Advertisement|Remove ads.

Diginex To Acquire Resulticks In $2B Deal, But Retail Remains Wary

Regulatory technology company Diginex (DGNX) has signed a memorandum of understanding to acquire Resulticks, an AI-powered global customer engagement firm, in a cash and stock deal that values the latter at $2 billion.

The deal aims to strengthen Diginex’s expertise in data management and artificial intelligence, setting the stage for enhanced service offerings in regulatory compliance and stakeholder engagement.

The company stated that the payment will be made in three tranches, including $1.4 billion in Diginex shares issued at $72 per share, with a lock-up period, and $100 million in cash due within 90 business days post-closing.

The last part includes a performance-based earnout of up to $500 million payable in shares, contingent on Resulticks meeting earnings before interest, taxes, depreciation, and amortization (EBITDA) milestones over fiscal years 2026 to 2028.

Based in Singapore and active in markets including the United States, India, and the Middle East, Resulticks enables businesses to deliver customized interactions across both digital and in-person channels by utilizing advanced automation and large-scale data processing.

“By turning ESG data into actionable insights, brands can deliver hyper-personalized engagement — like carbon footprint transparency for eco-conscious buyers — while real-time analytics build trust through verifiable sustainability claims,” said Co-Founder and CIO of Resulticks, Daxsan RB.

Through the integration of Resulticks’ technology and team, Diginex plans to expand its sustainability-focused data solutions, providing tailored insights in areas such as regulatory compliance, supply chain analysis, and risk management.

This move is anticipated to open up fresh industry segments and equip stakeholders with real-time, data-rich intelligence powered by sophisticated orchestration tools.

The deal follows Diginex’s recent agreement to acquire Matter DK ApS, a Copenhagen-based sustainability data provider.

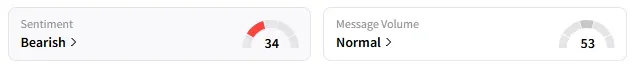

On Stocktwits, retail sentiment around Diginex remained in ‘bearish’ territory.

Since Diginex’s listing in January, the stock has gained over fivefold.

Also See: ZenaTech Stock Skyrockets After Launching AI Drone Service For US Defense Market: Retail’s Jubilant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)