Advertisement|Remove ads.

Cava Stock Plunges As CEO, Key Stakeholders Offload Shares Amid Record Highs: Is Retail Mood Souring?

Shares of fast-casual Mediterranean chain Cava Group (CAVA) dropped over 8% in pre-market trading on Tuesday, after closing at a record high in the previous session.

The decline comes in response to an SEC filing that revealed key shareholders and top executives have been offloading significant portions of their holdings in the company.

Artal International S.C.A., a 10% stakeholder in Cava, sold six million shares of the firm worth $732 million. This sale comes over and above the 5.55 million shares that Artal already sold in the past three months.

The move by Artal signals a potential shift in sentiment among early investors who have benefited from Cava’s meteoric rise since its IPO.

Cava's leadership has also been cashing in on the company’s recent success. CEO Brett Schulman exercised his option to sell 201,504 shares, netting $24.9 million. Founder and Chief Concept Officer Ted Xenohristos also sold 98,490 shares, earning $12.4 million. Furthermore, three other directors collectively sold 11,500 shares.

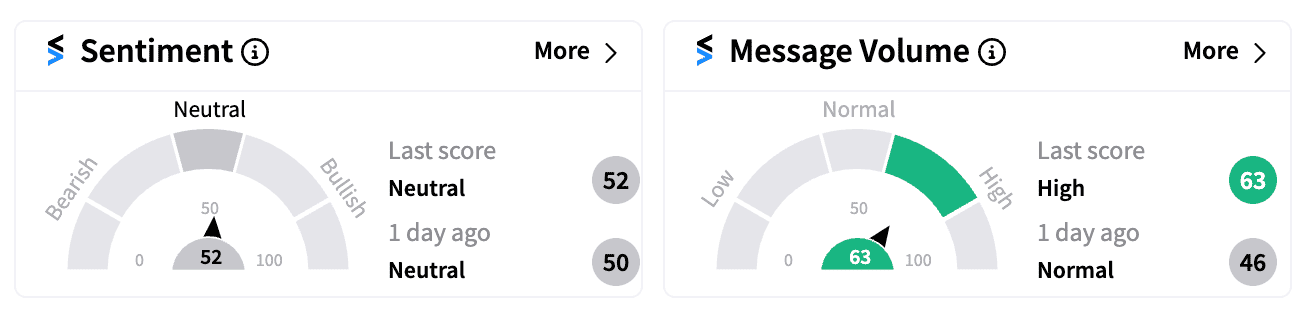

On Stocktwits, retail sentiment stayed in the ‘neutral’ zone (52/100), with message volume surging, as watchers digested the development.

Cava has been a stand-out performer in the restaurant sector. Since its market debut in June 2023, the stock has soared nearly 230%, driven by a series of earnings beats, impressive same-store sales growth, and the successful launch of new menu items.

Earlier this month, Cava reported better-than-expected Q2 results for 2024 and raised its full-year guidance.

However, concerns about the company’s valuation have begun to surface. Cava’s price-to-earnings (P/E) ratio currently stands at an eye-popping 345.89, far exceeding that of industry giants like Chipotle Mexican Grill (53.65) and McDonald's Corp (25.26).

Read Next: Papa John’s Stock Rises, Retail Buzz Grows As Analyst Note Sparks Takeover Speculations

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)