Advertisement|Remove ads.

Astra Microwave Shares Rebound: Analyst Sees Nearly 25% Upside Potential In The Long-Term

Astra Microwave shares have seen a strong recovery, surging more than 10% over the past five sessions, supported by high volumes.

Positive investor sentiment across the defense sector and buying from institutional investors have led to its recent upmove. This comes after the government’s recent approval of new defense procurement worth about ₹1.5 lakh crore, including radar and communication systems — areas where Astra Microwave has expertise.

Reports also suggest that the company has received fresh orders from DRDO and ISRO-related projects, which have improved investor confidence.

Technical Outlook

SEBI-registered analyst Deepak Pal noted that on the daily chart, it has rebounded after taking support near ₹1,000. The price has crossed above both the 20-day and 50-day Exponential Moving Averages (EMAs), showing a short-term trend reversal from bearish to bullish. Technical indicators such as Parabolic SAR and MACD confirm renewed buying interest, while the Relative Strength Index (RSI) around 57 shows improving strength but remains below overbought levels.

Overall, the chart structure suggests that if Astra Micro stock sustains above ₹1,100, it may head toward ₹ 1,160–₹ 1,200 in the near term, while support is placed around ₹ 1,070–₹ 1,080.

Fundamental View

Pal noted that the company’s order book stands at around ₹3,000 crore, providing good revenue visibility for the next few years. It maintains strong financials with low debt, steady margins of around 15–18%, and an ROE of nearly 18%. He added that Astra Microwave is well-positioned to benefit from the government’s rising focus on defense manufacturing.

Triggers To Watch

Investors will be monitoring the Q2 results due in late October 2025, where strong revenue and margin growth are anticipated. Positive earnings could push the stock beyond ₹1,160 resistance levels, according to Pal.

Additionally, the FY26 Defense Budget is likely to increase capital expenditure for electronic warfare and communication systems, directly benefiting the company. Any new announcements related to “Made in India” radar or missile tracking projects could act as a strong catalyst for the stock in both the short and long term.

What Should Investors Do?

According to Pal, in the short term, Astra Microwave looks strong both technically and fundamentally. Sustaining above ₹1,100 may lead the stock to ₹1,160–₹1,200, while strong support lies near ₹1,070. Traders can expect a positive bias, as both momentum and volume are improving. Any positive news from quarterly results or new defense orders can act as an immediate trigger for a short-term breakout.

From a long-term perspective, investors can accumulate the stock around the ₹1,050–₹1,080 levels with targets of ₹1,300–₹1,350 in the next 6–12 months. The outlook remains positive with potential 20–25% upside.

Pal cautioned that some potential risks include delays in order execution or government approvals, fluctuations in raw material costs, and dependence on defense budget cycles. He concluded that while short-term volatility may occur after strong rallies, the long-term structure remains intact.

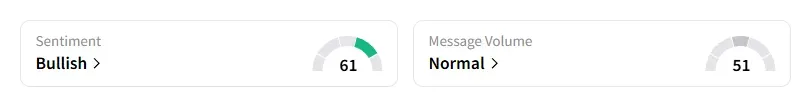

What Is The Retail Mood?

Data on Stocktwits indicates that retail sentiment shifted to ‘bullish’ a day ago. It was ‘neutral’ last week.

Astra Micro shares have rallied 45% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)