Advertisement|Remove ads.

Disney Stock Gains After Guggenheim Price Hike On Bundling Potential: Retail’s Keeps Neutral Ground

Shares of the Disney Company (DIS) saw a price target hike from Guggenheim to $140, up from $120, with the research firm affirming a ‘Buy’ rating ahead of the company’s upcoming earnings.

According to TheFly, the brokerage noted that after refining Disney’s operating expense forecasts for Linear Networks, reducing theatrical revenue estimates due to underwhelming film performance, and factoring in stronger sports ad sales and stable attendance at theme parks, it has increased its full-year segment operating income outlook to $17.7 billion, slightly above the consensus of $17.65 billion.

Disney’s stock was up nearly 1% in midday trade on Friday.

Guggenheim’s updated outlook also includes the decline in ticket revenue after recent box-office disappointments, better-than-expected sports advertising revenues, helped by strong sports viewership and consistent travel and spending trends in Disney’s Experiences division.

The research firm suggested Disney could leverage bundled offerings across Disney+, Hulu, and ESPN+ to generate new subscriber growth and revenue.

Disney and Comcast Corporation (CMCSA) put an end to their prolonged disagreement regarding Hulu on June 9, with Disney agreeing to pay an extra amount to purchase Comcast's remaining share of the streaming service.

A Bloomberg report stated Disney would be paying Comcast $439 million to acquire the final 33% ownership stake in Hulu.

Comcast had previously claimed Hulu’s value was substantially higher, seeking an extra $5 billion, whereas Disney held firm that the agreed minimum price was reasonable.

After Disney assumed full ownership of Hulu, Guggenheim believes the company is now “well positioned to pursue a unified direct-to-consumer strategy.”

For the fiscal year 2025, Disney anticipates an adjusted earnings per share (EPS) of $5.75, representing a 16% rise compared to fiscal 2024.

The entertainment conglomerate is expected to report third-quarter (Q3) earnings on August 8.

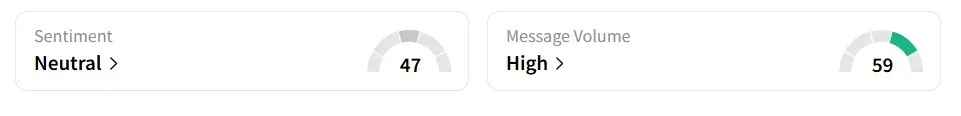

On StockTwits, retail sentiment around Walt Disney remained in ‘neutral’ territory. However, the message volume improved to ‘high’ from ‘normal’ levels in the last 24 hours.

Walt Disney stock has gained over 10% year-to-date and 20% in the past 12 months.

Also See: Microsoft Reportedly Delays Next-Gen AI Chip Launch As It Struggles To Match Nvidia Performance

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)