Advertisement|Remove ads.

CROX Stock Jumps 20% After Q4 Beat – CEO Highlights Buybacks And Global Growth Runway

- On the product front, Rees pointed to encouraging early performance in direct-to-consumer channels for the Crafty Clog.

- Market penetration in countries such as China, India, Japan, Germany, and France stands at roughly one-third of Crocs' share in more mature markets.

- In the fourth quarter, Crocs reported revenue of $958 million and adjusted earnings per share of $2.29, both above street estimates.

Crocs Inc. (CROX) is leaning on strong cash generation and new product momentum as it looks to extend growth at home and abroad, according to its CEO, Andrew Rees.

In the fourth-quarter (Q4) earnings call, Rees highlighted the company’s ability to simultaneously strengthen its balance sheet and return cash to shareholders.

“Strong free cash flow generation of $659 million in 2025 enabled us to pay down $128 million in debt and buyback approximately 6.5 million shares for $577 million, representing approximately 10% of our shares outstanding.”

New Products Drive Momentum

On the product front, Rees pointed to encouraging early performance in direct-to-consumer channels for the Crafty Clog, a newer addition to the company that intends to expand in 2026. He said both near-term and longer-range prospects for the franchise appear promising.

Looking ahead, Rees suggested Crocs sees a meaningful runway outside the U.S. Market penetration in countries such as China, India, Japan, Germany, and France stands at roughly one-third of the share it commands in more mature markets, suggesting room for further gains as brand awareness builds.

Crocs stock traded over 20% higher by Thursday mid-morning.

Q4 Performance And Outlook

In the fourth-quarter (Q4), Crocs reported a revenue of $958 million and an adjusted earnings per share (EPS) of $2.29, both surpassing the analysts’ consensus estimates of $916.12 million and $1.9, respectively, according to Fiscal AI data.

As of Dec. 31, 2025, cash and equivalents totaled $130 million, and inventories ticked up by 3.6% year-on-year to $369 million.

Looking ahead, Crocs expects first-quarter (Q1) revenue to decline in the range of 5.5% to 3.5%. For 2026, the company anticipates revenue in the range of a slide 1% decline to slightly higher, and adjusted EPS between $12.88 and $13.35. Capital spending is projected at $70 million to $80 million.

What Did Stocktwits Users Say?

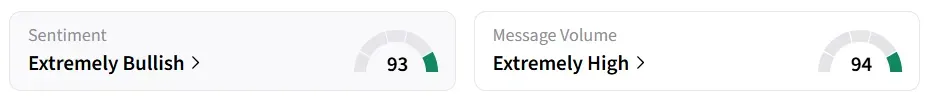

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

A Stocktwits user said the stock has more potential.

CROX stock has gained over 11% in the last 12 months.

Also See: NBIS Stock Tumbles 5% After Q4 Revenue Miss, But Retail Says Company Is ‘Going In Right Direction’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)