Advertisement|Remove ads.

Bank Of Baroda Shares: Breakout Above ₹245 Could Trigger Rally, Says SEBI Analyst

Bank of Baroda (BoB) shares have been rangebound after recent volatility. On its daily chart, it is trying to hold above the crucial support levels at the 200-day Exponential Moving Average (EMA) of ₹235.

The bank has recently classified some loan accounts of Reliance Communications (RCom) and the Anil Ambani group as “fraud,” similar to actions taken by SBI and the Bank of India. SEBI-registered analyst Deepak Pal said that this move is negative for sentiment as it raises credit risk perception and may increase provisions.

Once the fraud-related concerns are addressed, Bank of Baroda could deliver steady growth in the long term, supported by retail loan expansion, gold loan demand, and institutional confidence, according to Pal.

He said that a sustained breakout above ₹242–245 could open the door for a move towards ₹250–255 in the near term. On the downside, ₹235 and ₹230 remain critical support zones.

Technical Watch

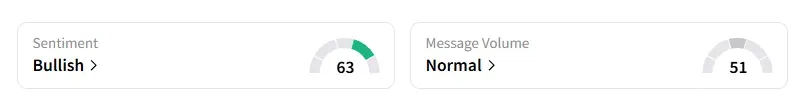

Momentum indicators are giving mixed signals, too. The Relative Strength Index (RSI) at 51 suggests neutral strength, while MACD remains slightly negative but is flattening, indicating that selling pressure is easing. The Parabolic SAR remains above the price, reflecting cautious sentiment, yet the stock is attempting to build strength near short-term moving averages (20 & 50 EMA) clustered around current levels.

News Triggers

Bank of Baroda has reduced some lending rates (MCLR-based), which will lower EMIs for borrowers – boosting loan demand, but may put some pressure on margins if deposit costs remain high.

Public sector banks, including BoB, are seeing strong growth in gold loans due to rising gold prices. And in other positive triggers, Societe Generale has picked up a small stake in Bank of Baroda, which reflects solid instiutional interest in the stock.

What Should Traders Do?

Pal said that in the short term, BoB stock may remain volatile due to mixed news. However, if the bank manages margins well and sustains loan growth, the outlook remains stable to positive in the medium term.

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a few weeks.

For the year so far, however, Bank of Baroda shares have traded flat.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)