Advertisement|Remove ads.

Abercrombie & Fitch Stock Sinks As CEO Points To 'Increasingly Uncertain Environment' — Retail Bulls Aren’t Backing Down

Shares of Abercrombie & Fitch Co. (ANF) plummeted 15% on Wednesday, marking the company’s most significant intraday drop in over two years, despite the firm posting strong Q2 results that beat Wall Street expectations.

Second-quarter revenue rose 21% year-over-year to $1.13 billion, surpassing analyst projections of $1.10 billion. Earnings per share (EPS) hit $2.50, also beating expectations of $2.22.

Comparable sales grew by 18%, above the anticipated 15% growth, driven primarily by the performance of the Hollister chain, while sales at Abercrombie stores met estimates.

Gross margin fell slightly short of expectations, and the company’s full-year outlook was largely in line with forecasts. For the current quarter, Abercrombie projects sales to grow by a low double-digit percentage.

CEO Fran Horowitz, while noting the company’s strong first half, warned, “Although we continue to operate in an increasingly uncertain environment, we remain steadfast in executing our global playbook and maintaining discipline over inventory and expenses.”

Adam Crisafulli, an analyst at Vital Knowledge, reportedly noted that Abercrombie is “held to a higher standard than most retailers” and said “people will probably be modestly underwhelmed” by the results.

Last month, Argus Research downgraded ANF from ‘Buy’ to ‘Hold.’ While the firm acknowledged Abercrombie’s advantages from improved supply chains and growth in average unit retail, it projected that the company’s growth rate could moderate to mid-single digits by FY26.

Argus also noted that Abercrombie shares trade at a “significant premium” in terms of price-to-sales and enterprise value-to-sales ratios relative to its peer group.

ANF currently has a price-to-earnings (PE) ratio of 20.73, compared to Gap, Inc.’s (GPS) 12.97, even as they have similar market capitalizations.

Despite the day’s dip, ANF stock remains up more than 52% for the year, outperforming its peers in the S&P Composite 1500 Apparel Retail Index.

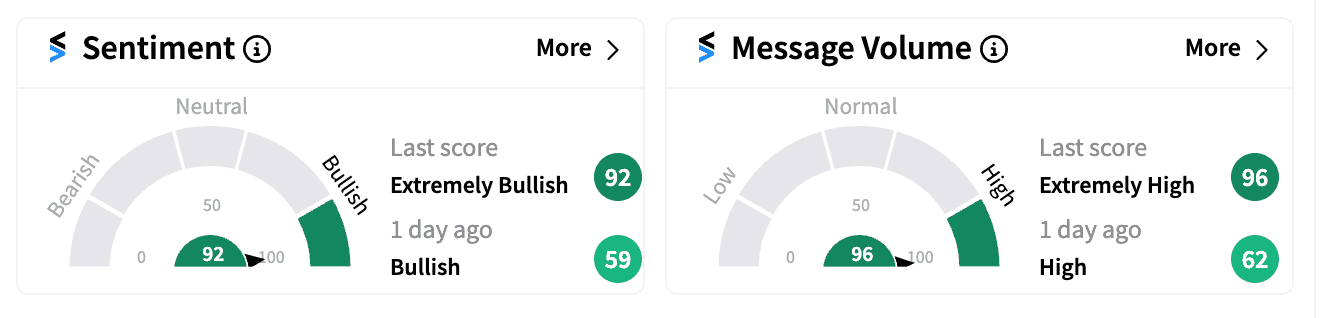

On Stocktwits, retail investors showed little concern over the dip, with sentiment remaining ‘extremely bullish.’

Many saw the sell-off as an over-reaction, emphasizing Abercrombie’s strong earnings and guidance.

Others view the decline as a buying opportunity.

The broader retail apparel sector has faced mixed earnings, with several companies citing macroeconomic headwinds and high inflation as factors making consumers more price-conscious.

However, there might be some relief on the horizon. With the Federal Reserve expected to cut interest rates next month, there’s hope that consumer spending might bounce back and benefit retail stocks.

Read Next: Chewy Stock Rises 5% After Q2 Net Income Jumps 14x: Retail Goes Crazy

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)