Advertisement|Remove ads.

Coromandel Hits Record High, SEBI RAs See Rally Continuing Toward ₹3,000

Coromandel International is gaining traction on analysts’ radar with a 11% rally in the last five sessions. The stock hit a fresh record high on Wednesday.

SEBI-registered analysts Bharat Sharma of Stockace Financial Services and Palak Jain have flagged a swing and positional breakout potential in this agrochemical company.

Sharma noted that the stock has breached the strong previous peak’s resistance with increased volume & large green candle, which signifies an upside momentum. Additionally, all Exponential Moving Averages (EMAs) are well aligned towards a further rally.

He recommends buying Coromandel between ₹2,550 and ₹2,610 for a target price of ₹2,800 and ₹3,000, with a suggested stop loss at ₹2,450 or ₹2,400 on a closing basis. Recommended timeframe is 30-60 days.

Jain noted that the stock has broken out above a significant resistance level, indicating a potential shift in market sentiment and a possible upward trend.

The double bottom pattern suggests that the stock has formed a strong support level and is likely to reverse its previous downtrend, potentially leading to a price increase. And its chart shows an increase in trading volume and a bullish price action, indicating growing investor interest and momentum, which can drive the stock price higher.

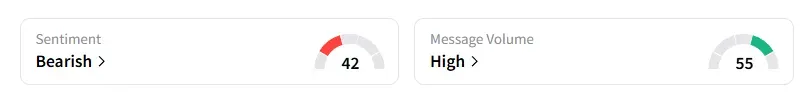

However, data on Stocktwits shows that retail sentiment flipped from ‘neutral’ to ‘bearish’ a day ago amid ‘high’ message volumes.

Earlier this month, Coromandel reported strong June quarter (Q1 FY26) earnings, with profits rising 62% and revenues surging 49%. Additionally, it announced plans to buy a 17.69% stake for $7.70 million in Senegalese rock phosphate miner Baobab Mining and Chemicals Corporation (BMCC).

Coromandel shares have rallied 37% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)