Advertisement|Remove ads.

Ashok Leyland Shares: Is It Time To Buy Or Wait? SEBI RAs Weigh In

Ashok Leyland delivered a robust set of numbers for the fourth quarter of FY25, reporting a 38% year-on-year surge in net profit to ₹1,246 crore and a 6% rise in revenue to ₹11,907 crore.

The commercial vehicle giant also turned around its balance sheet dramatically, ending the year with a net cash surplus of ₹4,242 crore, compared to a net debt position in the previous year.

The board signaled long-term confidence by announcing a 1:1 bonus share issue and a total dividend of ₹6.25 per share for FY25, further rewarding shareholders.

Additionally, the company earmarked ₹1,000 crore in capex for FY26 to accelerate its electric vehicle (EV) initiatives.

Despite these strengths, analysts remain divided in their near term outlook.

SEBI-registered analyst Prameela Balakkala notes that the company’s elevated debt-to-equity ratio of 4.53 needs closer scrutiny, while its UK-based EV arm, Switch Mobility, is grappling with softening demand. Ashok Leyland’s limited exposure to the 2–4 tonne light commercial vehicle (LCV) segment also curbs its growth potential in that space.

On the charts, the stock is hovering near a key resistance level at ₹250, and the Relative Strength Index (RSI) indicates a neutral to slightly overbought condition.

Balakkala advises against fresh entry at current levels, suggesting investors wait for a dip toward the ₹190–₹200 range for long-term accumulation. A breakout above ₹250, accompanied by strong volume, could open up targets of ₹265 and ₹280, she adds.

Overall, she maintains a cautious near-term outlook, citing the high debt load and execution risks in the EV segment, and advises against chasing the rally at current levels, favoring a patient, accumulation-based approach for investors.

Analyst Harika Enjamuri offers a more bullish technical view.

She observes that the stock has shown resilience after facing resistance at ₹245.71, and remains well above key moving averages—9-day EMA at ₹238.62, 70-day MA at ₹217.63, and 100-day MA at ₹216.25.

On the weekly chart, Ashok Leyland has decisively broken past the ₹233.40 resistance, and as long as it stays above this level, Enjamuri sees potential for the stock to climb toward ₹258.78.

However, if it fails to maintain above ₹233.40, there is a risk of retesting support at ₹226.08 or ₹221.83.

Overall, she maintains a positive outlook with a bullish bias on Ashok Leyland as long as it stays above ₹233.40, supported by strong technical indicators and a favorable trend.

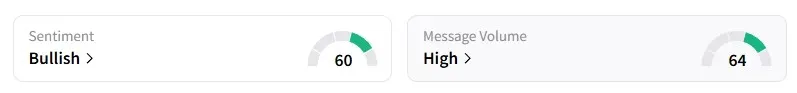

Data on Stocktwits shows that retail sentiment has turned ‘bullish’, up from ‘neutral’ a week ago, and several domestic brokerages have raised their target prices.

Year-to-date, Ashok Leyland shares are up 7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)