Advertisement. Remove ads.

Alibaba Retail Sentiment Swings Back Into Bullish Zone On Revenue-Boosting Move

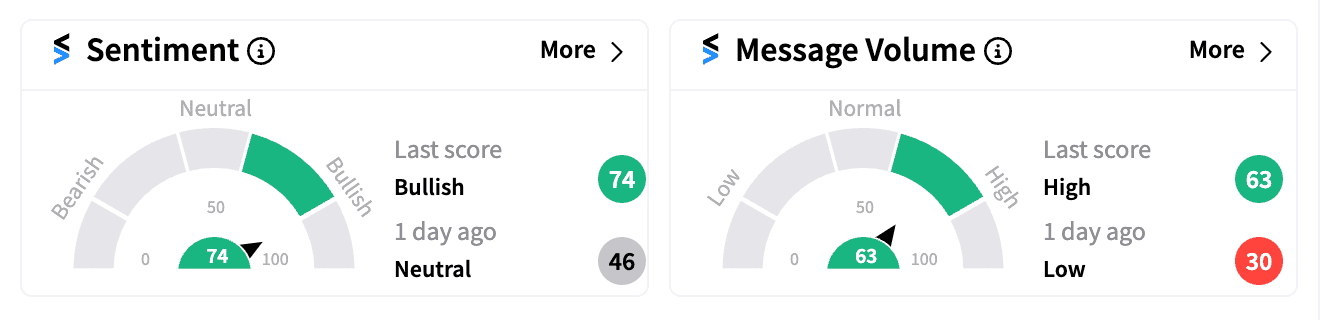

U.S. shares of Alibaba (BABA) surged over 3.30% to $79.10 on Monday, nearing a two-month high. Retail investor sentiment on Stocktwits transitioned from neutral to bullish (71/100) while message volume moved to “high” levels (64/100) from its low level a day earlier.

The surge came following Alibaba's plan to implement a new merchant service fee. Bloomberg reported that the e-commerce giant will start charging a basic software service fee of 0.60% on confirmed transactions for vendors on both its Tmall and Taobao platforms.

Jefferies analysts view the new fee structure as positive, particularly for Taobao, which they estimate contributes roughly 50% of Alibaba's total gross merchandise value. They maintained a "Buy" rating on Alibaba with a $116 price target, representing a potential upside of over 46%.

Alibaba reportedly generates most of its Taobao and Tmall revenue through customer management fees paid by merchants for advertising and product optimization. The new service fee aligns with existing practices of local competitors like PDD and JD.com and will provide a tailwind for revenue and margins going forward.

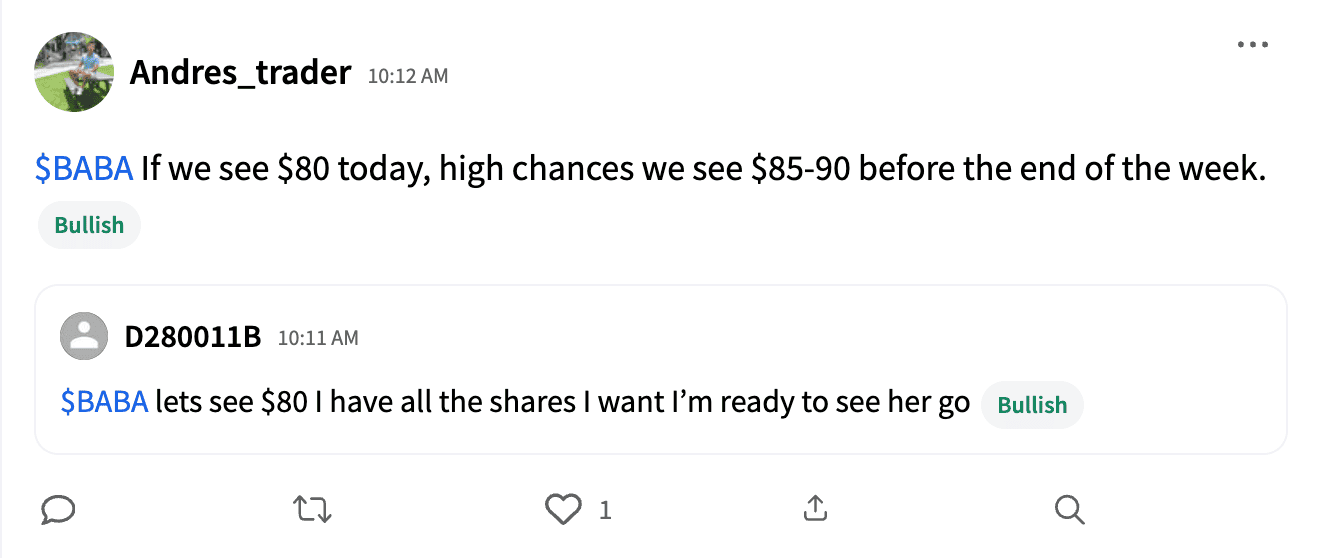

Alibaba ranks 13th on Stocktwits with over 404,000 followers. Popular posts on the platform lauded the revenue-boosting potential of the new fee, with some users predicting a surge to $90 by the end of the week if the stock breaks $80. Others questioned if this could be the "beginning of the run to $100," a level last reached in August 2023.

Despite a 5.40% year-to-date gain, Alibaba’s jump lags behind U.S. tech peers due to increased Chinese government scrutiny and regulatory curbs, particularly in the burgeoning AI sector. However, retail is betting the company’s latest move could get the stock back on track.

Photo via Vecteezy

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/gst-2025-08-0c85e16a4defd813c05e7fa63217dff5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/m-nagaraju-2025-02-e1c6095fe8963ea5707d968048b969f4.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/09/nclt-2024-09-368a6a429d0365fddd99a6ca5bbf067a.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2018/06/2018-06-21T050845Z_1_LYNXMPEE5K0CB_RTROPTP_4_INDIA-ECONOMY-INFLATION.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/03/France-Gold.jpg)