Advertisement|Remove ads.

Asian Paints In Consolidation Zone, SEBI RA Anupam Bajpai Advises Patience Before Fresh Entry

Asian Paints’ shares fell 3% on Wednesday, marking their steepest single-day drop in the last three months, as investors turned cautious ahead of the company’s March quarter earnings, due to be announced on May 8.

India’s largest decorative paints manufacturer has been under pressure amid growing competition, pricing, and volume concerns.

SEBI-registered analyst Anupam Bajpai observed that following a sharp rise, Asian Paints’ stock has entered a consolidation phase, establishing a key support level at ₹2,385 and resistance at ₹2,490.

He advised investors to monitor these levels closely and wait for a decisive breakout before taking action.

Bajpai further stated that he would be bullish on the stock if it closes above the resistance at ₹2,490 and would have a potential target equivalent to the difference between the support and resistance levels, i.e., 105 points.

Conversely, if the stock closes below the support at ₹2,385, he expects the price to decline toward the 50-day exponential moving average, which is currently near ₹2,320.

Bajpai also recommended a patient and careful observation of these technical levels before making investment decisions.

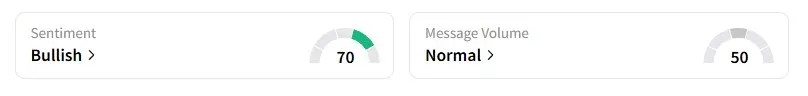

Data on Stocktwits shows retail sentiment remains ‘bullish’ on this counter.

Asian Paints shares have gained 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)