for their third straight session in the green.

However, this positive performance faces potential headwinds from fresh scrutiny by the European Commission.

The EU has launched “specification proceedings” to assess whether Apple is meeting its interoperability obligations under the Digital Markets Act (DMA), which took effect earlier this year.

The review will focus on whether Apple is granting third-party developers adequate access to iOS features necessary for building compatible products like smartwatches and headphones.

Should Apple fail to comply with the DMA, it reportedly risks facing a formal investigation and substantial fines — potentially up to 10% of its global annual turnover.

The EU’s move aims to enhance competition by allowing developers to integrate more fully with Apple’s ecosystem.

These regulatory challenges come as investors are already worried about other factors.

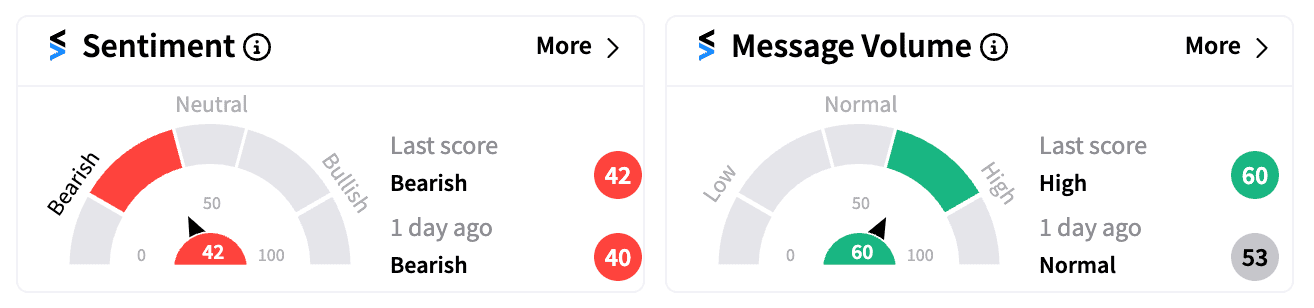

On Stocktwits, retail sentiment remained ‘bearish’ (41/100), with some users forecasting a significant downturn.

One commenter noted, “$AAPL crash inbound. Lackluster sales gonna kill it,” pointing to concerns about declining demand for Apple’s latest iPhone 16 lineup.

In its first weekend, Apple sold approximately 37 million iPhone 16 units—nearly 13% fewer than the iPhone 15’s first-weekend sales last year, according to TF Securities analyst Ming-Chi Kuo.

Kuo attributes this drop partly to the delay of key features like Apple Intelligence, which was not available at the launch.

Conversely, some investors remain optimistic, based on T-Mobile US’ CEO seeing stronger-than-expected sales for the iPhone 16, particularly for the high-end Pro and Max models.

Morgan Stanley notes that while lead times for the iPhone 16 have increased, they are still tracking lower year-over-year, and that the trajectory of lead times over the next few days will be more telling.

The latest development comes on the heels of a recent European Court of Justice ruling, which has ordered Apple to repay approximately $14.35 billion for illegal tax benefits in Ireland.

Still, Apple’s stock has risen over 22% this year, amid a broader tech-driven market rally.

As the world’s most valuable company navigates regulatory and market pressures, investors will be watching closely to see if its stock can maintain its upward momentum or if new challenges will throw a spanner in the works.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)