Advertisement|Remove ads.

Breakout Alerts: Chennai Petro And GIC Among Top Analyst Buys This Week

Two stocks offering attractive risk-reward setups are Chennai Petroleum Corporation and General Insurance Corporation of India (GIC). SEBI-registered analyst Palak Jain is bullish on these two stocks, driven by strong technicals and fundamental support.

Let’s take a look at her recommendations:

Chennai Petroleum

Jain noted a rounding bottom breakout above significant resistance, accompanied by strong volume buildup, in Chennai Petroleum. A daily relative strength index (RSI) above 67 and momentum indicators confirm a bullish turn.

She added that this leading South Indian refinery, with an improving product mix and cost controls, has a strong balance sheet, low debt, and stable book value, which support long-term prospects. It its June quarter earnings, it had reported weak margins but had contained its operational costs.

As crude cycles recover, this stock is poised to be a rerating candidate. Additionally, technicals suggest further upside, but risk management is essential due to volatile earnings, she cautioned.

Jain recommended buying Chennai Petro above ₹808, with a stop-loss at ₹726 for target prices of ₹832, ₹857, and ₹904.

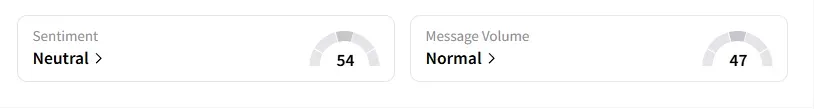

Data on Stocktwits shows retail sentiment has been ‘neutral’ for a few weeks,

Chennai Petro shares have risen 32% year-to-date (YTD).

General Insurance Corporation of India (GIC)

Jain flagged a major resistance trendline breakout after a long consolidation at support for GIC shares, backed by improving weekly volume and bullish DMI signals.

This market leader in the reinsurance business has a strong return on equity (12%), and is supported by healthy reserves and improving underwriting performance. June quarter earnings saw profits rising 81%, along with robust expansion in margins and investment income.

Additionally, she noted that the technical setup points to risk-reward favoring fresh upside, with strong earnings momentum and attractive valuation lending further conviction.

Jain recommended buying GIC above ₹382, with a stop loss at ₹343 and target price of ₹393, ₹404, and ₹427.

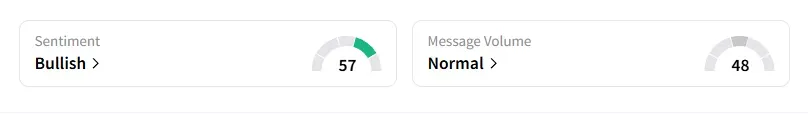

Data on Stocktwits shows retail sentiment turned ‘bullish’ a day ago. It was ‘neutral’ last week.

GIC shares have declined 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)