Advertisement|Remove ads.

Bank Nifty Scales New Peak: SEBI Analyst Eyes 60,000 On Strong Volume, Earnings Boost

Bank Nifty crossed its previous high of 57,628 on Friday, ahead of key earnings from HDFC Bank and ICICI Bank, over the weekend. From its March lows (47,702), the Nifty Bank index has rebounded over 10,000 points to hit a fresh high of 57,828 on October 17.

SEBI-registered analyst Finkhoz noted that Bank Nifty finally broke above the 57,500 level after several weeks of consolidation, signaling a potential shift in momentum.

Nifty Bank: What are technical charts suggesting?

On both the daily and weekly charts, the index continues to display a bullish structure with higher highs and higher lows remaining intact. The daily chart shows a strong breakout candle above the resistance zone of 56,500–57,000, accompanied by rising volumes, according to Finkhoz.

Meanwhile, the weekly chart indicates a clean close above the 50 EMA and consistent movement within an ascending channel since June.

The Relative Strength Index (RSI) stood at 75, indicating slightly overheated levels. Hence Finkhoz expects mild profit booking near the 58,000–58,200 zone.

Immediate support is seen at 56,000 & 55,400, with resistance at 58,200 / 59,000. In the short term, if Bank Nifty sustains above 56,500, the bullish momentum could extend toward 59,000–59,500. However, a drop back below 56,000 might trigger quick profit-taking.

Finkhoz’s targets are at 58,200, 59,000, and 60,000, with a stop loss suggested at 55,400.

What’s driving the Nifty Bank rally?

The liquidity boost from India’s central bank has been a huge support for the banking sector. PSU banks and prominent private names such as SBI, ICICI, Axis Bank led the breakout.

Finkhoz expects Bank Nifty EPS growth to stay strong in H2 FY25 as credit demand remains healthy. Additionally, foreign inflows are beginning to return to financials after three months of selling pressure.

The analysts concluded that this breakout on Bank Nifty appeared to be backed by data. Strong volume, higher timeframe confirmation, and positive sector outlook support this surge.

Bank Nifty: Levels to watch

They advised short-term traders to trail profits above 57,000, while positional investors may consider holding their positions with an eye on the 60,000 target. However, they cautioned that the index needs to hold above 57,500 for sustained upward movement; otherwise, a quick corrective dip before the next leg of the rally cannot be ruled out.

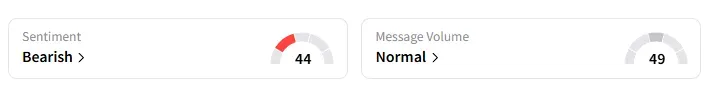

What is the retail sentiment on Stocktwits?

Data on Stocktwits showed that retail sentiment moved to ‘bearish’ a day ago.

The Nifty Bank index has gained 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)