Advertisement|Remove ads.

AU Small Finance Bank Poised For Breakout Ahead Of Q2 Results: SEBI Analyst

AU Small Finance Bank shares have gained 5% this week ahead of its September quarter (Q2 FY26) earnings report on October 17.

India's largest small finance bank had reported a strong growth in deposits and overall loan portfolio in its Q2 operational business update earlier this month.

SEBI-registered analyst Deepak Pal noted that some volatility can be expected on Friday, as positive results may prompt fresh highs, while any miss could trigger profit-booking.

He also added that its transition to universal bank status post-RBI approval puts AU Small Finance Bank in a unique league and may elevate its valuation multiples in the coming quarters. Just earlier this month, Jefferies too had initiated coverage with a ‘Buy’ call and target price of ₹910, citing a similar rationale.

The bank completed the country’s first “small finance bank merger” by acquiring Fincare Small Finance Bank in April 2024 and received RBI approval to become a universal bank in August 2025.

AU Small Finance Bank: What are the technicals showing?

Pal highlighted that AU Small Finance Bank stock has shown strong bullish momentum in recent sessions, breaking above key short-term resistance levels. On the daily chart, it was trading well above its 20 and 50-day Exponential Moving Average (EMA) with rising volumes.

Other technical indicators, such as the parabolic SAR and MACD, support the momentum drive, while the Relative Strength Index (RSI) stood above 70, indicating strong but slightly overbought conditions.

Pal identified support at ₹765 and ₹740, with immediate resistance at ₹815 and ₹841 (52-week high). He advised traders to consider aggressive long positions with a tight stop loss below ₹765.

What is the retail mood on Stocktwits?

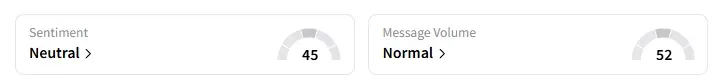

Data on Stocktwits showed that retail sentiment has been ‘neutral’ for a few weeks.

AU Small Finance Bank shares have surged over 40% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)