Advertisement|Remove ads.

Coinbase Breakout At Crossroads As Retail Sentiment Weakens

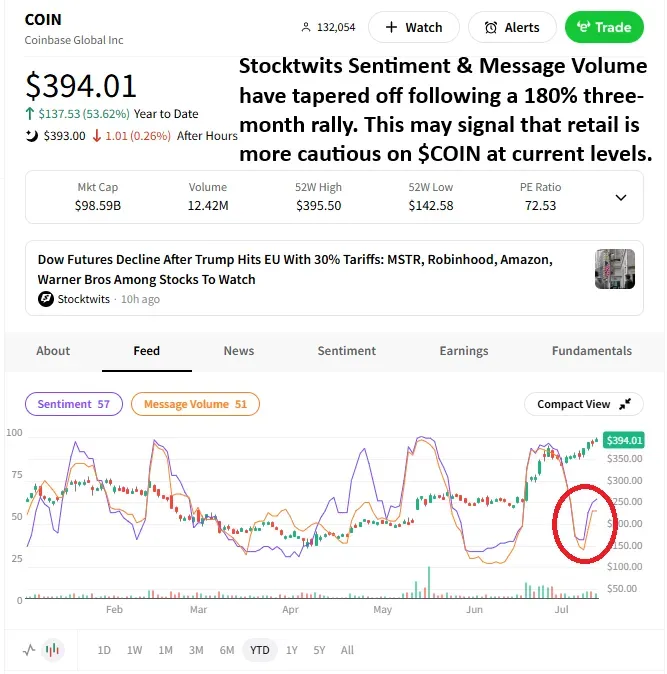

Last week, Bitcoin broke out to new all-time highs alongside risk assets, with retail’s reset providing a strong tailwind for the bulls. Coinbase also posted its highest weekly closing price ever as crypto-linked stocks soared. However, after a weekend of jubilation, Coinbase and other crypto-linked stocks faded throughout this week's trade. Let’s see what Stocktwits Sentiment may be suggesting about their next move.

With Coinbase in the news for trading above $100 billion market cap, Stocktwits Sentiment and Message Volume remain well off their highs. While not inherently bearish, it may suggest that retail is looking for opportunities elsewhere rather than jumping on the stock after its 180% three-month rally.

From a technical perspective, last week’s closing price was the highest ever, putting prices firmly above resistance near 340-370. Looking ahead, bulls will use that as a point of reference on the downside to signal that this breakout is the real deal. Traders are still using this fresh breakout to get involved in a risk-defined way. However, some investors are looking for the stock to digest its gains before jumping back in.

Other popular crypto-linked stocks, such as Robinhood, SoFi Technologies, and Marathon Digital, also saw volatility increase this week, putting traders on alert for a potential reversal. While the long-term trends for these stocks remain bullish, caution flags are being raised by some in the community following record short-term runs.

Add $COIN to your watchlist to monitor this development. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto.

Unlock Stocktwits Sentiment insights with Stocktwits Edge — subscribe now.

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in Coinbase or any other stocks/crypto mentioned as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)