Advertisement|Remove ads.

CFG Stock Falls Pre-Market After Profit Misses Estimates: Retail Bearish

Citizens Financial Group stock was down 1.1% pre market (7:42 am ET) after its third quarter profit fell 11.8% from a year ago, with retail sentiment turning bearish.

Its earnings per share (EPS) stood at $0.77, below the $0.79 estimated by analysts, on revenues of $1.9 billion, down 5.7% from the same quarter last year. Analysts had estimated $1.94 billion in revenues.

The Providence, RI-based-based bank also posted a steep dip in net interest income to $1.4 billion, down 10% from last year, partly due to lower net interest margin and a 1% decline in average interest earning assets, the bank said in a statement.

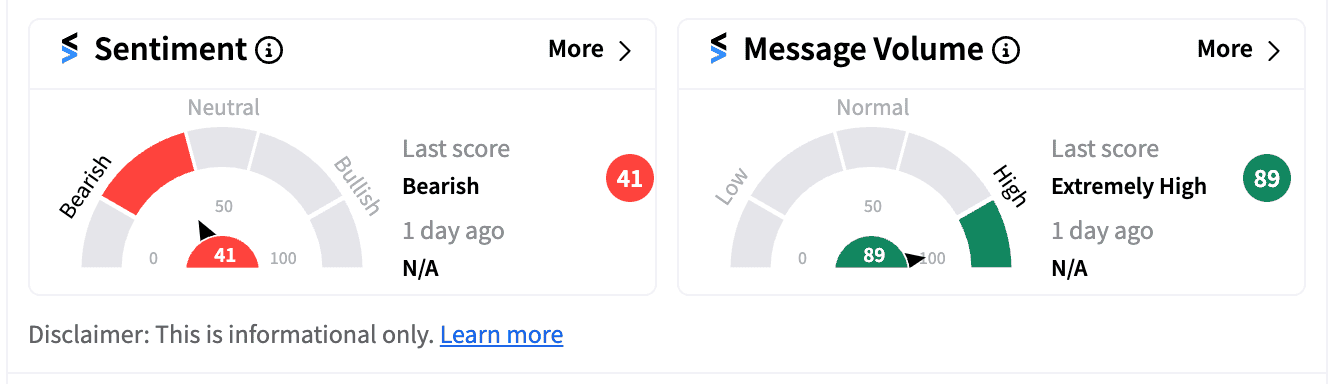

Retail sentiment was ‘bearish’ (41/100) and messages volumes in the ‘extremely high’ zone.

“We continue to be pleased with the strong execution of our key initiatives during the third quarter,” Chairman and CEO Bruce Van Saun said in the statement. “Our Private Bank reached $5.6 billion in deposits and $4.1 billion in AUM, our NYC Metro region continues to achieve strong growth, and we are close to launching a TOP 10 program with $100 million plus impact.”

Van Saun added the bank’s balance sheet remains strong across capital, liquidity, funding and loan loss reserves. However, the quarter was hit by forward starting swaps that began in July, and fees pushed out to the next quarter.

Van Saun predicts a “strong fourth quarter and launch into 2025.”

Citizens has also announced a quarterly common stock dividend of $0.42 per share.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)