Advertisement|Remove ads.

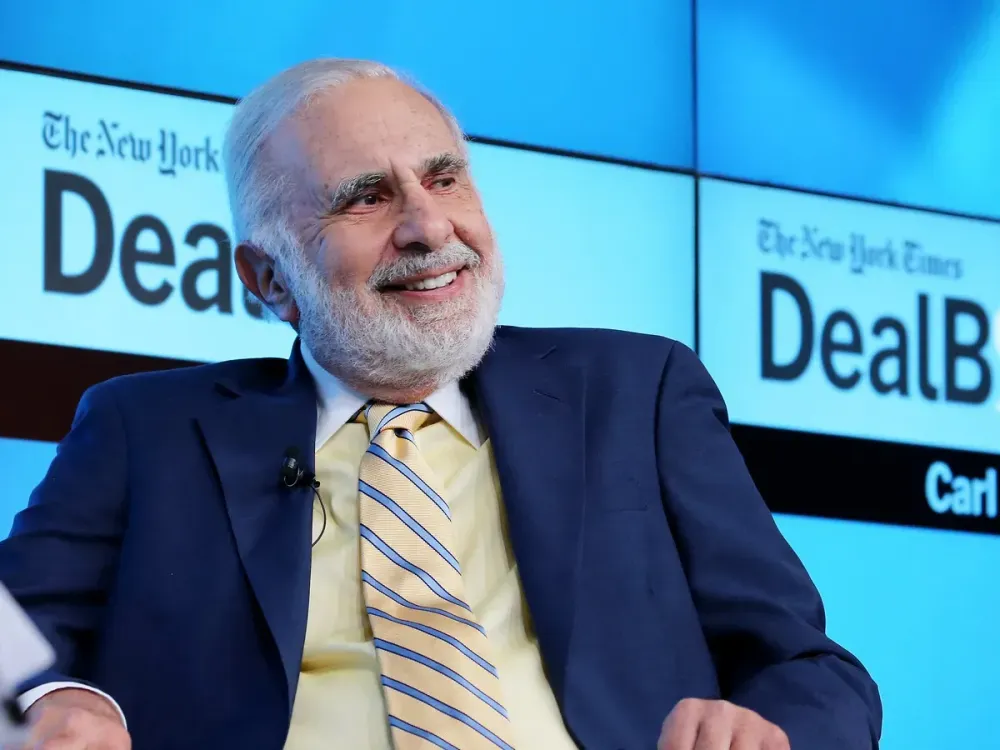

Bausch Health Says Carl Icahn Has 34% Economic Interest In Its Outstanding Shares

Bausch Health Companies Inc. (BHC) announced on Tuesday that billionaire activist investor Carl Icahn has a total economic interest of 34% in the company’s outstanding shares.

Bausch Health’s shares were up by more than 8% at the time of writing.

Icahn currently owns a 9.4% stake in the company; the other 24.6% exposure he has to Bausch Health is courtesy of cash-settled equity swap agreements.

This refers to a contract that entitles the buyer to benefit from stock movements, but does not confer any equity ownership.

Bausch Health revealed this in a supplemental filing to its proxy statement for its upcoming annual general meeting.

According to the filing, Icahn and his affiliates own 34.72 million equity shares of Bausch Health.

In addition to this, they have cash-settled equity swap agreements for 90.72 million shares. It also revealed that Icahn entered into these agreements between May 2021 and September 2023.

Although Bausch Health sought copies of the swap agreements entered into by Icahn, the investor declined the request but confirmed that these swaps do not confer any voting power, the company said in its filing.

This disclosure comes days after the company announced a new “poison pill” plan to safeguard shareholders’ rights and prevent hostile takeovers.

As part of this plan, Bausch Health prevented any single investor from acquiring more than a 20% stake in the company.

Bausch Health is scheduled to announce its fiscal 2025 first-quarter earnings on April 30. Data from Stocktwits shows that the company is expected to report earnings per share (EPS) of $0.84 on revenue of $2.28 billion.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Boeing Confirms Sale Of Parts Of Digital Aviation Business To Thoma Bravo For $10.55 Billion

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)