Advertisement|Remove ads.

Carvana Stock Jumps, Drawing Retail Buzz Amid Analyst Optimism

Shares of online used-car retailer Carvana Co. (CVNA) surged over 7% on Monday and continued to climb in pre-market trading Tuesday, grabbing the attention of retail investors.

The stock's rise comes on the back of bullish views from Wall Street analysts, sparking optimism about the company’s future prospects.

Evercore ISI analyst Michael Montani raised Carvana’s price target from $142 to $157 while adding the stock to the firm’s “Tactical Outperform” list.

Montani highlighted Carvana's focus on delivering a superior customer experience as a key driver for sustained growth and market share gains. After meeting with Carvana's leadership, Montani is confident the company is “well-positioned” for strong Q3 results and sees positive catalysts in the coming months.

Bank of America echoed this bullish sentiment, reinstating coverage of Carvana with a ‘Buy’ rating and an even higher price target of $185. The firm expects Carvana to benefit from an improving market as used-car prices stabilize, car supply increases, and interest rates ease.

Carvana surprised investors in July by reporting a second-quarter profit, driven by increased retail sales. The firm sold over 100,000 vehicles, cementing its position as the second-largest used-auto retailer in the U.S.

CEO Ernie Garcia attributed the company’s success to stable inventory, stronger brand sentiment, and an improved customer experience.

Used-car prices fell by 1.00% in August, following a 2.30% drop in July, according to Labor Department data.

These factors have helped the stock more than triple in value this year, significantly outperforming both the S&P 500 and the Nasdaq.

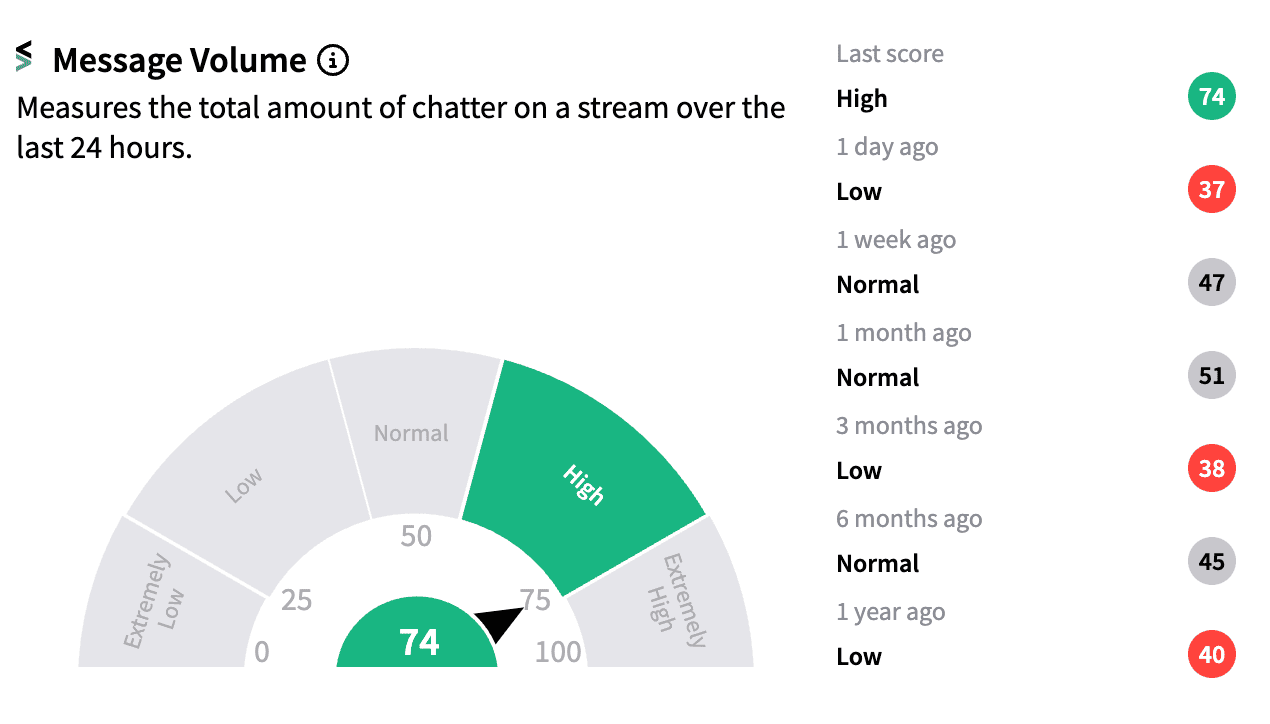

On Stocktwits, Carvana’s recent rally drew a surge of interest from retail investors.

The stock’s follower count grew by more than 5% on Tuesday, and message volume shot up by 3,500%.

One bullish investor predicted further gains based on technical indicators.

However, some are wary of potential September market volatility.

Despite its recent rally, Carvana stock remains well below its record highs from August 2021, when pandemic-era demand for personal vehicles drove shares to unprecedented levels.

Yet, with analysts and the broader market keeping their faith in the stock, Carvana may be poised for more gains in the coming months.

Read next: Microsoft Stock Rises On $60B Buyback Program, Dividend Hike: Retail Gets More Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Northrop_Grumman_resized_7270231cb2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_spglobal_OG_jpg_61bf3a69e9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_constellation_energy_three_mile_island_resized_3185b1517a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)